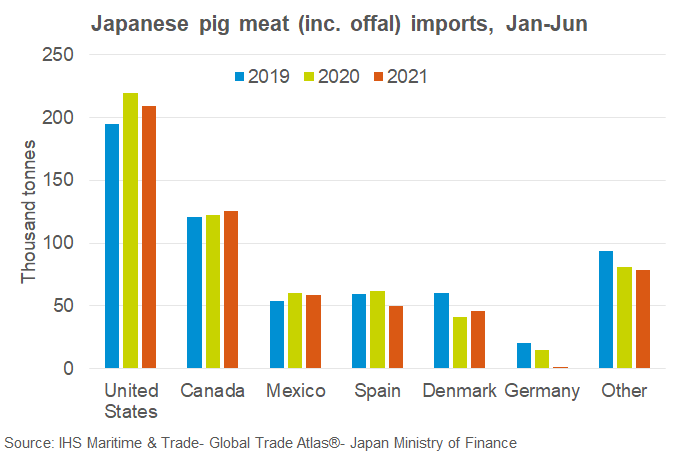

Total pig meat shipments to Japan were down slightly in the first half of this year compared with last year, with volumes totalling 567,700 tonnes, 5% lower than in 2020, AHDB analyst Bethan Wilkins reported.

“Lower imports have been influenced by ongoing weakness in foodservice demand due to coronavirus restrictions,” said Ms Wilkins. “This is likely to remain a challenge in the short-medium term, as Japan is currently struggling with rising cases of the Delta variant, with much of the country under a state of emergency.”

The US remained the largest supplier, though volumes were 5% below last year at 208,800 tonnes for the first half of 2021. Canadian suppliers exported 125,200 tonnes of pork to Japan, up 3% on the previous year.

Imports from the EU were 13% lower at 139,200 tonnes. Germany was banned late last year due to African Swine Fever cases within its borders. Imports from Spain also recorded a sharp drop of 19% to 49,900 tonnes.

Other EU suppliers increased shipments and compensated for these declines to some extent. Denmark and Ireland are the most notable examples, with volumes totalling 45,600 tonnes (+11%) and 7,300 tonnes (+139%) respectively.

Ms Wilkins added that, despite a weak demand picture so far this year, and ongoing difficulties, the latest commentary from Rabobank suggests imports could fare somewhat better in the second half of 2021.

“This is because of low stocks of imported pork,” she explained. “The latest forecasts from the USDA, published in July, also indicate a 1% growth in import volumes is expected for 2021 overall.

“Japan’s pork import requirements, and the price they are willing to pay, will be an interesting watch-point for many exporting nations in the coming months. This is especially the case given the apparent drop-off in Chinese demand.”