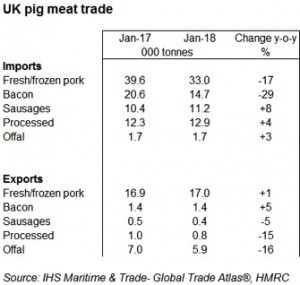

Despite significant growth in production in January, UK pork exports were less than 1% higher than year earlier levels during the month, totalling 17,000 tonnes.

However, even with lower farmgate prices, the average unit price of these exports was 3% higher. As such, the value of the pork export market was 4% above January 2017, at £22.5 million. The increase partially reflects a shift towards exporting more, higher value, boneless cuts. These export volumes reached almost 3,800 tonnes, 18% above year earlier levels.

In contrast to December, exports to China failed to match year earlier levels, recording a 29% decline to stand at 2,600 tonnes. This was the main cause of the drop in bone-in shipments, as China is the UK’s primary destination for these cuts. Nonetheless, rising pork shipments to the EU countered the decline in Chinese volumes, with particularly strong growth recorded to Ireland and Denmark. Interestingly, while fresh/chilled shipments continued to make up the majority of exports to the EU, exports of frozen pork increased by more than half.

Offal exports were slower month, declining 16% year-on-year to 5,900 tonnes. Shipments to both China and Hong Kong declined by 34% (1,200 tonnes) and 42% (700 tonnes) respectively, which drove the overall fall. Although, increasing trade with the Netherlands and the Philippines minimised the overall drop.

Continuing the trend from the latter half of 2017, UK pork imports were recorded behind year earlier levels in January. At 33,000 tonnes, volumes were 17% below January 2017, but this was still 17% above the month in 2016. As in previous months, the decline was particularly driven by a sharp fall in shipments from Denmark, although again at 12,000 tonnes these volumes remain elevated above historic levels. However, shipments from the UK’s other key suppliers were also recorded as behind 2017 levels, likely reflecting the increase in domestic supplies.

Bacon imports were 29% lower than year earlier levels at 14,700 tonnes, continuing the recent trend, as imports from the top three suppliers (Denmark, the Netherlands and Germany) all fell. However, there was some modest increase in imports of sausages and other processed products. Growth for sausages was particularly driven by German shipments (+800 tonnes), whereas more processed pig meat was imported from Poland (+900 tonnes) and Denmark (+700 tonnes).