Estimated GB slaughterings were down 12% year-on-year during May, representing more than 100,000 head, AHDB data shows, as tight supplies continue to drive pig prices higher.

Estimated GB slaughter for the five weeks ending June 3 totalled 761,700 head, a weekly average of 152,300 head. This represented a further 4% (35,700 head) decline on the previous five-week period and was 12%(101,800 head) lower than the same five-week period last year.

The May figures followed Defra’s UK-wide slaughtering statistics for April, showing a 13% decline on 2022 levels. Supplies remain tight into June, with no sign yet of a return to a more balanced market. “Processors were keen to take more pigs but low numbers being offered to the market kept most outlets short,” Thames Valley Cambac said in its latest weekly market update.

Carcase weights eased slightly during May, with the SPP average for May down 240g to sit at 89.4kg.

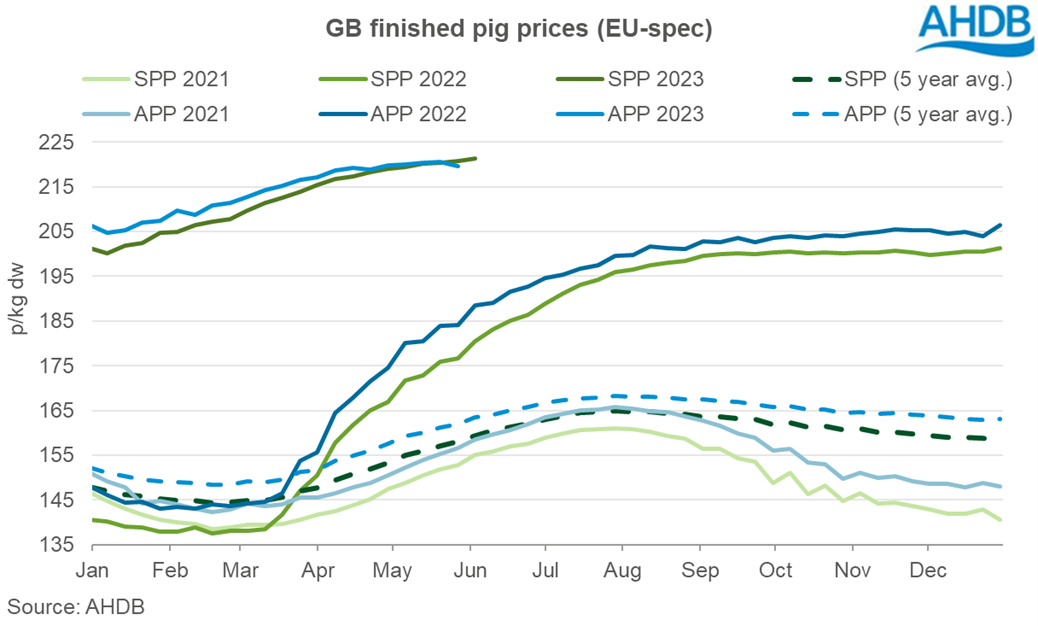

The EU spec SPP averaged 220.68p/kg – an increase of almost 2.5p from April, with weekly price increases averaging 0.45p. “Hitting 220p/kg has been in producers’ sights since the end of March, and was achieved in the week ending 13 May. Since then, the steady upward trend has continued, with prices ending the month (w/e 03 June) at 221.34p/kg,” AHDB senior analyst Freya Shuttleworth said.

“Improved prices are positively impacting on producer margins. Our most recent cost of production estimate showed that net margins in Q1 (Jan-Mar) 2023 were in a considerably better place than they have been in the past two years, although still at a negative value. As some inflationary pressures and input cost prices have eased over spring, margins look likely to move further into a positive position as summer arrives.”

Like the SPP, the EU spec APP has seen growth in May. Averaging 220.12p/kg for the four weeks ending May 27, this growth is more subdued at just under 1p, however, when compared to the previous four-week period in April. In the week ending May 27, the APP moved below the SPP.

“A spectrum of influences – including a tight marketplace, industry reports over contract commitments and continued pressure on premium product categories at the shelf edge as consumer purchasing behaviours reflect the cost of living crisis – have all influenced this shift,” Ms Shuttleworth said.