Pig producers should finally enjoy better prices towards the end of the year, following a flat market over the summer, according to NPA chief executive Zoe Davies.

The NPA has held meetings with with processors and marketing groups over the last two months to try and understand what is going on with the pig price.

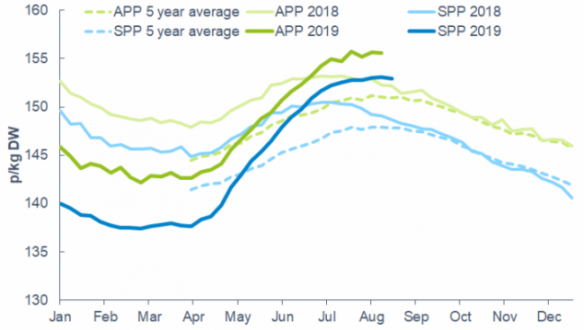

UK pig prices continued to disappoint during August. The SPP stood at just below 153p/kg in the week ended August 24, down slightly on the previous week, meaning the price index was just 0.16p\kg higher than at the end of July. AHDB pointed out that prices are currently falling at a slower rate than this time last year, with the late-August price more than 4p up on a year ago.

EU prices surge ahead again

However, the UK price, which normally carries a healthy premium over EU product, remains well below prices in all the major EU pig producing countries, including a German price of 174.18p, up from 160p/kg at the end of July.

AHDB’s EU reference price also currently shows Spain (163.44p/kg), Poland (162.55p/kg), Denmark (157.39p/kg), the Netherlands (156.62p/kg), and France (153.99p/kg) ahead of the UK price. Prices rose in each case during August, including by nearly 15p in the Netherlands.

However, the difference can be largely explained by the relative supply situations. AHDB noted that supplies on the UK market ‘remain ample’ as the carcase weight continues to hover around 1kg above the 2018 weight.

In contrast, lacklustre European production, combined with re-emerging growth in Chinese demand, prompted by short domestic supplies and record pig prices, has supported higher prices.

Dr Davies said: “We know that UK market demand has been dire, but we have also been killing more pigs this year which has added to the oversupply situation.

“What was most surprising to me, however, was the fact that until recently, most UK primals still traded way above the EU’s in price, even with the uplifts seen, so were not competitive.

“The UK is a loin market (we produce 10 million, we need about 23 million), but as the EU values their carcass differently to us, loins are far cheaper, coming in at around a £1/kg less than the UK price, despite the 30% price increases seen.

“This is changing though and there is a light at the end of the tunnel with both legs and shoulder now becoming more expensive and bellies doing a roaring trade in some countries.

Chinese imports

UK pork exports to China were up 77% in the first six months of the year, totalling 32,692 tonnes, compared with 18,429 in the first half of 2018, with offal exports also up. Chinese import demand is expected to grow further in the second half of the year, following a brief lull, as the full impact of ASF-related herd losses and record domestic prices feeds through. And the UK should better-placed to meet demand.

Dr Davies added: “Chinese exports will increase still further as more UK plants become fully approved, including for the lucrative trotter market, hopefully by the end of September.

“Marketing groups have consistently said that the real increase will be seen at the end of Q3, beginning of Q4 so the picture will be much more positive towards the end of the year at a time when prices would traditionally drop.

“The suggestion was that without China, we would not have seen any of the price increase that we have seen this year. This fact, combined with the excellent harvest and reductions already being seen in feed prices will mean that the situation for many should ease considerably. It could have been much, much worse – so there is a lot to be thankful for.

While the threat of an October 31 Brexit no deals adds some uncertaity into the equation, the market picture is undoubtedly brighter.

Zoe concluded: “There is still plenty of work to be done to promote pork and get more of the British public eating it however! I know it feels like we have been saying this for weeks, but our time is coming…”