Pig farm incomes plummeted in the last financial year, as input costs soared, in stark contrast to strong profitability across most other sectors, official Defra figures show.

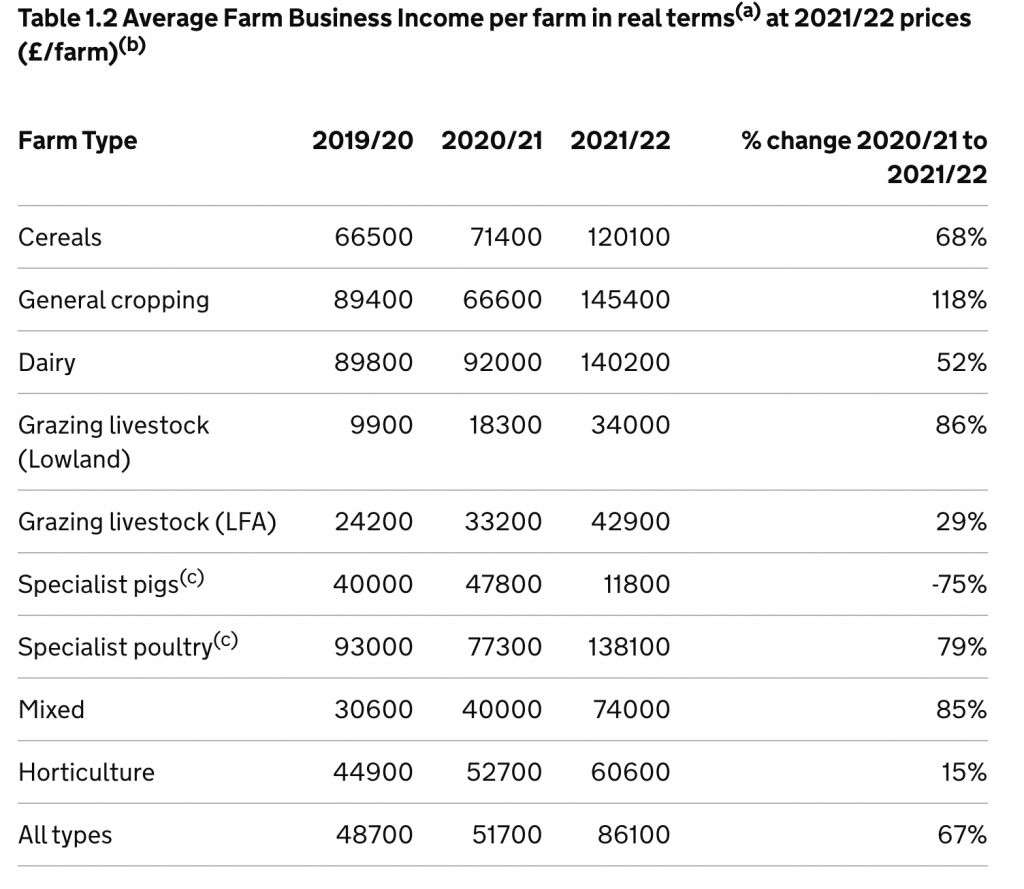

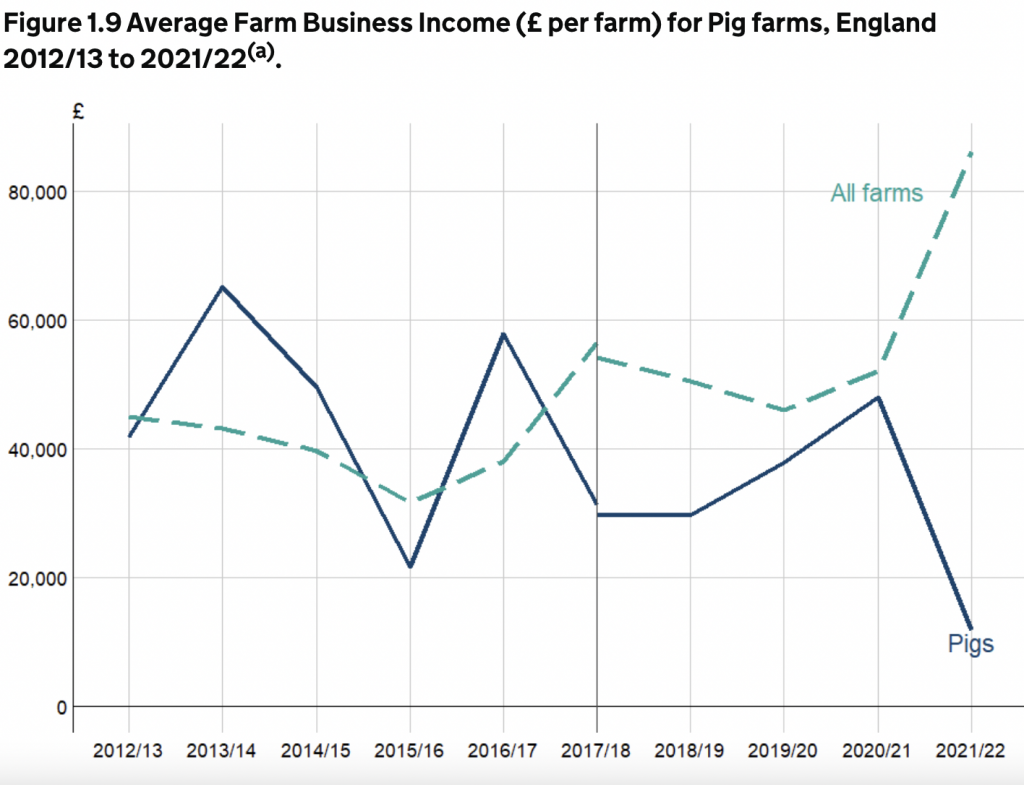

Defra’s average Farm Business Income figures for England show income for specialist pig farms fell by 75% to £11,800 in 2021/22, from a relatively comfortable £48,000 the previous year and £40,000 the year before. It is the lowest figure recorded over the past decade.

