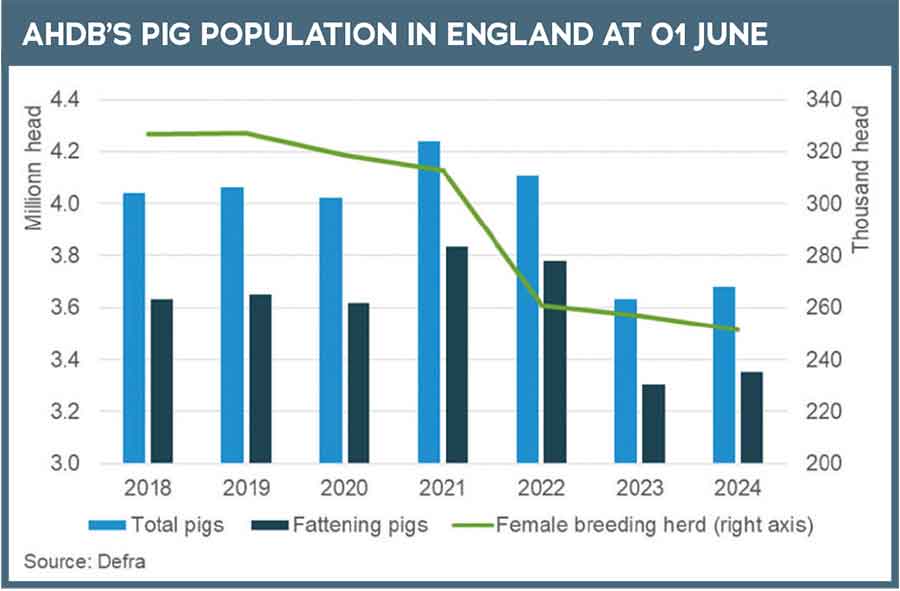

The publication of Defra’s latest livestock population update for England, based on the June census, paints a decidedly mixed picture of the state of the pig industry, as it looks to rebuild post-crisis.

The headline is that the English breeding herd has fallen to its lowest level ever recorded.

However, overall pig numbers were up, with a big surge in weaner numbers suggesting we will see higher-than-expected abattoir throughputs and pig production in the second half of this year.

See also: How to reduce the risk and spread of swine dysentery

Breeding herd decline

The English breeding herd, including boars, fell by a further 1% to 325,900 head in the year to June, the Defra figures show.

The number of sows in pig was down fractionally to 183,000 head, alongside a 5.3% fall in gilts in pig to 29,600 head and an 8.3% drop in ‘other sows’ (dry sows or those kept for further breeding) to 38,600 head.

This meant the female breeding herd (not including gilts not yet in pig) fell by 2.2% to 251,400 head, the smallest figure on record.

More encouragingly, however, the number of gilts intended for first-time breeding was up 4.3% to 66,400 head.

In June 2021, the English breeding herd (including boars) stood at 402,600, prior to a devastating 18% decline to 328,600 in June 2022 as a result of the pig crisis.

There was a slight recovery in June 2023, before numbers slipped back again this year.

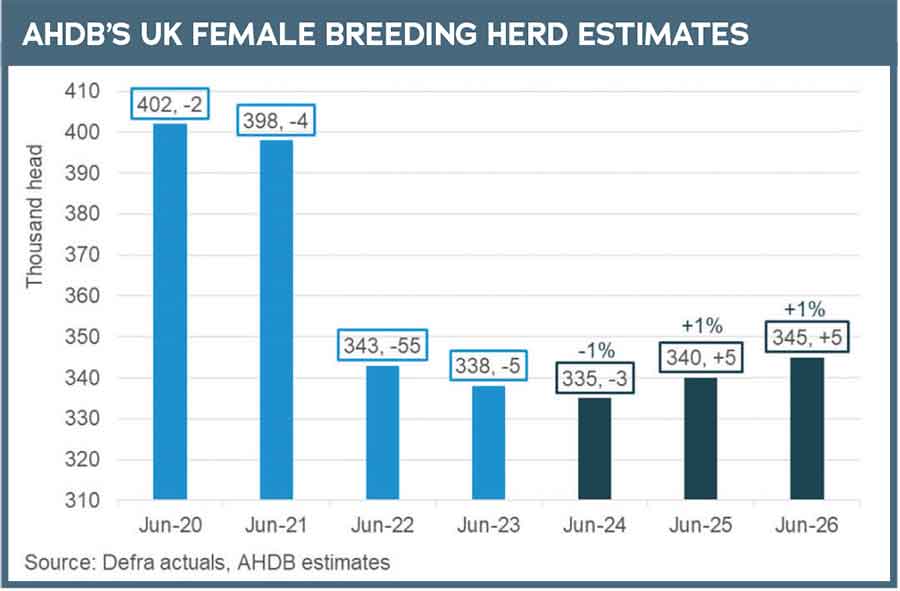

The English pig herd makes up around 75% of the UK total, and AHDB is predicting a slightly smaller decline for the UK female breeding herd of 1%, balancing the reality that some producers have departed the industry over the past 12 months, while others have reported intentions to expand.

“Looking longer term, minor growth in the breeding herd is forecast in the next couple of years if market conditions are favourable. However, these estimates would only see the herd size return to 2022-23 levels. No recovery to historic pig population size is expected in the foreseeable future,” AHDB said in an update to its 2024 Pig Outlook.

