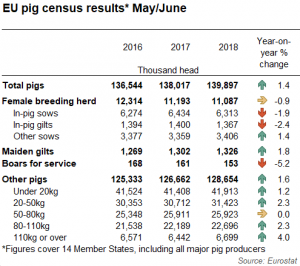

The overall EU pig herd increased slightly in the year to June 2018, according to provisional figures from Eurostat, however within this there was some contraction in the breeding herd. The latest census results cover 14 countries, including all the major producers, so should be representative of the whole EU.

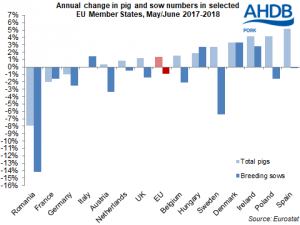

Growth in the overall EU pig herd was driven by the 5% rise in the Spanish herd, which accounted for nearly 80% of the overall increase. While most of the EU’s constituent herds recorded rises, declines were recorded by Romania, Germany and France.

The number of breeding sows declined by less than 1%, to 11.1 million head. This is, perhaps not, surprising considering prices trending lower year-on-year. Also, assuming sow productivity has continued to increase, fewer sows would be required to produce the same number of piglets.

The majority of the major producing countries recorded downwards movement within the breeding herd, compared to last year. The largest declines in breeding sow numbers were recorded by Germany and Romania, which both recorded a decrease of around 47,000 head. The Romanian figures will be influenced by the increasing spread of African Swine Fever (ASF) through the country. Meanwhile in Germany producer optimism has been low due to declining consumption and increasing pressure from animal welfare and environmental regulations.

At the other end of the scale, Denmark bucked the overall trend, recording a 3% increase in sow numbers, to 1.3 million head. Also, while Spain recorded a stable sow herd at the time of the census, the number of maiden gilts did record significant uplift (+8%) implying some further expansion may soon occur.

The small decline in the breeding herd suggests that growth in pig slaughterings should start to slow moving into 2019, although no dramatic tightening of supplies would be expected. The likely slowdown in production is also suggested by the figures for the rest of the pig herd. The number of non-breeding pigs picked up by 1.6% overall, to 128.7 million head, but the total number of weaner pigs under 20kg was only 1.2% higher. This growth is clearly lower than the 3% rise in pig slaughterings recorded in the first half of 2018.

Nonetheless, even this modest increase in output may well mean prices remain subdued in at least the short-term, unless the export market improves, as consumer demand within Europe remains generally lacklustre. Developments in the ongoing ASF situation in China will likely be key for EU pig price prospects.