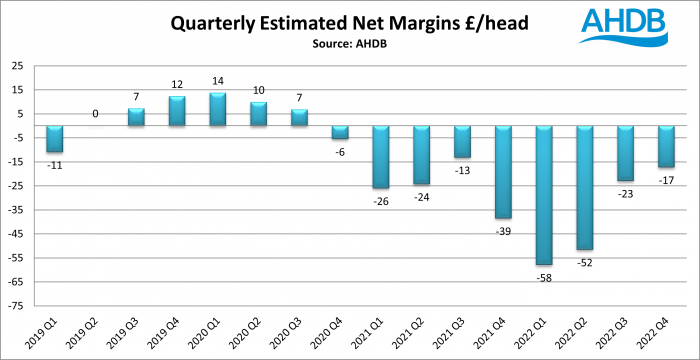

Pig farmers continued to lose, on average, £17/head in the fourth quarter of last year, the ninth successive quarter of negative margins.

The estimated full economic cost of production came down slightly from 227p/kg in Q3 to 224p/kg in Q4, as feed costs dropped back by 5p, with feed still accounting for an historically high 69% of total costs.

However, energy costs, stemming from rising fuel and gas prices, reached yearly highs in Q4, impacting on transport, rearing and finishing costs, while increases in mortgages and other interest rates have increased costs relating to capital, buildings, and equipment, according to AHDB trainee analyst Isabelle Shohet.

Pig prices stabilised to 205p/kg (APP), and 200p/kg (SPP) during Q4. However, these prices continued to fall belowthe full economic cost of production.

These estimates use the latest performance figures for breeding and finishing herds for the 12 months ending 31 December 2022.

While still representing significant losses on many pigs farms, the Q4 figures are at least an improvement on average losses of in excess of £50/pig in Q1 and Q2 and the Q3 figure of £23/pig.

The outlook has improved during the current quarter, with feed prices coming down further in January, before recovering slightly in February and the pig price increasing steadily since the start of the year, with the SPP topping 207p/kg in the week ending February 18. It remains to be seen whether this will be enough to see the sector, on average, back in the black in the first quarter of this year.