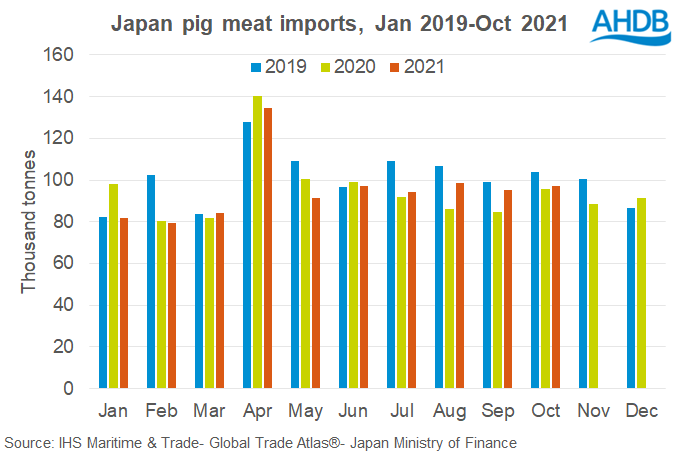

During the first ten months of this year, Japan’s global imports of pig meat, which were made up primarily of fresh/frozen pork, but also contained some sausages and processed meat, remained level to same period last year, totalling 953,100 tonnes, according to AHDB.

“While not a significant UK trading partner, Japan is the second largest global pig meat importer, with domestic production unable to meet demand,” commented AHDB lead analyst Bethan Wilkins, adding that with the Chinese market outlook uncertain, the performance of other key importers is becoming increasingly significant.

Shipments to the country in the third quarter were up by nearly 10% on 2020 levels, before slowing again in October (+2% year on year). The growth has been driven by an increase in volumes from the US, its main supplier. Other suppliers also shipped increased quantities in the third quarter, except Germany, which is currently banned due to cases of African Swine Fever reported in the country.

Across the year so far, imports of chilled pork actually showed a small increase, while frozen volumes have been below 2020 levels. Frozen pork imports totalled 395,000 tonnes, 3% lower than in 2020, whereas chilled pork imports totalled 356,000 tonnes, 4% higher than last year.

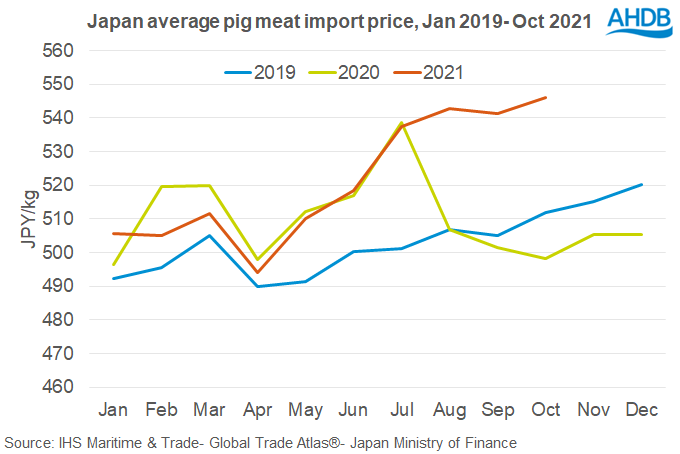

Ms Wilkins noted, however, that in the third quarter, more frozen product was also imported, particularly from Europe: “This may well be product that would otherwise have been sent to China,” she said.

Processed ham imports saw little change, with volumes in the first nine months of the year were only down by 1% and totalling 60,000 tonnes. The US remained the main supplier. Sausage imports have seen more of a decline, falling by 14% to 22,000 tonnes.

Looking forward, Ms Wilkins commented that the path of recovery from the COVID-19 pandemic will be key to developments in Japanese import requirements, with foodservice an important outlet for imported frozen pork: “Cases have been low since the autumn, which ought to be positive for import demand if this can be maintained.

Looking forward, Ms Wilkins commented that the path of recovery from the COVID-19 pandemic will be key to developments in Japanese import requirements, with foodservice an important outlet for imported frozen pork: “Cases have been low since the autumn, which ought to be positive for import demand if this can be maintained.

“Global pork supply availability, and competition from other markets, will also be important. Currently, Chinese import demand continues to be reduced, and US farmgate pig prices have dropped back in the second half of the year, both of which may be supportive of import levels.”