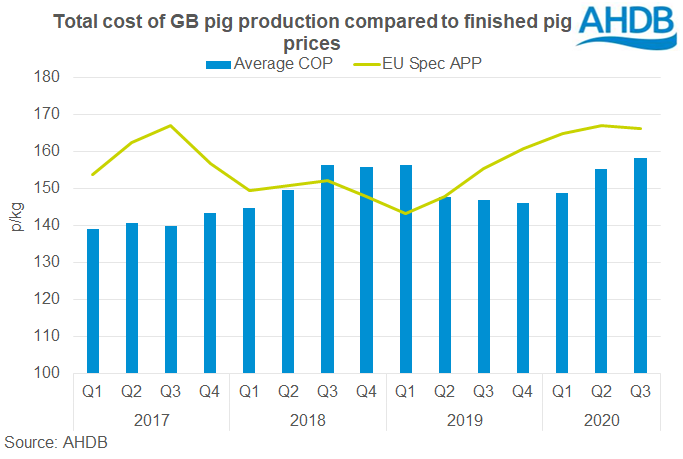

Estimated net margins for GB pig producers dropped back to 8p/kg deadweight, or £7/head, in the third quarter of 2020 and are now likely to be in negative territory, according to AHDB.

The third quarter margin was 4p/kg, or £3/head, down on the previous quarter, as finished pig prices started to fall due to lower EU prices, constrained slaughter capacity and China export issues, with the EU-spec APP averaging 166p/kg.

The average cost of GB pig production rose by 3p to 158p/kg, the highest quarterly figure since 2013.

Feed costs continued to rise in Q3, which accounted for the majority of the rise in production costs (+2p).

Higher feed prices and increased feed usage both contributed to the rise in costs. ‘Other’ variable costs also recorded a slight uplift compared to the previous quarter (+1p).

This was due to the sharp drop in cull sow prices, which made breeding costs more expensive.

Further price drops and rising feed costs mean margins are now likely to be in negative territory, AHDB added.

GB finished pig prices have fallen further in recent weeks. The EU-spec APP was only about 159p/kg by early November, just above our estimated average production cost for Q3.

However, feed prices have also been on the rise recently, reflecting the tighter domestic grain situation. In October, GB ex-farm prices for feed wheat averaged £180/tonne, £17 (11%) more than the average in July and £15 (9%) more than the average across Q3.

“With this in mind, it looks like average margins could now be entering negative territory,” AHDB analyst Felicity Rusk said.

“The outlook is challenging for the British pork industry currently. Supplies available are testing demand levels, particularly as processors tackle lost efficiency as plants adhere to social distancing measures, while reports indicate pigs are backed up on farms.

“This, alongside the likelihood of more muted Christmas demand and ongoing low prices in wider Europe, will likely keep British prices under pressure in the coming weeks.”