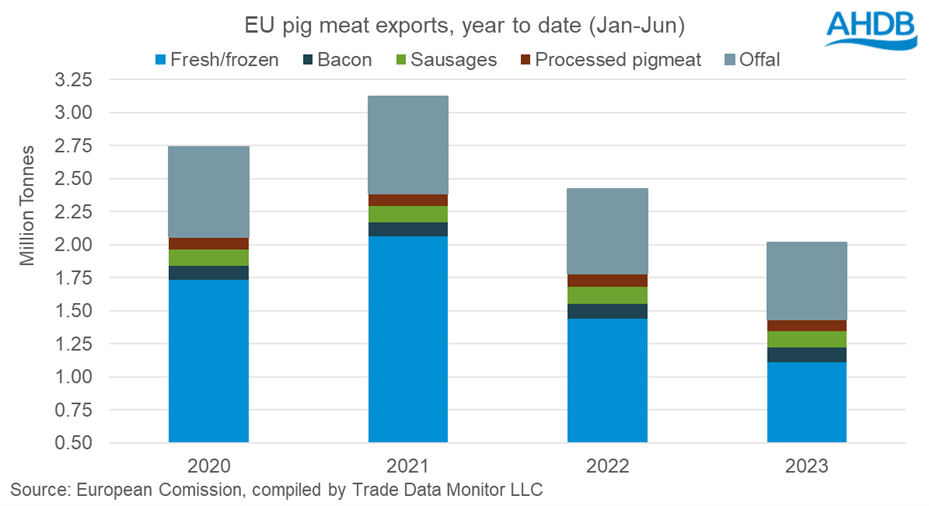

AHDB analysis has shown that EU exports of pig meat are down 17% year-on-year.

Almost 2.02 Mt was exported between January and June 2023, the smallest volume for the six-month period since 2015.

Fr eya Shuttleworth, senior analyst at AHDB, reported that total pig meat exports have fallen 17% compared to the same period in 2022. She said: “The fresh/frozen category has seen the largest declines, dropping 23% to 1.11 Mt. This is the smallest volume since 2015, when shipped volumes of fresh/frozen pork were less than 1 Mt. All product categories have seen volumes decline; exports of both offal and processed pig meat are down 10%, while bacon and sausages recorded smaller declines of 4% and 3%.”

eya Shuttleworth, senior analyst at AHDB, reported that total pig meat exports have fallen 17% compared to the same period in 2022. She said: “The fresh/frozen category has seen the largest declines, dropping 23% to 1.11 Mt. This is the smallest volume since 2015, when shipped volumes of fresh/frozen pork were less than 1 Mt. All product categories have seen volumes decline; exports of both offal and processed pig meat are down 10%, while bacon and sausages recorded smaller declines of 4% and 3%.”

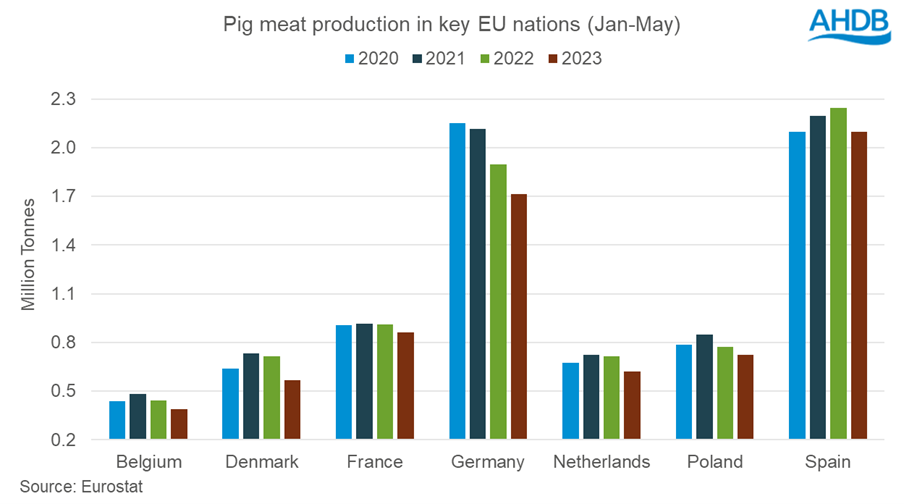

Ms Shuttleworth reported that the decline was due to a reduction in supplies on the continent, with a 9% (8.68 Mt reduction in volume between January and May compared to the same period last year. Declines have been recorded in all EU nations, with the largest changes seen in Germany, Denmark and Spain.

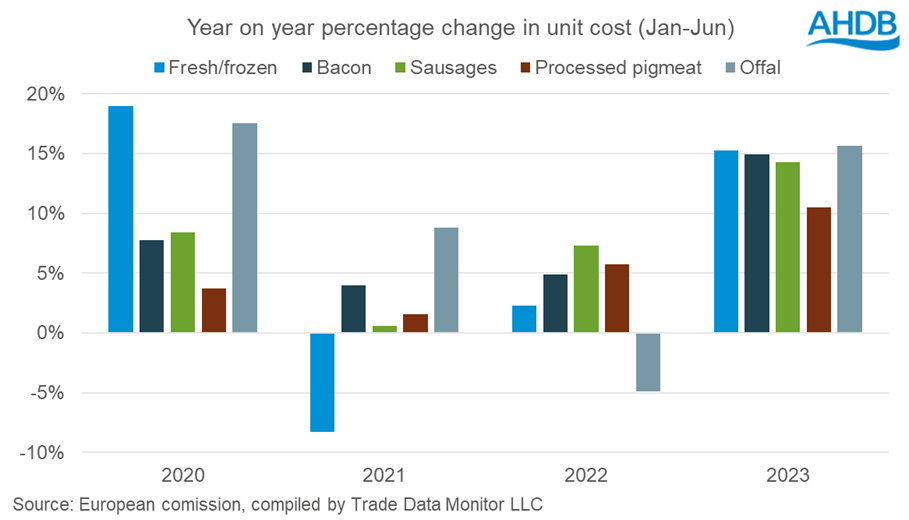

Ms Shuttleworth identified that the loss of production has led to an increase in prices. She said: “Paired with rising inflation, this has driven up the value of exports. The total value of EU pig meat exports for the year to date (Jan–Jun) stands at €6.16bn. Although this is a slight decline year-on-year (-4%), this is due to the lower volumes, as the average unit price (value divided by volume) has grown 16% to €3,051/t.

“The unit price for bacon has seen the strongest growth, up nearly €750, with sausages a close second increasing by €660. Offal has seen the smallest growth (up €230), while the processed and fresh/frozen pork categories have gained €520 and €400 respectively.”

The top five countries for the EU to export pork to are unchanged. China takes the lead with 31% of EU exports (3% increase from 2022) whilst the UK takes its share up to 20% (6% increase year-on-year). The Philippines and South Korea have seen shares fall to now hold 6% each, while Japan has maintained its 9% market share.

The European Commissio n forecasts EU pig meat production to end the year 5.5% below that of 2022. Ms Shuttleworth said: “This indicates there will be little change from the current market place, with exports anticipated to end the year 12% behind volumes from last year.

n forecasts EU pig meat production to end the year 5.5% below that of 2022. Ms Shuttleworth said: “This indicates there will be little change from the current market place, with exports anticipated to end the year 12% behind volumes from last year.

“However, there remains some questions around the direction of travel for pig prices. Input costs have eased from the historic highs seen throughout 2022 and, although lower availability of product has driven prices up, demand is weakening. High prices have led EU product to be less competitive on the international market, with consumers at home and abroad looking for more affordable options.”