The NFU has written a letter to Prime Minister Sir Keir Starmer calling on him to stand by his commitments to British farmers by delivering a renewed agriculture budget and confirming the continuation of Agricultural Property Relief (APR) later this month.

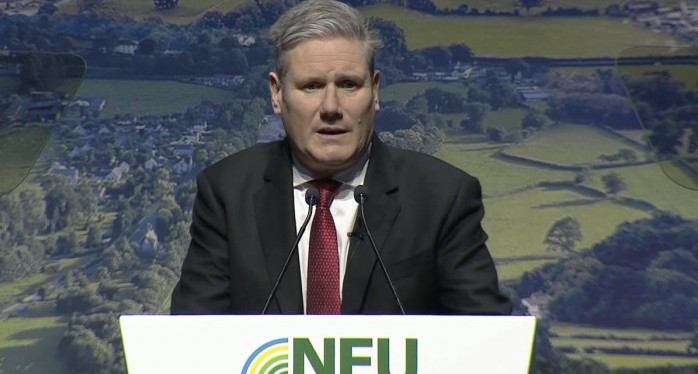

Sir Keir’s chancellor Rachel Reeves will outline her first autumn Budget on October 30. Ahead of this, the NFU has highlighted that, while in opposition at its conference in 2023, the Prime Minister said that British farmers and growers need a government that ‘seeks a new relationship with the countryside and farming communities… based on respect, on genuine partnership’.

He also said: “We can’t have underspends in the allocated money, we can’t have farmers struggling while they wait for the right Sustainable Farming Incentive (SFI) standards to be announced. We can’t have everyone burnt out by the bureaucracy and constantly moving goal posts, it’s too important.”

NFU President Tom Bradshaw said: “The Prime Minister’s words were warmly greeted at NFU conference. We finally heard recognition of the certainty and stability needed for a thriving food and farming industry – one that underpins the UK’s largest manufacturing sector food and drink which delivers £148 billion to the economy.

“However, reports that the government is considering cutting the agriculture budget due to the failure of the previous government leading to an underspend of £358 million, and a possible review of Agriculture Property Relief (APR) are incredibly concerning.

“We are asking for a renewed multi-year annual agriculture budget of £5.6 billion, not because it would be nice to have, but because it is an essential investment to deliver the government’s environmental goals, increase growth and support the economic stability of farm businesses.”

APR concerns

The NFU is also deeply concerned over suggestions the government could be about to drop APR, to save the Treasury £120m a year.

Mr Bradshaw added: “The loss of APR could mean family farms, who are vital to producing food for the country, providing jobs and looking after our countryside, having to be sold to cover the costs. Changes would amount to a ‘Family Farm Tax’. It would also have a devastating impact on tenant farmers and new entrants.

Around two thirds of the farmed area in England is occupied by working farmers who rent in some or all of their land. If APR was abolished is it likely that land owners would no longer be willing to let their land and seek to end existing tenancies, according to the NFU.

“On October 30, we’re asking for an increased agriculture budget and confirmation of no change to APR. This will deliver certainty to our food producing businesses and ensure our food security and environmental targets, all of which contribute to the government’s own missions for growth and prosperity,” Mr Bradshaw added.

The NFU is also asking the Treasury to:

- Ensure adequate resourcing to deliver the Farming and Countryside Programme, maintain flood defences and deliver the government’s new bTB strategy.

- Introduce enhanced capital allowance to incentivise investment in climate smart investments.

- Only apply Capital Gains Tax increases to non-business or short-term gains.

- Commit to a full consultation ahead of the proposed abolition of the Furnished Holiday Lettings regime.

- Confirm a further round of the Rural England Prosperity Fund.