New estimates from the members of the EU Commission’s working group on pig meat suggest that increased supply levels can be expected throughout 2018. These forecasts are based on the December results of the EU pig censusand industry sentiment from member states.

With some modest expansion recorded in the breeding herd last year, a year-on-year increase of just over 1% is expected for EU slaughter in 2018. The rate of expansion is predicted to accelerate slightly as the year progresses.

However, the situation is expected to vary at member state level. Denmark and Spain anticipate the largest increases in slaughterings this year, with GIP (Gross Indigenous Production- the slaughter of pigs born domestically) forecast to increase by 3% and 2% respectively. While a smaller producer, Poland also anticipate that GIP could increase by 3%, despite ongoing challenges with African Swine Fever, as their domestic consumption increases.

Other member states have been more cautious about the throughputs anticipated this year. In Germany, an increase in GIP of less than 1% is expected for the year overall, reflecting increasing challenges regarding animal welfare regulations and attracting the younger generation to work in the industry. The risk of African Swine Fever is also an increasing concern for the German industry.

With GIP trends differing between member states, trade in piglets is likely to pick up this year. A number of countries anticipate procuring more piglets from Denmark, the Netherlands and Belgium this year, to supplement their own domestic supplies. This will likely limit the growth in net slaughterings recorded in these countries.

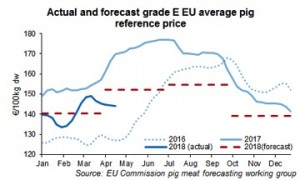

Reflecting the higher production levels, the forecast working group expects pig prices within the EU to be lower this year. Prices are expected to peak in Q3 at around the €154.77/100kg level, around 18 eurocents lower than the peak last year.

Stagnant domestic demand in the face of expanding production levels is a key driver of the lower price expectations this year, as well as lower global pork prices. There is also uncertainty surrounding prospects for the international export market. Expanding production in the US and Canada means competition on the Asian markets should intensify this year. However, if China’s recent 25% import tariff on US pork were to be implemented for prolonged period, the competitive position of the EU would be boosted.

The threat of African Swine fever also represents a significant risk to the outlook for EU pig prices in 2018. The number of incidents reported in wild boar so far this year has already reached almost 2,300 cases, more than half the total number recorded in the entire of 2017. The industry is extremely nervous of the disease reaching Germany, which would likely result in the loss of most of Germany’s pork exports outside of the EU (400,000 tonnes in 2017). Such an event would generate an oversupply situation on the European market, and significantly lower pig price prospects across the union.

Given these forecasts, it seems unlikely that the EU market will provide much support to UK pig prices this year. On current exchange rates, the EU average price for 2018 would be equivalent to around 128p/kg. Retailer commitment to British pig meat will therefore be important to maintain the UK price premium, which has averaged 20p for the year so far.