The recent World Trade Organisation (WTO) judgement against Russia is more of a “political win” than a development that will see a material step-change in the market, according to AHDB Pork.

Warning that a lot has changed across the global pigmeat market since Russia imposed its ban on EU imports in 2014, AHDB Pork comments that even if Russia decides to obey the WTO ruling and lift the current sanctions, that will have less of an impact across the EU would have been the case 12 months ago.

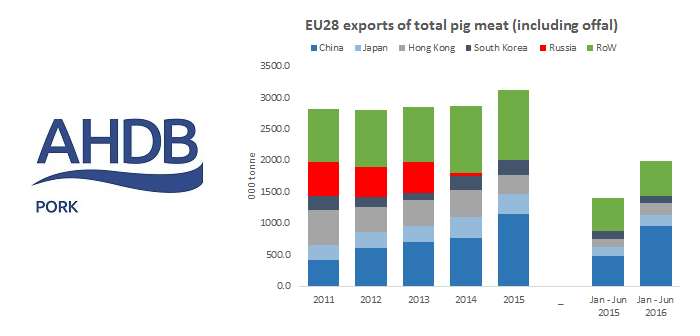

The argument is that the EU’s “burgeoning trade” with the Far East and Russia’s commitment to be self-sufficient in pigmeat by 2020, have significantly changed the trading goalposts. Even so, AHDB Pork agrees that a reopening of the Russian would be “welcome”, especially in relation to fats and offal, EU products that have proved difficult to find an alternative market for.

“The second outcome that may occur, of course, is that Russia may choose to ignore the (WTO) outcome and keep its sanctions in place,” said AHDB Pork. “Should this be the case, the EU may impose retaliatory sanctions in place on Russian products. However, what goods might be sanctioned remains a topic for debate, as the impact would need to be greater for Russia than it would be for the EU.

“Crude petroleum is the largest Russian export, accounting for 35% of the value of all Russian exports in 2014. However, the EU has a huge reliance on Russian oil, so any sanctions on this may be potentially detrimental to the EU. If any retaliatory sanctions were restricted to agri-food products, then wheat is the largest Russian agricultural export, accounting for 1.6% of the Russian export value in 2014.

“Russia accounted for 11% of common wheat imports for the EU over the 2014-15 growing year. This was down two percentage points against the previous five-year average. However, over the same period, the import volume from Ukraine has increased from 24% to 50%, and reports are that there has been another bumper harvest this year, so there are other viable source countries for this commodity.”

All of which produces the conclusion that this is very much a “political win” at present, albeit one which highlights that WTO members must operate within the body’s predefined frameworks.