Finished pig prices continued to rise in the first quarter of 2020, however an increase in feed and labour costs have diminished some of the potential margin gains, AHDB analyst Felicity Rusk reports.

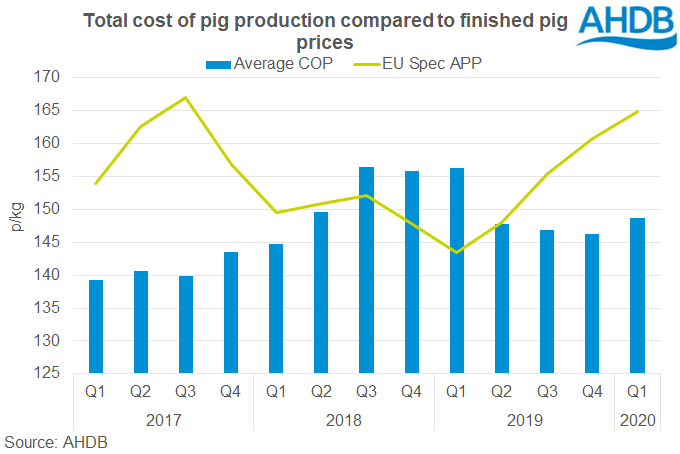

Between January and March, the estimated net margin was 16p/kg or £14/head for UK finished pigs. Rhe EU-spec APP for the period averaged 165p/kg. Meanwhile, the average cost of GB pig production was 149p/kg, according to the latest AHDB estimates.

On a per kg basis, production costs were 3p higher than in the previous quarter due to a combination of higher feed and labour costs. There was a 1p decline in ‘other’ variable costs, but it was not enough to compensate for the rise in feed and labour costs.

Ms Rusk reports that since the end of March, pig prices recorded an increase of just under 2p, however, looking at feed wheat prices, feed prices have probably also been a little higher from late March, which makes it seem unlikely margins will have increased further in recent weeks.

Looking forward, she adds: “China’s own battle with the coronavirus has only slowed the nation’s recovery from African Swine Fever (ASF). As a result, the Chinese pork output this year is likely to be lower than previously anticipated. This will only increase the nation’s reliance on imported protein, which if realised, would be price supportive. However, there is still a range of factors that could present challenges.

“A second wave of the virus in China remains an ongoing risk as the nation continues to adjust to post-lockdown life. Furthermore, there remains a risk of competition from lower-priced US and Brazilian product, although the ongoing disruption to pig slaughter in the US might mitigate this.”