Sales of some key pork cuts, including loin joints, sausages, chops and bacon, are surpassing market averages, as coronavirus continues to bring about big changes in consumer behaviour.

Changes in shopping behaviour, the rise of in-home eating and the media focus on coronavirus have all influenced consumer behaviour. Consumers’ trust in the industry and views of farming has also been impacted, according to Grace Randall, consumer insight analyst at AHDB.

She has analysed research by AHDB and YouGov from April, giving an insight in to how consumers are acting during lockdown.

Behavioural changes

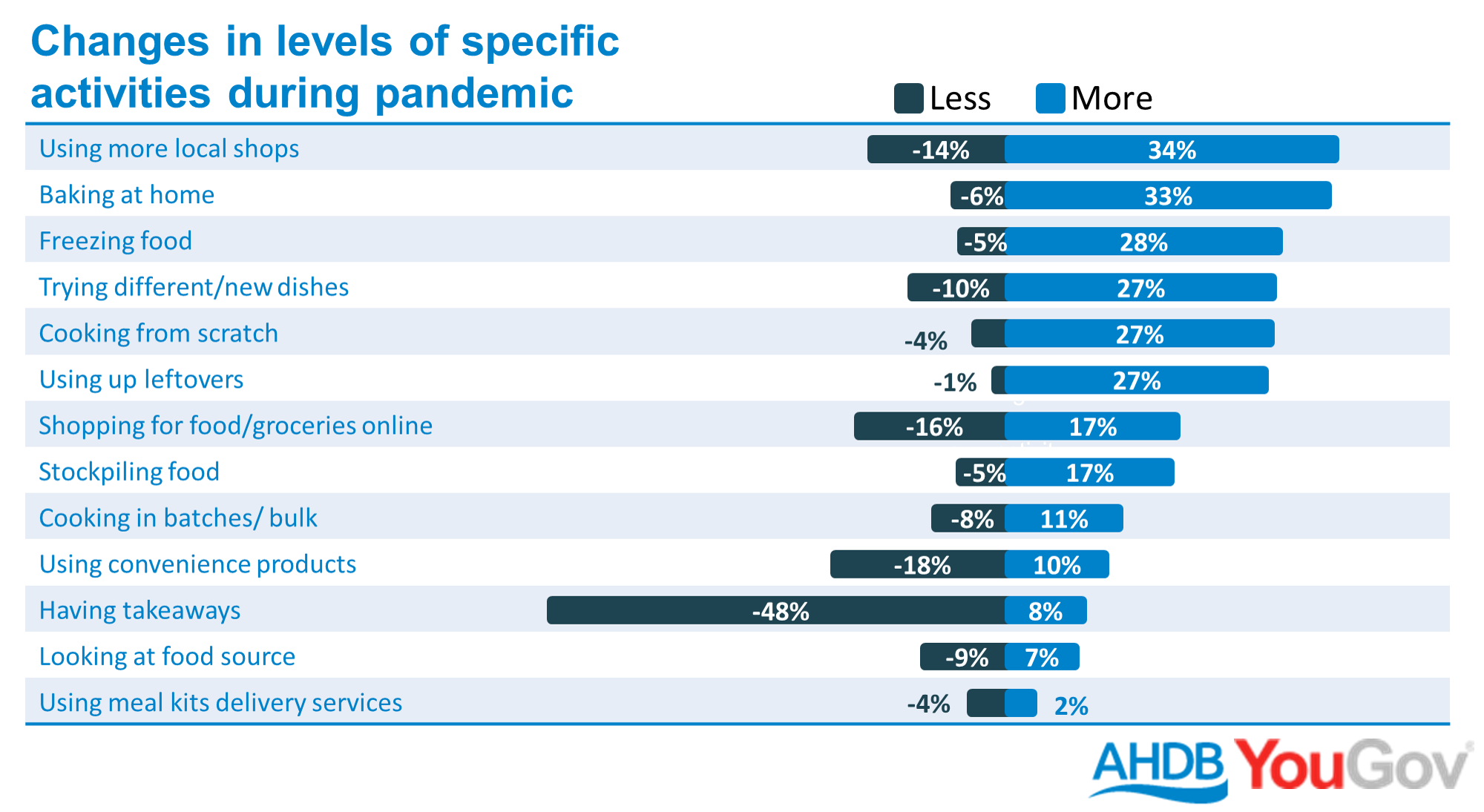

The research revealed that more people are claiming to be doing more home baking, trying new dishes and cooking from scratch, all of which are having an impact on the way people shop.

With many people spending more time at home, there has been an increase in at-home meals. The number of consumers who enjoy cooking has remained unchanged since before the lockdown (72%), but 27% have said they are scratch cooking more now than they did previously and the same number have been using up leftovers more often. Overall, nearly a quarter of consumers say they are cooking from scratch more than six times a week, up from a fifth pre-lockdown, and a third have been baking more and trying new dishes.

