Rising pig prices saw margins for pig producers reach to the highest level in more than two years in the final quarter of 2019.

The estimated average net margin of 15p/kg, or £12/head, the best since the third quarter of 2017, compared with +8/head in the third quarter of 2019, 0 in the second quarter and -£11/head in the first quarter, highlighting how the situation altered during the year as prices rose and costs fell.

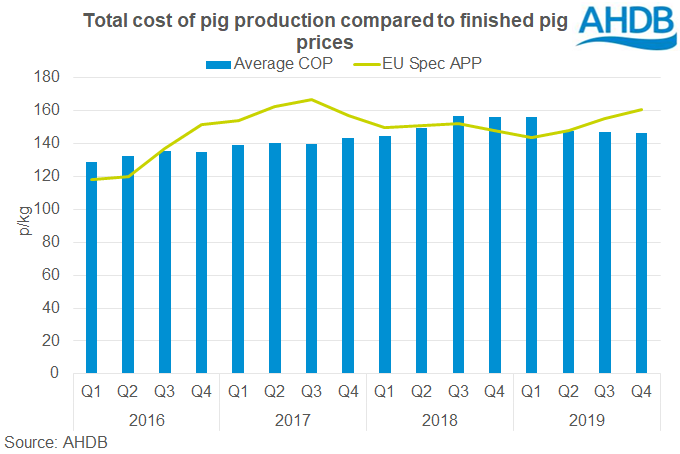

During the final quarter, the EU-spec APP averaged 161p/kg, up 6p on the previous quarter, while the average GB cost of pig production stood at 146p/kg, 1p lower than in Q3, according to AHDB estimates.

The slight drop in costs was driven by a slight decline in building and financial costs, as well as a reduction in other variable costs. However, a marginal increase in feed costs eroded away some of these gains.

Finished pig prices have unusually remained stable in early 2020, not showing the typical seasonal decline, so, assuming production costs have remained similar, margins remain positive during the current quarter, according to AHDB analyst Felicity Rusk.

However, the impact of coronavirus remains unclear. “Despite difficulties with supplying the Chinese market early this year, due to the coronavirus (COVID-19) outbreak, markets have generally been optimistic that strong import demand will return,” she said.

“The latest reports do suggest that businesses in China is starting to return to “normal”, which if realised, would be price supportive.

“However, uncertainty remains over how the escalating situation in Europe will affect the market.

“Maintaining food supply chains will be a priority, but risks around labour supply and logistics both here and in our EU trading partners remain. How these challenges interlink with changing demand patterns will be influential for pig prices in the coming months.”