The standard pig price (SPP) and all pig price (APP) have been around since 2014, when they replaced the deadweight average pig price (DAPP).

They are effectively voluntary, whereas the third UK pig price measure, the UK reference price, is mandatory for abattoirs.

Each is calculated in a different way and serves a different purpose.

UK reference price

This is the average weekly pig prices paid by abattoirs, including both standard and non-standard pigs, covering the previous week (Monday to Sunday).

Any UK abattoir that kills more than 500 clean pigs per week is required to provide information for UK reference prices. These prices are reported to Defra for ongoing monitoring of the market.

Prices are reported for all pigs classified as E, S and R grade, as defined here:

- E: 55-59.9% lean meat percentage (LMP), 60-119.9kg

- S: 60%+ LMP, 60-119.9kg

- R: 45-49.9% LMP, 120-179.9kg

In the UK, most pigs are classified as S and only a very few are R. The abattoirs provide weekly kill data by individual pig, which includes the weight, probe, sex, kill date, grade, kill reference and p/kg.

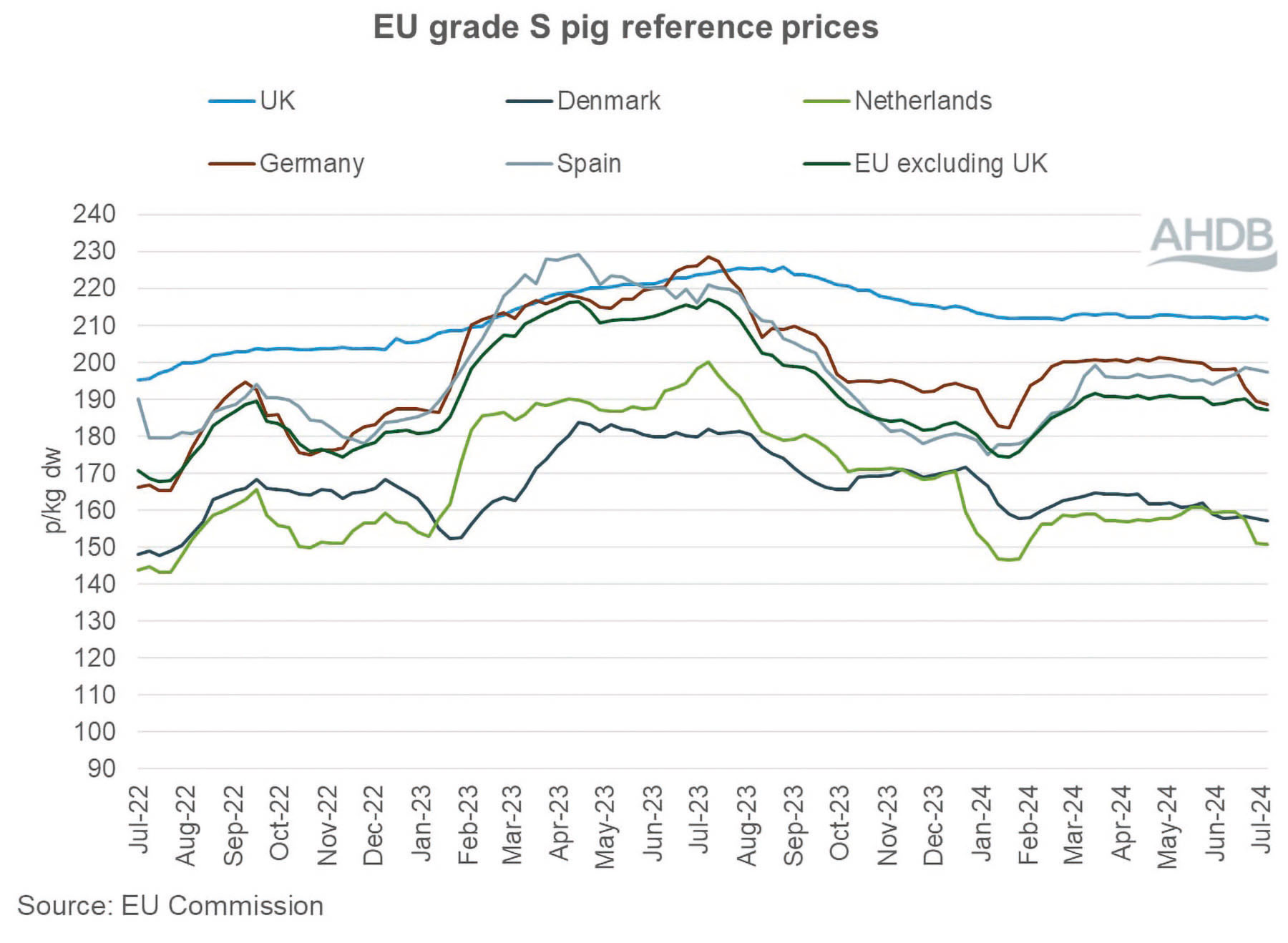

AHDB also publishes a weekly comparison between the UK price and equivalent EU reference prices.

The SPP

The SPP shows the average price paid by abattoirs in Great Britain for pigs in the previous week (Monday to Sunday). It is published on AHDB’s website each Wednesday.

As the name suggests, it only includes standard pigs, on which no explicit premium, other than weight and grade, is paid for a specific attribute. Therefore, it excludes outdoor-reared and bred pigs and rare breeds, as well as schemes such as RSPCA Assured.

