The outcome of the UK’s trade negotiations with the EU concerning Brexit will be crucial to the pig industry, according to AHDB Pork’s latest analysis of how import and export tariffs options may operate in the future.

While declaring from the outset that we simply don’t know yet how Brexit will change future UK/EU trade agreements, AHDB Pork is clear in its view that the Brexit decision will have far-reaching effects on the pork sector.

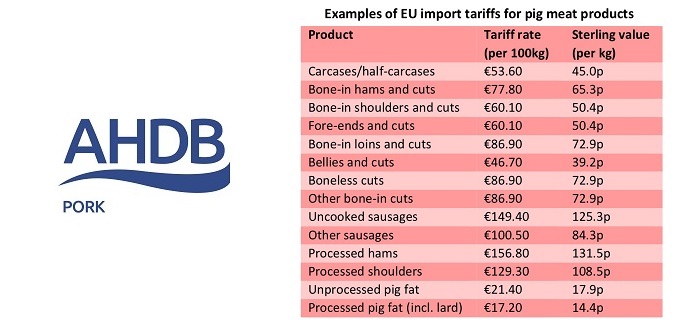

“Trade between the UK and other EU countries is largely unrestricted under the single market,” said AHDB Pork. “However, it’s a very different story for pork entering the EU from outside with pigmeat imports, apart from offal, being subject to sizeable import tariffs.

“The high level of these tariffs effectively means that most imported pork is uncompetitive on the EU market, even though production costs and wholesale prices are lower in other exporting countries such as the US, Canada and Brazil.”

In seeking to assess where the UK might eventually end up in relation to the EU’s tariff structure, therefore, AHDB Pork examined the trading extremes which are currently on the table, ranging from the UK remaining part of the single market and experiencing almost no trading change to having to negotiate completely new trading terms, and starting out with no deal being in place at the time the UK leaves the EU.

In that case, UK exports would become subject to the same EU import tariffs as other countries with no trade agreement, at least until a deal is agreed.

“In other words, UK exports to the EU could become uncompetitive,” said AHDB Pork. “Given that 74% of pork exports are to the EU (or at least routed through it), this could have a dramatic impact on the UK industry.

“A particular concern will be over exports of sow carcases, which would be subject to a tariff of 45p/kg. This could mean cull sows have little or no value, hitting producer returns and effectively raising the cost of producing piglets.”

In such a situation, of course, the UK could decide to impose its own tariffs on imports from the EU which might, in turn, mean much less imported pork reaching the UK, potentially leading to higher domestic pig prices.

Surrounded, however, by so many ifs, buts and maybes, AHDB Pork’s conclusion is that the outcome of trade negotiations will certainly be “crucial” to the pig industry, adding that it will be keeping the situation under review as and when more information becomes available.