A new article from AHDB has been released which examines the possible long term changes in meat eating habits that are likely be occur as a result of the Covid-19 outbreak.

For the meat industry the key takeaway is that the overall amount of meat being purchased from grocery is expected to rise and go some way to offset the losses made by the closure of the food service industry, but that the types of meat being purchased may be vastly different.

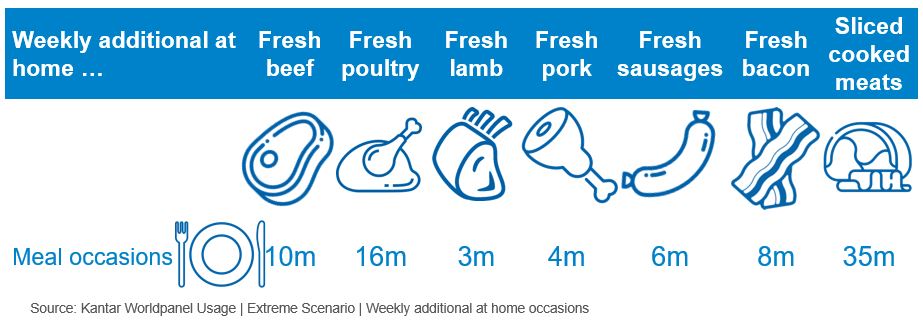

Data from Kantar Worldpanel estimates that 503 million more in-home meals will be eaten per week in this lockdown period, a rise of 38% and an estimated increase in spending of £670m on grocery. In the article, Steven Evans, senior consumer insight manager at AHDB, breaks down where this additional money is likely to be spent.

Sliced cooked meats are expected to feature in 35 million additional meals, with sliced ham to make up over 90% of this rise. Pork is expected to feature in an additional six million meals per week, and fresh bacon is expected to feature in an additional eight million meals per week as consumers start to favour cooked breakfasts.

In other categories: fresh beef is likely to feature in ten million more at-home meals per week; fresh poultry is expected to feature in 16 million more meals; lamb is predicted to feature in three million more meals; chilled burgers and grills will be boosted by an additional one million meals per week; mince will feature in six million more meals; and roasting joints will feature in five million additional occaisions.

Overall, all categories of meat are expected to see a rise of between 20 and 72 per cent.

Steven Evans said that the current lockdown will likely have ripple effects further down the line after it has been lifted, and that looking at historic events will go some way to informing how this might look.

He said: “For instance, in the credit crunch of 2007/2008 markets saw big spikes of in-home meal occasions. Foodservice struggled as people faced tough economic circumstances, but there were trade up opportunities in retail. Many shoppers remained price conscious but a fancy in-home meal kit can still be cost effective when compared to dining out with the family.

“To a certain extent the Covid-19 pandemic and potential economic ripple effect to consumers may well fast track some of the recessionary behaviour which Kantar observed and AHDB reported on initially during Brexit uncertainty.

“Adapting to consumers demand is really challenging when the size of the shift in lockdown has never been seen before. Adapting and evolving as the consumer needs change over the coming months will be pivotal to long term success.”