Participation is voluntary and there are six contributing companies – Pilgrim’s UK, Cranswick, Karro-Sofina, Woodhead Bros (Morrisons), HG Blake and C&K Meats.

These companies supplement the weekly kill data they provide for the UK reference price with a flag which indicates whether a pig is standard or non-standard.

Generally, 55,000-65,000 pigs are included in the SPP each week – for the week ended July 20, the figure was just over 57,000.

The APP

The APP shows the average price paid to producers in GB for clean pigs two weeks prior (Monday to Sunday) and incorporates both standard and non-standard pigs, so includes outdoor-bred/reared pigs, RSPCA Assured and so on.

The sample, typically about 60,000-70,000 head, therefore tends to be bigger.

Another big, but often unrecognised difference is that, whereas the SPP is based on buyer data from abattoirs, suppliers provide the data for the APP. It comes from six marketing groups – Anglia Quality Meats, Ian Mosey (Livestock), Meadow Quality, Scotlean Pigs, Thames Valley Cambac and Yorkshire Farmers.

It is therefore based on a completely different set of data to the SPP.

For the SPP and APP, AHDB’s report shows prices by weight band, as well as the overall average. Both prices are reported for EU and UK dressing specifications.

What does and doesn’t go into these price measures?

All three reporting mechanisms exclude pigs traded within integrated processing companies or any pigs in which the processor retains some legal interest.

They also exclude sows, boars, liveweight purchases and fully condemned pigs, although part-condemned pigs are included with an adjusted price.

They represent the gross price paid to producers for the net cold weight for an EU-spec dressing specification before any below-the-line deductions, such as transport, insurance, lorry wash, meat inspection and levies, compensation payments for weight or overnight slaughter delays and payments for procurement.

They include bonuses paid on slaughter, such as sex or antibiotics-free bonus, compensation for additional haulage and bonuses to incentivise delivery times.

These differ for the SPP as, unlike the other two measures, it does not include ‘non-standard’ pigs. They do not include bonuses paid in arrears.

How is accuracy ensured?

The abattoirs are subject to several audits for the SPP and reference prices. The Rural Payments Agency or the Scottish government conduct quarterly abattoir audits to ensure the data meets the specification for the UK reference prices.

AHDB also conducts annual audits to ensure the data provided to AHDB meets the APP specification and to check pigs are correctly classified as standard or non-standard for the SPP.

On a weekly basis, AHDB employ a team of trained analysts who use their expertise alongside dedicated systems, to perform several checks on the data for publication.

If necessary, data is queried directly with the abattoirs to ensure it is robust and representative, AHDB said.

SPP as a price setter

Although AHDB actively recommends that it does not form part of contracts, the SPP has become the primary price-setting mechanism for GB, still forming at least part of many contracts today, even as more are linked to cost of production.

Effectively basing this week’s pig price on last week’s average has been a self-stabilising mechanism for the SPP.

This is never more evident than when comparing the UK and equivalent European prices.

For example, since September 2022, the UK reference price has remained within a fairly tight band of just over 20p, while some European prices, which are more reactive to market signals, have moved up and down within a range of more than 50p.

The German VZEG pig price tends to move up or down by 5-10 euro-cents at a time.

But when the previously rock-steady SPP dropped by 1.26p in June, it came as a shock to many, with some questioning whether it might have been a data issue.

After further falls, it lost about 2p during June and July. But, in reality, this is a time of historic stability – the SPP fell by 1.65p over the first six months of the year, the smallest change between January and June since it was introduced 10 years ago, AHDB analyst Freya Shuttleworth pointed out.

This stability is a double-edged sword – it sometimes appears to go up too slowly as market forces shift, but, by the same token, it also comes down more slowly, as comparison with European prices shows.

There are always some question marks over the SPP, including about its transparency, what does and doesn’t go into it, how it is reported and its non-responsiveness to market signals.

Some would like it to be reviewed, but others believe that while it is not perfect, the SPP is the best price-recording mechanism the industry has and would be difficult to replace with anything better.

Uncertainty surrounds pig slaughter data

Uncertainty continues to surround data on UK pig slaughter numbers.

When Defra published its June UK slaughter figures for pigs in mid-July, it came with a caveat that slaughter numbers for April to June 2024 have been modified due to missing data.

“These figures are still provisional and remain subject to further revision,” the notice said.

This provisional data for June suggested clean pig slaughterings were down 3.2% year on year at 791,000 head, while UK pigmeat production, at 73,000t, was 1.7% down year on year.

This meant that over the first six months of this year, UK slaughterings were 1% down on 2023 at 4.95 million head, while pork production was 0.6% up on the back of higher carcase weights. Both figures were way down on 2022 levels.

The UK slaughter figures inform AHDB’s weekly GB slaughter estimates and the uncertainty forced AHDB to make major backdated upward revisions to the estimates for April, May and June.

Initially, no figure was published for the first week of July as AHDB queried what lead red meat analyst Tom Dracup described as ‘a significant error’ in the Defra slaughtering data set.

AHDB has since resumed the publication of the estimates, albeit with the caveat that, due to the ongoing query regarding the June Defra slaughterings, clean pig figures for June and July 2024 are being weighted by the Defra May 2024 figure.

Mr Dracup said AHDB has had ongoing correspondence with Defra and was beginning to get the necessary details/reassurances for the figures, but uncertainties remain with the June data.

“Naturally, an element of caution would be wise until all outstanding queries are resolved,” he said.