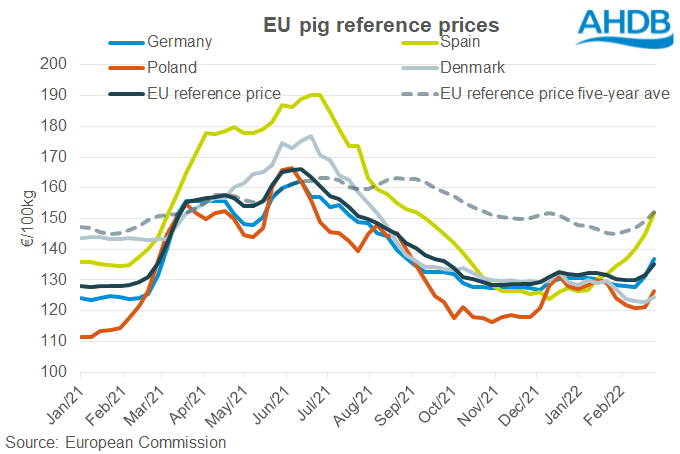

EU pig prices have varied in member countries across February, as prices in Demark dipped, remained stable in the Netherlands, and rose in Germany, Poland and Spain.

The rising price in Germany is likely in part due to supplies of slaughter-ready pigs becoming tighter in recent weeks.

Whilst Europe continues to have a plentiful supply of pork, supplies of pics on farms across the EU appear to be easing back, AHDB senior red meat analyst Rebecca Wright pointed noted, calling it a positive in terms of both processor’s ability to handle the current number of pigs.

“A bottleneck at the point of slaughter (i.e. more pigs than slaughter capacity) has been one of the key pressures on prices over the past six months, in addition to the large supply of pork for consumption,” said Ms Wright.

“While in Europe this pressure has been slightly released, in the UK the number of pigs ready for slaughter continues to far exceed slaughter capacity.”

The overall demand for pork continues to outweigh overall demand as China’s reduction in pork imports remains constant.

“Some abattoirs on the continent have reportedly responded to the substantial and widespread increase in input prices, by offering a premium to producers,” Ms Wright added.