The Chinese market has provided the UK pork sector with a ‘soft landing’ amid the global disruption to trade caused by the COVID-19 pandemic.

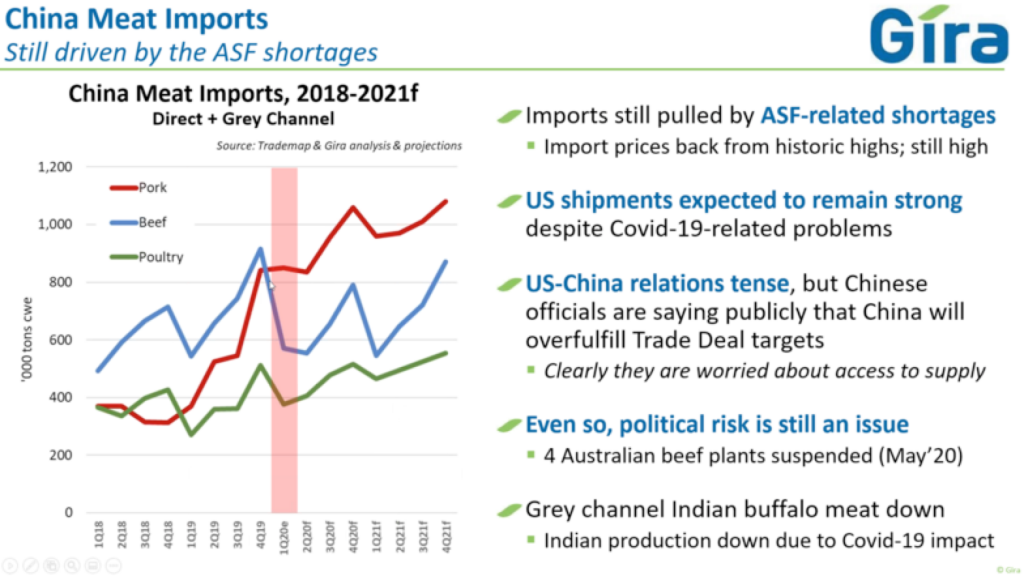

But with a complex mix of COVID-19, African swine fever (ASF) and political tensions currently shaping the outlook for the global pork market, the UK should pursue other export opportunities, particularly in Asia, according to Rupert Claxton, meat director at global consultants GIRA.

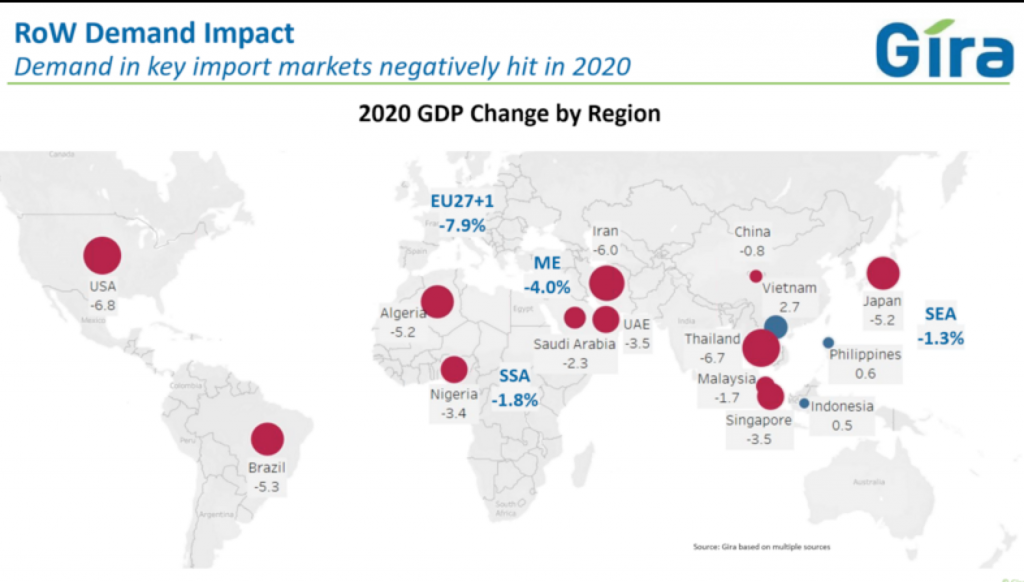

During an AHDB export webinar, he outlined the impact of the pandemic on economies across the world – GDP is down, for example, by nearly 8% in the EU, 7% in the US, 5% in Brazil, 7% in Thailand, 5% in Japan, with many other countries similarly affected.

The UK pork sector has largely ‘weathered the storm’ thanks to strong domestic demand and continuing high volumes of exports to China. However, the winding down of the furlough scheme in the UK over the coming months is likely to contribute to turn the disease crisis into economic crisis, with a knock-on effect for the meat industry, Mr Claxton said.

