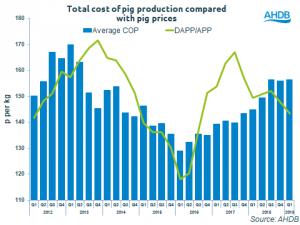

AHDB has reported that due to falling pig prices, producer margins worsened in the first quarter of this year. The latest estimates suggest that, on average, producers were losing £11 per pig sold (-13p/kg). This is the most significant loss-making period since Q3 2012.

Pig prices declined steadily throughout the first quarter; the EU-spec APP stood at 143p/kg, the lowest since 2016. Meanwhile, the average GB finished pig production cost remained at 156p/kg. This was the same as the second half of 2018, and the highest level since 2013 before this. Compared to the same period last year, costs were 12p/kg higher.

AHDB analyst Alex Cook said: “Pig production has been in a loss-making position for over nine months now. Although prices have gained around 9p/kg since the end of March, assuming total production costs have remained similar, producers would still be losing around £4/head (-4p/kg).

“The estimated cost of production is a representation of the whole economic cost for a producer. This includes non-cash costs, such as building depreciation and family labour, which average around 15-20p/kg. “

Mr Cook said that while these non-cash costs won’t directly affect the immediate cash flow of a business, they are important for longer-term viability.

Mr Cook added: “Fortunately, the outlook for the rest of the year offers more positivity. Rising import demand from China has already resulted in an increase in UK pig meat exports and looks set to continue amidst the ongoing ASF crisis.

“Chinese demand has also supported EU prices, and on top of this EU supplies could remain tightened in the near future as current EU pig herd numbers are down on last year. With strong global demand and lower competition from EU imports, UK prices look set to continue their rise in the coming weeks.”