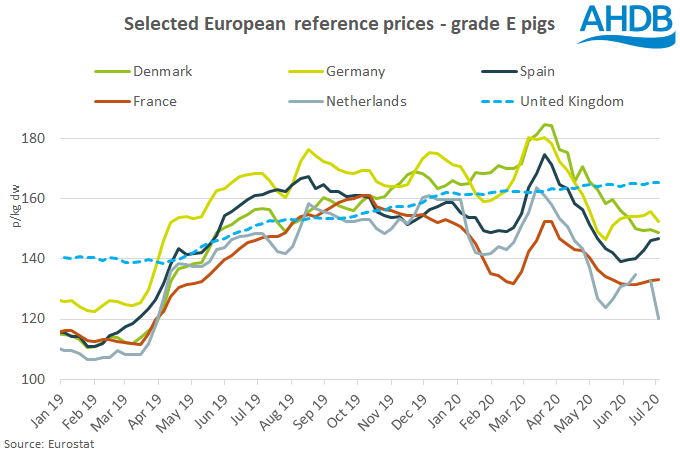

The EU Reference price (excluding the UK) stood at 144p/kg last week, 3p down on the previous week and 22p below the late-March peak.

Prices in Germany, Belgium and the Netherlands are coming under particular pressure, largely as a result of plant closures and the knock-on impact on exports.While the German Reference price was down only 3.3p in the first week of July, reports suggest it has taken a battering over the past week.

German pig industry organisation ISN said the closure of the Tönnies processing plant, in Rheda, cost the industry €20 million (£18m) last week alone, with the price of slaughter pigs falling 19 cents since over the past fortnight, creating ‘unbearable economic misery’ for farms.

This is backed by the latest Tribune prices, which show a 12.5p/kg drop in the German price last week, with falls up up to 5p elsewhere. AHDB analyst Duncan Wyatt said a backlog of finished pigs developing in Germany and Belgium is putting EU pig prices under significant pressure, while the Dutch price has also weekend significantly in recent weeks due to an export ban from China.

“Although the Netherlands supplies slaughter pigs to Germany, six Dutch plants have themselves temporarily had export licenses for China withdrawn due to COVID-19 outbreaks, compounding the situation in the country. The Dutch prices fall cannot, therefore, be wholly attributed to the closure of the important German plant at Rheda.

“Future developments in the EU market as a whole will depend not only on how and when these suspensions are lifted but of course also on how local demand evolves as lockdowns are lifted across the region. In a change from recent weeks of relative stability, it now appears that weaner prices in the EU are coming under pressure too.”