China recovery

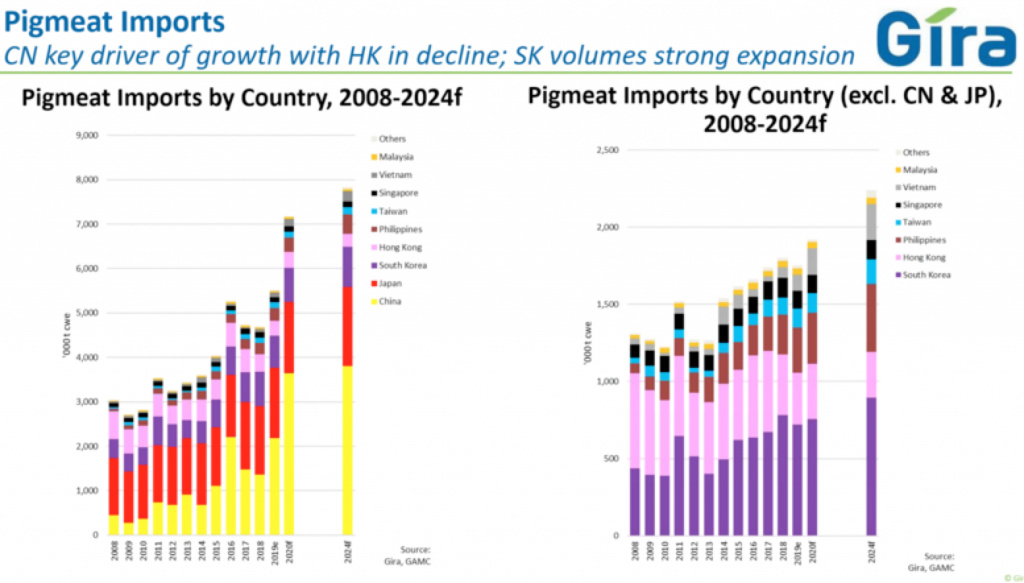

This is one reason why exports are so important, in particular to China. After being at the centre of the COVID-19 crisis in January, almost 90% of Chinese employees are now back in work, although foodservice trade remains 30-40% down and tourist travel is very limited.

The logistical issues caused by the COVID-19 outbreak are now largely resolved and, with China remaining ‘very short’ of pork, it continues to be the major market’ for pork exporters, Mr Claxton said.

But he stressed that ‘massive investment’ investment is currently going into rebuilding the Chinese pork sector after ASF, with news coming through recently of a pig farming company constructing a 5 million head a year slaughter plant, with another five planned.

“There is huge investment going in, with vertical integration across the big players, that will completely change the situation in the Chinese market,” he added.

Gira does not expect China to ever fully recover to pre-ASF production levels. “Roughly, we are looking at a recovery point of approximately 80% of 2018 volume in seven years,” Mr Claxton said.

Although down from a February peak, retail pig prices in China remain high and still comfortably more than double pre-ASF levels n 2018. But the piglet price is soaring, the equivalent of £258 for a 22kg pig, reflecting the demand for quality female breeding stock, Mr Claxton said.

He pointed out that the major constraint to Chinese imports is generally available supply among exporters, as they have to service their domestic markets. But pork exports to China have actually exceeded forecasts during the COVID-19 pandemic as the loss of foodservice markets has increased availability among major exporters.

This was particularly true of the US, but the crisis in the US pork sector in recent weeks, with an estimated 44% of capacity was lost at the peak due to plant closures, has resulted in a tightening of supply again, he added.

“All of those plants are now open, although they are still talking about being 20% below capacity because of all the measure put in place to mitigate the impact of COVID-19,” Mr Claxton said.

Before the US shut down, high volumes of US exports to China were ‘really challenging’ the export market, with EU prices under significant pressure. But over the second half of the year, Gira expects the US to ‘come back with more volume’ to again intensify competition in the Chinese marketplace and pressurise export prices.

Political tensions

However, Mr Claxton stressed that one caveat to this could be the deteriorating relationship between the Trump administration and China over COVID-19, on the back of the president’s repeated accusations over the ‘Wuhan virus’ and China’s role in the crisis. While at the moment, China is honouring the conditions of the current trade agreement, trade could be affected if tensions escalate, Mr Claxton added.

But he warned that the same could apply also to the UK, given the current tensions between the respective Governments over Hong Kong.

Given all the global uncertainty, Mr Claxton stressed the importance of pursuing new export opportunities, particularly in Asia, highlighting the potential of Vietnam, Taiwan, Singapore and the Philippines in particular.

ASF is still prevalent and spreading in South East Asia, prompting China and some neighbouring countries to seek high volumes of imports to make up for domestic losses. Economic recovery in Asia is going to be a key factor in determining Asian import demand for the rest of this year, he said.

