Estimated GB pig slaughter was significantly down in January, compared with average volumes for the month, as pig supplies tighten significantly on the back of last year’s herd contraction.

For the four weeks ending 28 Jan throughputs totalled 629,500 head, a decline of 22,300 head compared with the previous four weeks. Weekly throughputs averaged at 157,400 head, significantly lower than the numbers seen a year ago (-12,900 head) and the 5-year average (-17,200 head).

Indeed, weekly throughputs for January are among the lowest full week throughput figures seen for a very long time – you have go back ti 2011 for lower full-week January figures.This supports wider industry commentary that the supply of finished pigs is beginning to run tight, according to AHDB analyst Freya Shuttleworth.

Average carcase weights increased in January compared to December, with the SPP sample averaging 89.31kg for the four weeks ending Jan 28, up almost 2kg on the month, with the APP sample up 1.5kg to average 88.15kg (for the four weeks ending 21 Jan).

“It has been reported that some pigs were brought forward early in December to ensure seasonal demand was met. Despite this, average carcase weights are now in line with the 5 -year average and significantly lower (-6kg) than this time last year when the heaviest weights on record were reported,” Ms Shuttleworth added.

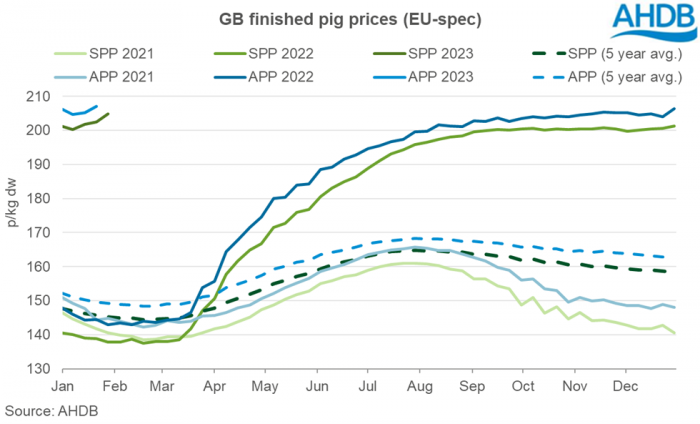

Meanwhile, the SPP moved to new record highs for three successive weeks in January, ending the month at its highest ever value of 204.78p/kg – nearly 70p above this time last year and 60p above the 5-year average. For the four weeks ending January 28, the EU spec SPP averaged 202.34p/kg, up 1.75p/kg on the December average.

The APP has been following the same overall trend as the SPP. For the four weeks ending 21 Jan, the EU spec APP averaged 205.87p/kg, an increase of 1.19p/kg compared to the previous four-week period .It also ended the period on a new record high, standing at 207.03p/kg (w/e 21 Jan), more than 60p higher than a year ago.

EU pig production falling

Meanwhile, the latest production data from the EU Commission, dating back to the autumn, shows that year-on-year EU pig meat production is down compared to last year.

Total pig meat production in October was 1.79 million tonnes, 6.1%l down, compared to October 2021, with the total volume of pig meat produced in the EU for the year to date down 18.3Mt, a decline of 5.2% year on year and inline with the EU forecast.

Slaughterings have also been in year on year decline. In October it was reported that 19.29 million head of pigs were slaughtered, again a decline of 6.1% compared to October last year. This brings the total number of pigs slaughtered at abattoir for the year to date 196.2m head, down 4.6% on the same period in 2021.

Spain and Germany remain the top producers of pig meat, totalling 4.17 million tonnes and 3.72 million tonnes respectively for the year so far. However, nearly all EU nations are in decline with Germany, Poland and Denmark having recoded the largest volume decline, losing 407,000 tonnes, 141,000 tonnes and 107,000 tonnes respectively so far in 2022.

“Producers in the EU are facing similar pressure to those in the UK with input costs squeezing farm margins and consumer demand easing due to the cost-of-living crisis as well as coping with disease outbreaks,” Ms Shuttleworth said.