More favourable weather in June saw a welcome decline in global grain markets, as UK pig producers continue to battle with record costs of production.

Despite the steady rise in pig prices over the past few months – the SPP stood at 157.57 in the week ended June 26 – margins remain under pressure. Input costs remain high, after being recorded at a record average of 174p/kg over the first quarter, driven by wheat prices in excess of £200/tonne and soya at around £360-370/tonne.

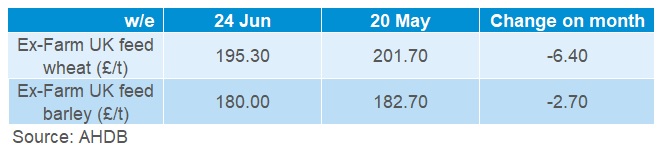

Cereals

While cereal prices have remained high during much of this quarter, better weather in June started to ease new-crop supply concerns, according to AHDB analyst Megan Hesketh, with spot UK ex-farm feed wheat prices losing more ground than barley prices. The discount of barley to wheat narrowed by £3.70/t to £15.30/t. This reflects tight UK barley availability as we approach the end of the season, Ms Hesketh said.

“Rains and cooler temperatures across the US maize belt eased supply worries in June, pressuring feed grain prices. However, hot and dry conditions on the Northern Plains meant US spring wheat crop ratings fell to the lowest level in 33 years. Despite improved maize conditions, this concern has limited falls in global wheat prices,” she said.

With US maize is entering its key growth stage, weather will be critical in the coming weeks to crop conditions and price direction. If the weather changes direction towards hot and dry, we could see some volatility in prices, or even price rises, in July, she added.

More favourable weather in the EU boosted the supply outlook in June. The latest EU crop monitoring (MARS) report increased all winter crop, and spring barley, yield forecasts. This puts many EU grain yield forecasts ahead of 5-year averages. France and Russia have started their winter barley harvests, which may take some risk premium from prices as grains start to come in.

Globally, the International Grains Council (IGC) boosted 2021/22 grain supply by 9Mt this month to a new record. This raises global grain stocks for the first time since 2016/17.

“However, stocks remain low and the market is sensitive to weather news. There is a risk of further cuts to the 2020/21 Brazilian maize crop on drought stress too, which if realised, may heighten market sensitivity,” Ms Hesketh added.

“As we look to the new season in our domestic market, recent rains have been beneficial for crop prospects. Some in industry are now looking more towards a 15Mt wheat crop. This may ease tight supplies in the UK and further pressure prices in the coming months as harvest begins.”

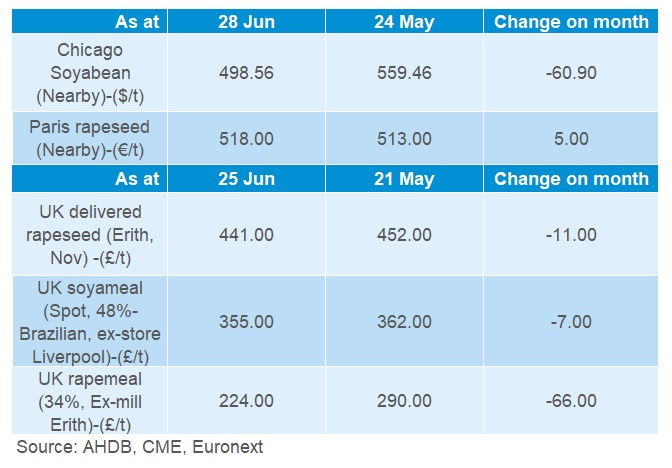

Proteins

Global Supply and demand for oilseed look more comfortable for the new season. Global supply is forecasted to rise for rapeseed, soyabeans and sunflower seed in 2021/22. With total production rising faster than demand, ending stocks are forecasted to increase too.

Importantly for the UK, EU-27 2021/22 rapeseed production forecasts rose in June to 17.0Mt, 0.5Mt higher than 2020/21, Ms Hesketh added.

For soyabeans, new crop supply (2021/22) looks more positive in size. Throughout June, rains have been easing concern for US soyabean crop conditions. The boost to crop prospects pressured prices. Large year on year increases are forecast for the US, Argentinian and Brazilian crops. US and Canadian acreage reports are due this week, which may confirm short-medium term price direction.

“Vegetable oil prices have been feeling pressure from reduced demand prospects. In the US, a court ruling makes biofuel blending requirement exemptions easier for small refineries. However, it is not yet clear how this may impact oilseed demand or meal prices next season,” she said.

With a tight supply picture for rapeseed, prices remain at a premium to other oilseeds. Despite large falls in soyabean prices in June, rapeseed has seen some support, as dry and hot weather in Canada causing supply concerns.

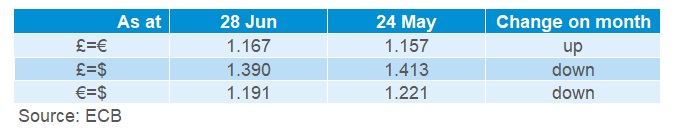

Currency

From May 24 to June 28, sterling marginally gained against the euro, but fell against the US dollar.