EU pork production has contracted further during the first quarter of 2023, while prices continued to rise.

“Pig producers in the EU continue to face multiple challenges impacting on the market. High input costs continue to prevail, impacting on production, while the threat of African swine fever (ASF) continues to persist over the region, limiting export opportunities,” AHDB analyst Isabelle Shohet said.

Production

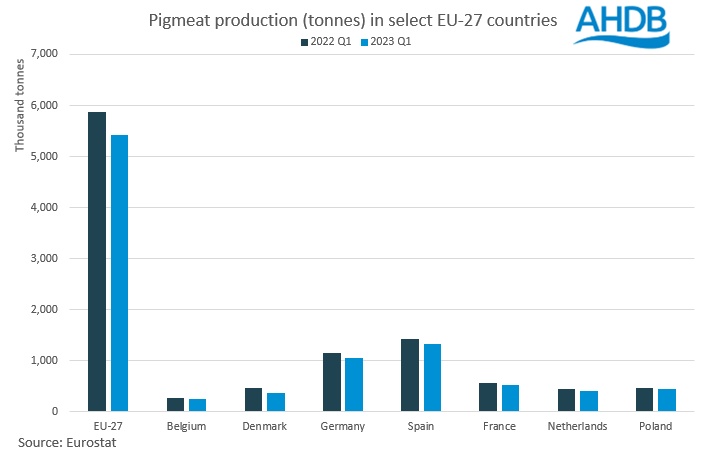

During the first three months of 2023, an estimated 5.4m tonnes of pig meat was produced in the EU-27, a reduction of just under half a million tonnes (-8%) from the same period in 2022. EU short-term outlooks forecast production to decline 5% across the whole year, following a contraction in 2022.

Spain continues to be the largest producer of pig meat in Europe, but has also seen the largest decline year on year, with Q1 2023 levels sitting just below 1.33m tonnes. This is a fall of 97,600 tonnes (7%) from Q1 2022. Germany and Denmark have also recorded large falls in production of 94,800 tonnes (-8%) and 91,600 tonnes (-20%) respectively from 2022 levels.

Other key producing countries such as the Netherlands, France, and Belgium have seen production fall between 27,000–47,000 tonnes (5-10%) compared to last year. Poland recorded the smallest year on year decline of the key producers, with production down 12.1k tonnes (-3%) in the first three months of the year.

The fall in production volumes has been driven by a reduction in slaughterings, estimated to have reached just shy of 57.1m head during Q1 2023, more than over 4.7m head below the figure from Q1 2022.

As with production, Spain saw the largest year on year reduction, with slaughter numbers down 1.4m head (-9%), which bought Q1 slaughter to 14.1m head.

Germany has also seen a significantly large drop, down nearly 1.0m head (-8%) from 2022, to 11.1m head. Denmark’s slaughterings fell 810k head to nearly 4.2m head for Q1 2023. Again, Poland saw the smallest decline, down 150,000 head; while other key producing countries, such as the Netherlands, Belgium and France, have seen slaughter numbers decline between 300,000–430,000 head.

Prices

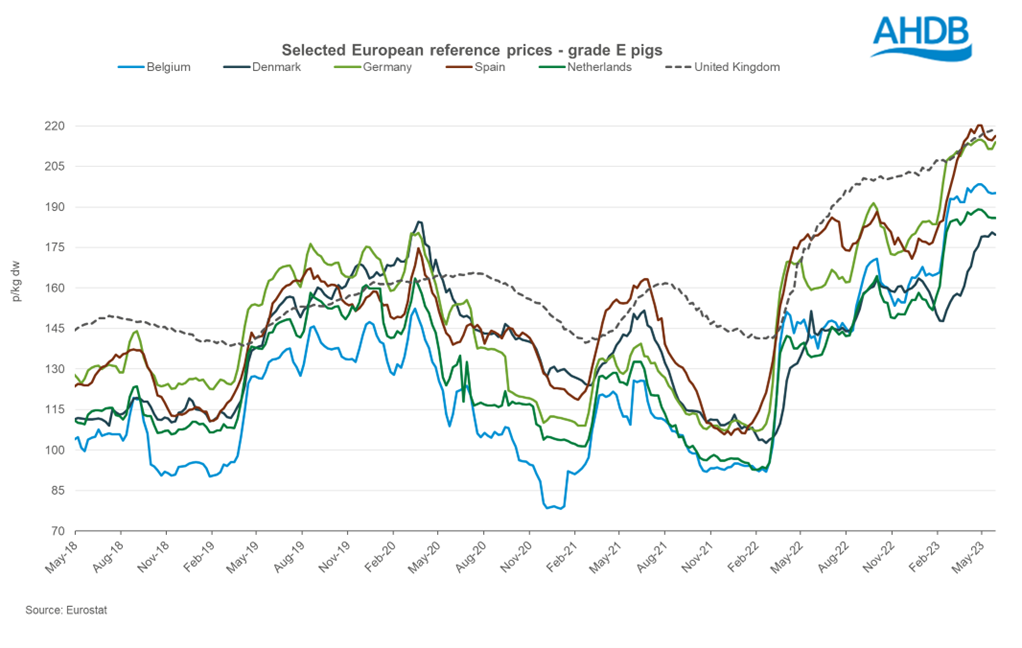

Following the falling production levels and supply levels reducing, EU prices have seen continued growth since the end of January 2023.

Following a four-week decline, EU deadweight prices have re-gained momentum, reaching an average of 208.39p/kg for the week ending 28 May. This is an increase of 28.54p from the beginning of the year. The average EU reference price reached a peak of 212.14p for the week ending 30 April.

Reference prices in key producing countries have, for the most part, all seen similar climbs from the beginning of the year. Spain has seen a gain of nearly 40p/kg, as Belgium, Germany, the Netherlands and Poland saw gains of around 30p/kg. Price rises in Denmark have been dampened compared to other countries, only gaining 19p/kg with upwards movements starting a month behind most other nations.

In the last month, movements in reference prices have been more subdued, possibly due to volatility in the export market, especially regarding China, Ms Shohet added. For the three weeks ending May 21, prices eased between 2-5p/kg in Belgium, Germany, Spain, the Netherlands and Poland. In the final week of May (w/e May 28) prices regained ground in Germany, Spain and Poland by roughly 2p.