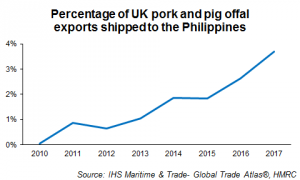

The Philippines is an important and growing export market for UK pig meat. In 2017, the UK shipped nearly 4,500 tonnes of pork and 6,500 tonnes of pig offal to the country, making it the seventh largest destination for UK pig meat exports.

Exports of UK pig meat to the nation have increased eight-fold since 2012, demonstrating its significance to the UK as an emerging market. For this year so far, it has also been one of the UK’s largest growth markets, with pig meat shipments up by around a third (+1,200 tonnes) in the year to May.

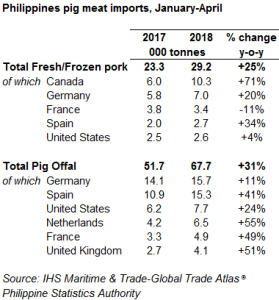

Increasing demand from the Philippines has helped drive the increase in UK shipments. In 2017, the Philippines’ imports of pig meat were the highest on record, at 300,000 tonnes, a rise of 18% compared to year earlier levels.

2018 looks as if it may surpass the record 2017 levels; already in the year to date (Jan-Apr) pork imports are 25% higher and offal imports are 31% higher compared to the same period last year. The latest USDA forecasts anticipate an 18% increase in pork imports for the year overall.

According to the annual report from the Philippine Statistics Authority, the total pig inventory started 2018 1.5% up from 2017 levels. Additionally, there was a swing towards commercial enterprises, in which the pig number increased by nearly 5%, while backyard farm inventories declined marginally. As such, an increase in domestic production is expected this year, with USDA forecasts pegging this at around 2%.

This is perhaps not surprising, since the Philippine pig industry is going through a modernisation period. Last year, the ‘Hog Industry Roadmap’ was published, a plan to address some of the major challenges facing the domestic industry over the next decade. The plan involves increasing the number of pigs sold/sow/year from 18.8 in 2015 to 30 in 2027 and doubling carcase meat production/sow/year to 3.5 tonnes.

These targets reflect a need for the Philippine pig industry to modernise if it is to keep up with growing consumer demand. The latest OECD-FAO outlook anticipates consumption grew to 15.4kg/capita last year (+3% year-on-year), and is now expected to reach 17.0kg/capita by 2027.

The long-term growth is even larger than that anticipated when the Hog Industry Roadmap was produced. To avoid losing out to increasing import levels, the domestic industry will need to become more consistent and efficient.

At present, imports can be favoured in the meat processing sector, due to higher quality and presentation standards.

While commercial pig production does seem to be picking up in the Philippines, it remains to be seen whether the industry will achieve its ambitious targets over the next decade. As such, it looks as if the Philippines is set to continue being a valued and growing export market for the UK, in the near future at least.