Germany is traditionally the EU’s largest producer, consumer and trader of pig meat, but pork consumption took a big hit in 2019.

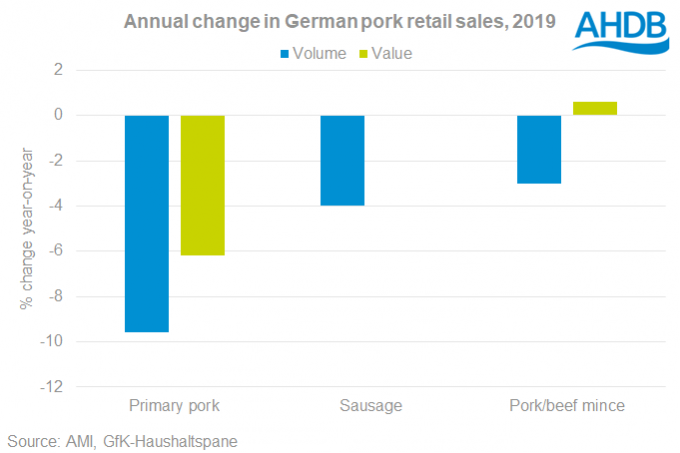

German pork retail sales volumes in 2019 were 10% lower than in 2018, with the anti-meat agenda seemingly playing its part.

“This is partly due to the extremely hot summer reducing barbecue demand,” AHDB analyst Bethan Wilkins said.

“However, reports also suggest there has been increasing criticism of meat consumption, and meat substitutes are becoming more popular. An ageing, health-conscious population, and an increase in eating-out, may also have negatively affected retail sales.”

Lower EU demand is also reflected in Germany’s exports to other EU states. These shipments decreased by 7%. The decline was driven by Poland and Italy in particular. At retail level, Italian pork purchases fell by 4% last year.

supplies in Germany were also down considerably in 2019 as production declined and less product was imported.

supplies in Germany were also down considerably in 2019 as production declined and less product was imported.

German pig meat production in 2019 was down about 2% (-117,000 tonnes) on the year before, while EU production as a whole was back by 1%, meaning that available supplies were tighter.

Ms Wilkins added: “Tight EU-wide supplies led to a small fall in pig meat imports to Germany. Denmark was particularly affected. Within total imports, primary pork declined more significantly, falling by 6%. Trade in cured and processed products was less subdued, declining by only 1%.

Despite the lack of product, exports still held firm, driven by Chinese demand. When offal is included, pig meat exports were up 1% (+21,000 tonnes) overall. Shipments to China were up by 61%, now making up over 20% of German trade.

Germany is also a major importer and exporter of live pigs. Imports were down 5% at 13.4 million head, with shipments of both weaners and slaughter pigs falling. Live exports were down nearly 25% at 1.9 million head, mainly due to fewer weaner pigs being shipped to Hungary and Romania. Both of these countries are affected by ASF outbreaks.