Asian opportunity

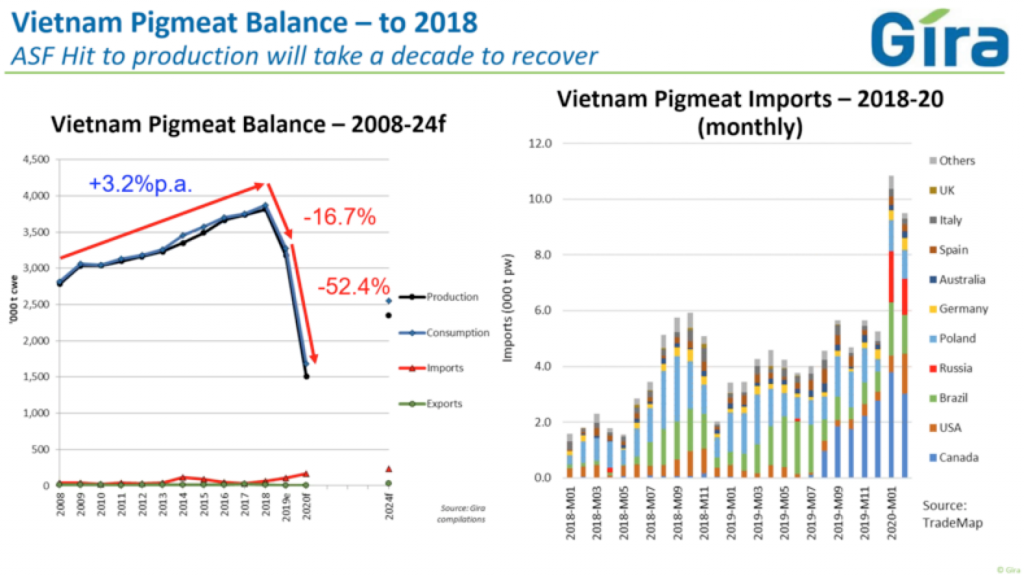

In Vietnam, pork production has fallen by almost 17% as a result of ASF, with expectations of a further drop to around 52% by the end of this year. “We predict it could take a decade for the country’s pork sector to recover,” Mr Claxton said. “Therefore, there is a real opportunity to potentially increase volumes over the next five to ten years.”

AHDB’s Head of Asia Pacific Jonathan Eckley highlighted the ongoing work of AHDB’s export team in these key markets.

He said: “While inward and outward missions have been cancelled due to coronavirus, the work of AHDB’s export team continues and we are working collaboratively with agencies and partners in a number of markets to fly the flag for the UK’s red meat sector.”

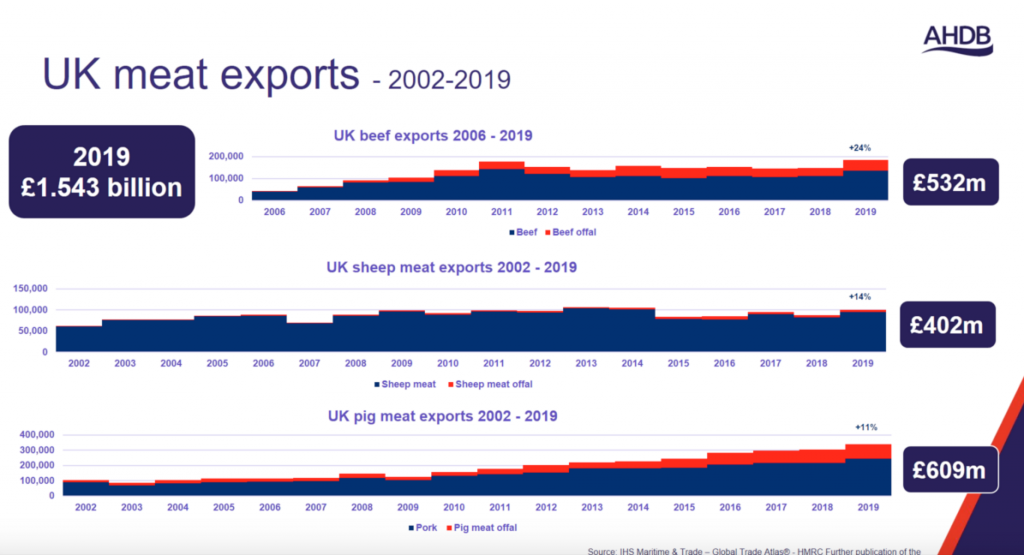

He gave an overview of the UK’s red meat exports in 2019, worth over £1.5 billion, including a record £609m of pork exports.

The start of 2020 following lockdown in China resulted in some logistical disruptions affecting shipments. However, by the end of March UK pig meat exports had again surpassed year earlier levels, reaching 30,000 tonnes in March, driven by increased demand as logistics started to ease in China.

- You can listen to the webinar here https://ahdb.org.uk/pork-events-archive

- A second webinar on July 2 will focus on the all-important US market.