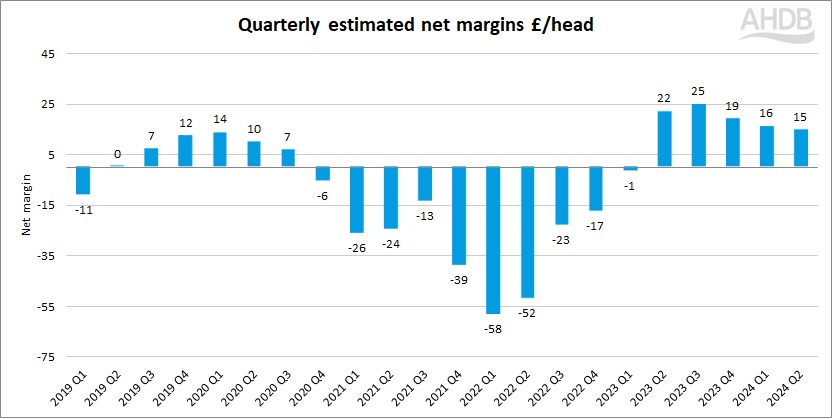

GB pig farming margins slipped back very slightly during Q2, but remained at a relatively healthy average of £15/head, meaning producers have remained in the black for five successive quarters.

The full economic cost of production for April to June, calculated by AHDB using performance figures for breeding and finishing herds, was estimated at 195p/kg deadweight. This was fractionally up on the Q1 figure of 194p/kg.

Feed costs, which made up up 62% of total costs, remained in line with Q1 over the three months, but they have been increasing through Q2, which could have an impact on cost of production and net margins in the second half of 2024, according to AHDB senior economist Jess Corsair.

Energy prices fell by 12% compared to Q1, although this was offset by an increase in fuel costs.

Pig prices have stayed consistent with the beginning of 2024 at 212p/kg (APP) during Q2, giving an estimated average margin per slaughter pig of £14.86 per head and 16.74p/kg deadweight.

This compares with £25/head during Q2 2023 and, although margins have now dropped for three successive quarters, this relatively prolonged period of pig industry profitability comes as a relief following 10 successive negative quarters that saw estimated cumulative losses in excess of £750 million.