The EU pork market is showing welcome signs of stabilising after plummeting since the summer and putting pressure on the UK market in the form of cheap imports.

The EU reference pig price has continued to fall throughout Q3 but show some tentative signs of stabilising, currently sitting at 184.93p/g for the w/e November 19, having barely moved for the past three weeks.

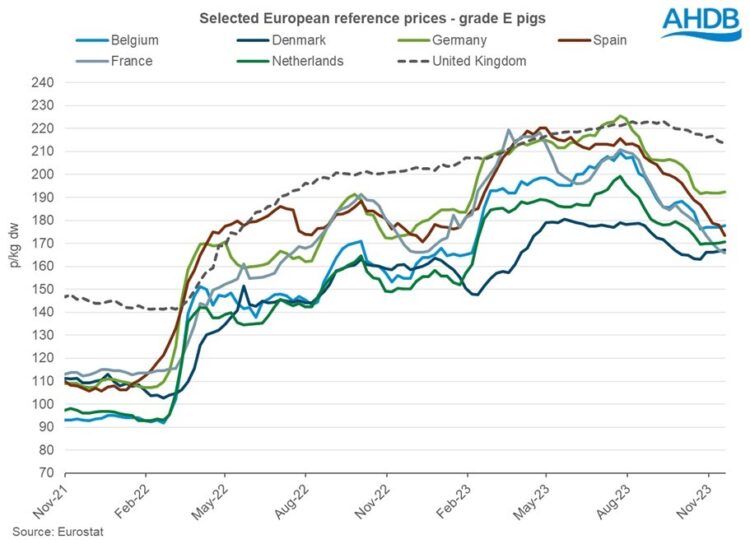

Demand both in the EU and globally has been easing throughout 2023, resulting in a decline in the pig price of just under 31p from the peak of 215.45p/kg July this year. The European Commission is forecasting little change in the current downward trend seen in EU pig prices.

But the EU average price has declined by just over 2p over the past month, a more subdued decline than previously seen, with some key producers recoding minor price increases in the most recent weeks.

This overall downward trend in prices has been driven by the large drops experienced in Spain (-13p) and France (-11p). However, prices in other key regions have been more stable in recent weeks, with Germany, the Netherlands and Belgium seeing prices increase by around 1p in the latest four-week period, AHDB analyst Ella Roberts said.

Denmark has seen a price increase of almost 4p, however, trends show consistently lower prices in Denmark. It should be recognised that across the key producers prices do remain elevated above those seen in 2022, Ms Roberts added.

The UK price currently sits at 213.69p/kg for the w/e 19 November 2023, just short of 29p above the average EU price.

The UK price currently sits at 213.69p/kg for the w/e 19 November 2023, just short of 29p above the average EU price.

Due to market pressure following the drop in EU prices, UK pig prices have also been in decline for the last couple of months, albeit at a steadier rate than those seen on the continent. For the w/e the November 19 2023, the UK reference price was just 9.54p lower than the price peak seen in w/e September 10.

Production

Production levels for 2023 (up to July) have continued to fall short compared to 2022, with tight supply reported amongst key EU pigmeat producers.

There was an overall decline of 8.2%, with the largest declines seen in key pigmeat producing countries such as Germany (-9%), Denmark (-21%), and Spain (-5%). This likely to have been driven by an overall reduction in EU pig slaughter seen in 2023 (up to July) of 8.5%, Ms Roberts added.

High input cost over the past two years have eroded margins in EU pork producing countries, resulting in many opting to leave the sector and a decline in pig numbers and pork production. Despite a small easing in input costs, the cost of production remains high for pork producers throughout the EU, particularly energy and feed ingredient prices.

“However, with feed prices slowly easing in Europe, production rates are likely to see some recovery towards the end of 2023 and into 2024, according to the European commission’s latest forecast,” Ms Roberts said..

Exports

Overall EU exports of pigmeat (excluding offal) have declined year-on-year, currently sitting at 2.06 Mt for the year to date (January-September). This is the lowest volume since 2015 and driven by reduced product availability as a result of declining production.

Another limiting factor on EU export opportunities has, until recently, been pricing, Ms Roberts added. It is reported by the EU commission that due to greater price competition on the global market EU producers of have lost volume share in key markets including Japan, Australia, and the Philippines. Volumes shipped to China have fallen 27% and are now similar to levels seen in 2018.

The UK remains the largest importer of EU pigmeat (excluding offal) with a 28% market share on volume and is the only key importer to increase their import volumes in 2023, by a marginal 5,900t (1%). UK consumption of pork through foodservice is growing year on year likely contributing to the increase, paired alongside lower EU pricing compared to UK product.

EU exports of pigmeat are estimated to end the year down 16% compared to 2022. However, if pig prices continue to decline, there may be room for improvement in 2024.