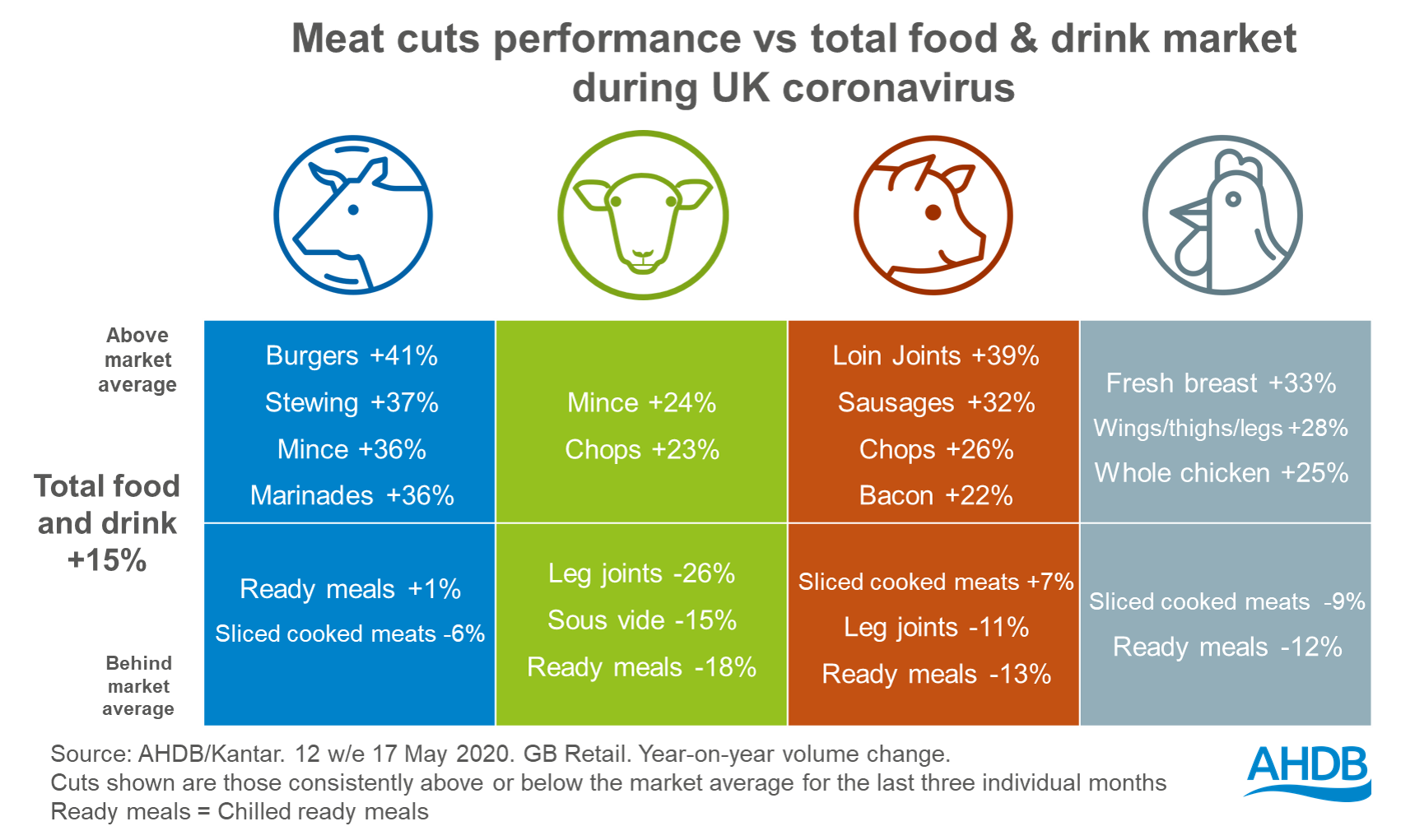

Ms Randall said: “More people scratch cooking tends to benefit versatile cuts such as beef mince and chicken breasts. We have seen an increase in the number of consumers who think beef, lamb and pork are suitable for a mid-week meal, which may be due to them having more time to cook or cooking a wider variety of meals.”

Ms Randall said: “More people scratch cooking tends to benefit versatile cuts such as beef mince and chicken breasts. We have seen an increase in the number of consumers who think beef, lamb and pork are suitable for a mid-week meal, which may be due to them having more time to cook or cooking a wider variety of meals.”

Price vs Quality

The AHDB consumer tracker shows a diverse consumer attitudes towards price, with a third of consumers agreeing they have adjusted their food budget and a third disagreeing. The financial impacts so far appear asymmetric, with some consumers unemployed or furloughed and others on full pay with fewer outgoings on leisure and travel.

Many pig meat cuts are up above market average including loin joints (+39%), sausages (+32%), chops (+26%) and bacon (+22%). In contrast, sales of pig leg joints are down by -11% and the sale of pork-based ready meals are down by 13%.