In an otherwise good year for agriculture, the average income across all farm types in England was £86,000, up 67%, as all other sectors recorded increases, in some cases big hikes. Average profits of in excess of £120,000 were recorded by the cereals, general cropping, dairy and poultry sectors.

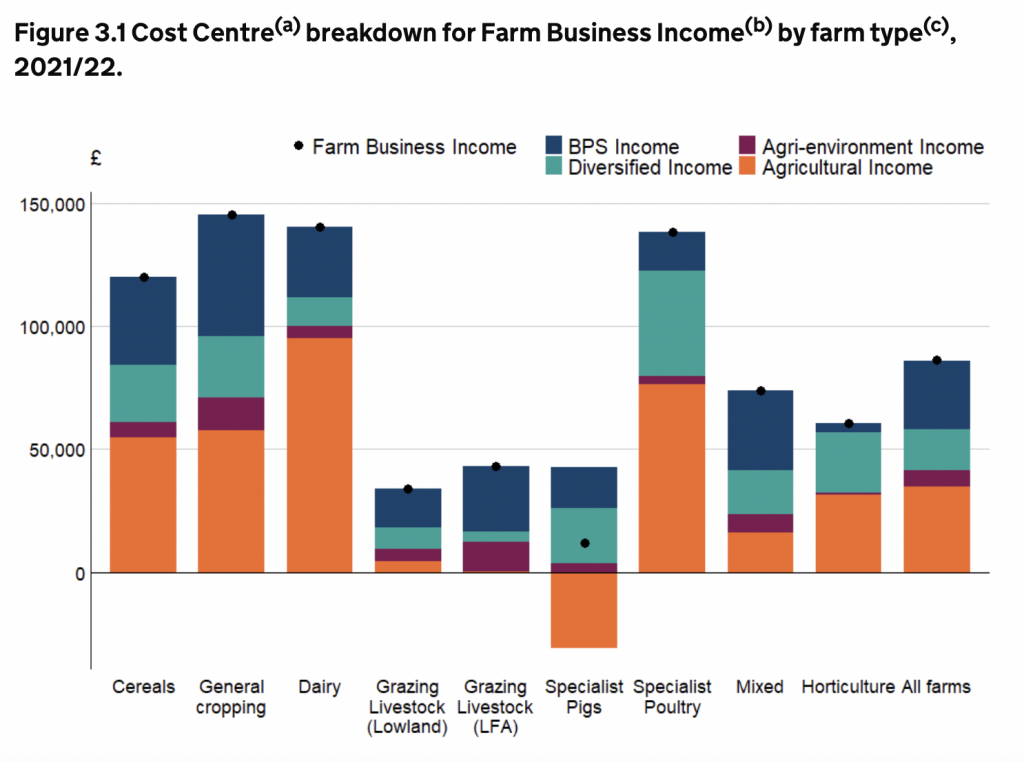

The figures also show that pig producers made losses of, on average, nearly £31,000 from pig farming alone during the year. The overall figure of nearly £12,000 was bolstered by increased income from diversification, which increased from £8,300 to £22,600, driven by the tripling of income from the rental of buildings, as well as agri-environment payments and the Basic Payment.

The figures also show that pig producers made losses of, on average, nearly £31,000 from pig farming alone during the year. The overall figure of nearly £12,000 was bolstered by increased income from diversification, which increased from £8,300 to £22,600, driven by the tripling of income from the rental of buildings, as well as agri-environment payments and the Basic Payment.

The problem, of course, for pig producers has been that rising input costs have significantly outpaced output. Variable costs were 26% higher, primarily driven by substantially increased costs for both purchased and home-grown feed. A fall in fixed costs of 10% was insufficient to compensate for this and overall, agricultural costs were 11% higher. In comparison, output rose by just 1%.

Pig farms with crop enterprises saw average crop output nearly double, but this was not enough to offset an 8% fall in output from pigs alone, which was affected by supply chain issues, including labour shortages in pork plants, and lower prices for finished pigs.

Closing valuations for pigs were lower than opening valuations over the course of 2021/22, which also had a lowering effect on enterprise output.

While the trends shown are clear, Defra cautioned that the overall figures should be treated with caution because of the small sample size of pig producers and the wide confidence intervals.

Contract rearers are also well represented in the FBS sample. Business models for contract rearing operations are varied and these types of farms may not be impacted by price variations to the same extent as non-contract rearing farms.

The unique challenges facing pig producers were highlighted by the wider Defra FBI figures, which showed, on average, all other farm types in England generated a positive return on their farming activities, and, in some cases, large profits.

The latest figures from AHDB show that in the two quarters since the end of the 2021-22 financial year, pig producers have continued to endure heavy losses, which have continued into October as costs averaged 232p/kg and prices around 200p/kg. AHDB estimates that pig producers have lost more than £700m since autumn 2020.