Industry is investing, but is it expanding?

Defra’s June figures, albeit for England only, point to an industry still showing little appetite to expand, despite a prolonged period of profitability.

However, that doesn’t tally with the evidence on the ground, according to consultant Dominic Charman. “The census doesn’t bear out what I or the vast majority of my contacts see in the real world. On the ground, we are seeing growth and significant investment,” he wrote in the Weekly Tribune.

Speaking at the latest NPA Pig Industry Group meeting, AM Warkup’s Andrew Hall said there was significantly more investment going forward into new-builds, but that it was mainly replacing old for new, rather than expansion.

Finishing pig numbers

Despite the breeding herd setback, the total number of pigs in England increased by 1.3% to 3.7 million in June 2024, due to a 1.5% rise in the number of fattening pigs to 3.4 million.

This was entirely down to a 10% increase in weaner numbers under 29kg, which is likely to drive slaughter throughputs in the coming months, according to AHDB livestock analyst Freya Shuttleworth.

But there were declines in young piglets (-1.9%) and older fattening pigs (-2%), which she said was not surprising given the unfavourable weather conditions since October last year.

At the UK level, in the first eight months of 2024, the clean pig kill totalled 6.78 million head, up 1.6% on last year, according to Defra UK slaughter figures.

They suggest a 0.6% year-on-year decline in August, however, following a surprising and almost unfeasible 17% year-on-year increase in July.

Defra has now removed the warning that the figures are subject to clarification, but their accuracy cannot be guaranteed.

Meanwhile, AHDB’s weekly GB slaughter estimates have been consistently up on 2023 levels by 5,000-7,000 head a week since mid-August.

Based on this evidence of a recent hike in throughputs and the big rise in English weaner numbers, AHDB expects to see production growth accelerate for the rest of the year.

In fact, its forecast for Q3 of a 4.2% year-on-year increase in throughputs is more than double its original outlook estimate, published in February.

Over the course of 2024, it forecasts that the clean pig kill will be up 1.5%, double its original estimate, to 10.2 million head,

Production growth

Pigmeat production, at 631,500t, increased by 3.2% year on year in the first eight months of 2024, despite Q1 volumes being 1.6% down as pigs were pulled forward to meet Christmas demand at the end of 2023.

In contrast, Q2 were volumes up 4.4% year on year, although this was in comparison to an historic low, AHDB said.

It is now forecasting that UK pigmeat production will increase by 2.7% over 2024 to 951,000t, compared with its initial estimate of 0.6%.

This is despite a static breeding herd and well ahead of the proportional rise in slaughterings due to productivity gains, including falling piglet mortality and higher carcase weights, which, at 90.1kg in the year to August, were 1.3kg higher on the year. Sow and boar throughputs have also picked up.

AHDB anticipates smaller growth of just 0.9% in 2025, weighted to the second half of the year, and driven by a 0.8% increase in clean pig slaughter, with minimal change in carcase weights.

However, this, as with all forecasts, is caveated by the growing risk of a major disease outbreak, such as ASF.

Trade

In the first half of 2024, UK pigmeat export volumes fell by 2.4% to 148,000t, the lowest level since 2015, due to subdued demand from China and increased competition from Brazil and the US.

However, HMRC data shows July shipments were up nearly 12% year on year, moving year-to-date export volumes more in line with last year.

Imports grew by 1.4% to 387,000t in the first half of the year, as the UK-EU price differential widened significantly, alongside a weakening euro. UK pigmeat imports in July were 1% down year on year, however. AHDB forecasts UK exports to end the year 2-3% down on 2023, with imports up by 1-2%.

Demand

Retail demand for pork fell by 2.2% year on year in the year to August 4, according to Kantar, while the foodservice market, which tends to be dominated by imports, has seen volumes grow by 5.2% (AHDB estimates).

For the full year, AHDB is forecasting pork volumes will be 2% down on 2023 and 4% down on 2019. However, with a better overall economic outlook predicted, 2025 is expected to see a ‘flatter performance’.

Prices

GB pig prices saw minimal movement in the first half of the year, but have moved marginally lower in recent weeks.

As forecast production and demand travel in opposite directions over the rest of 2024, there is potential for downward pressure in the coming months, although there may be some seasonal uplift over Christmas. EU prices and supply, alongside exchange rates, will continue to be key, AHDB said.

EU pigmeat production and slaughterings rise

EU pigmeat production totalled 10.5mt in the first half of 2024, up 2% on 2023, with growth recorded across most EU nations.

Poland accounted for close to half of this increase, (+80,000t), with Germany, the EU’s second-largest producer, gaining nearly 19,000t, and Danish production growing by 2% to 673,000t. However, Spain, the EU’s largest producer, saw a decline of just over 27,000t to 2.46mt.

Production has been partly driven by a 1% increase in slaughter numbers, thanks mainly to a 7% lift in Poland to 9.7 million head.

Germany recorded minor growth, while Denmark recorded a 3% decline, despite higher pork production. Spanish slaughter numbers declined by 1.7% to 26.2 million head.

Higher EU production, alongside weak domestic and international demand, has resulted in a steady fall in EU pig prices.