Ms Randall commented: “Consumer confidence towards eating out will be impacted both in terms of social distancing measures and tighter household budgets. Over a third of consumers claim they will reduce the amount they eat out in order to save money. As a result, some consumers will spend more on value tier supermarket products, while those consumers who may have eaten out in high end restaurants may trade this for premium tier offerings. Consumers who are celebrating special occasions at home or looking for a treat are also likely to trade up tiers.”

Purchase Drivers

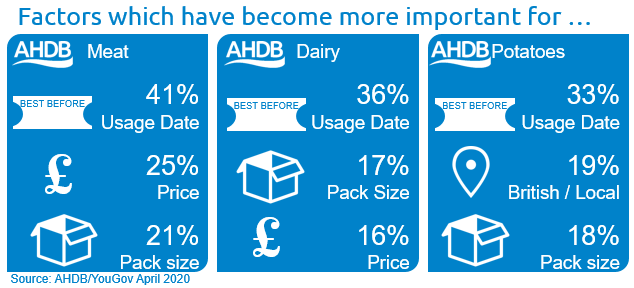

The lockdown has seen changes in the importance of purchase drivers, with the use by date becoming more important for consumers shopping for meat, dairy and potatoes, as they have made less frequent shopping trips. Across all categories, brands are seen as the least important factor by far.

Ms Randall added: “With all of these different dynamics at play, it is critical that the retail sector adapts to changing consumer needs, particularly as lockdown eases and households reassess their behaviours in and out of the home.

“The intensity of trends will differ depending on government policy, consumer confidence and how quickly the country emerges from lockdown. AHDB will continue to track and monitor consumer attitudes and behaviours to bring you the latest insights. We will also look at a range of potential scenarios and how consumer reactions could affect demand for meat, dairy and potatoes – this will be featured in our upcoming Agri-Outlook Report planned for release at the end of June.”