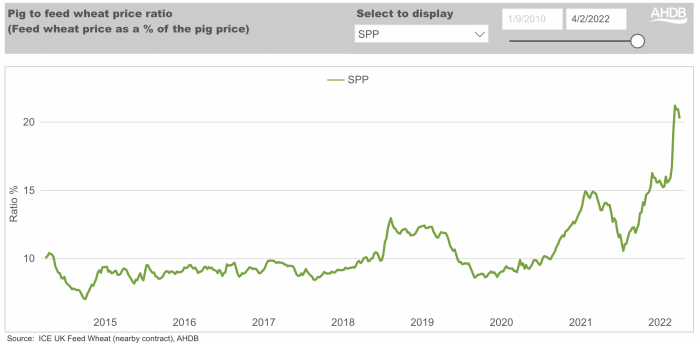

The relationship between the pig price and the cost of feed wheat is now, by a long distance, the least favourable it has been for pig farmers since records began, more than a decade ago.

While most people connected to the pig industry will know this anyway, the shocking recent trend is officially documented in informative AHDB data tucked away on its website.

It is often said that a sound basis for a pig business is when the pig price, in pence per kilo, matches the feed wheat price, in pounds per tonne. When the pig price is higher than the wheat cost figure, it can spell good times. When it goes the other way, it can be a financial struggle on pig farms,

AHDB records the pig to feed wheat price ratio on a weekly basis, measured as the feed wheat price as a percentage of the pig price (APP and SPP), and this sheds some stark light on the financial situation currently facing producers.

The index currently stands at more than double the comfort zone of pig price/wheat cost parity. A look back at the trends since the index was introduced highlights just how unprecedented these times are.

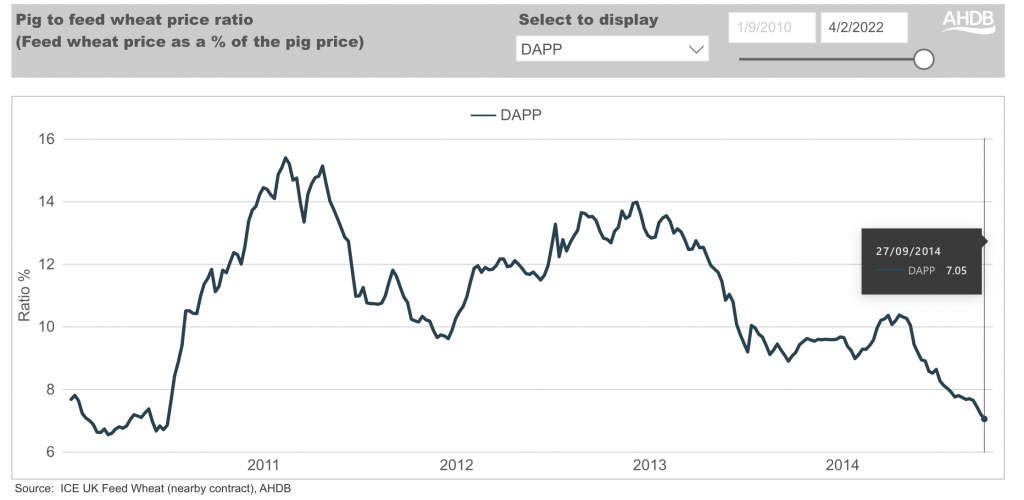

February 2010 – April 2014

The index initially compared the DAPP to the wheat price, and in its very early years, in March 2010, it saw an all-time low of 6.5, with the DAPP at 142p/kg and wheat at just £93/tonne.

Things rapidly shifted the wrong way, however, as the index went above the 10-mark in August and, as the wheat price topped £200/t in early 2011, it surpassed the very difficult 15-mark.

Things rapidly shifted the wrong way, however, as the index went above the 10-mark in August and, as the wheat price topped £200/t in early 2011, it surpassed the very difficult 15-mark.

The situation calmed down over the next few years and steady wheat and pig prices saw the index swing between 9 and 13.5 until the introduction of the SPP in 2014.

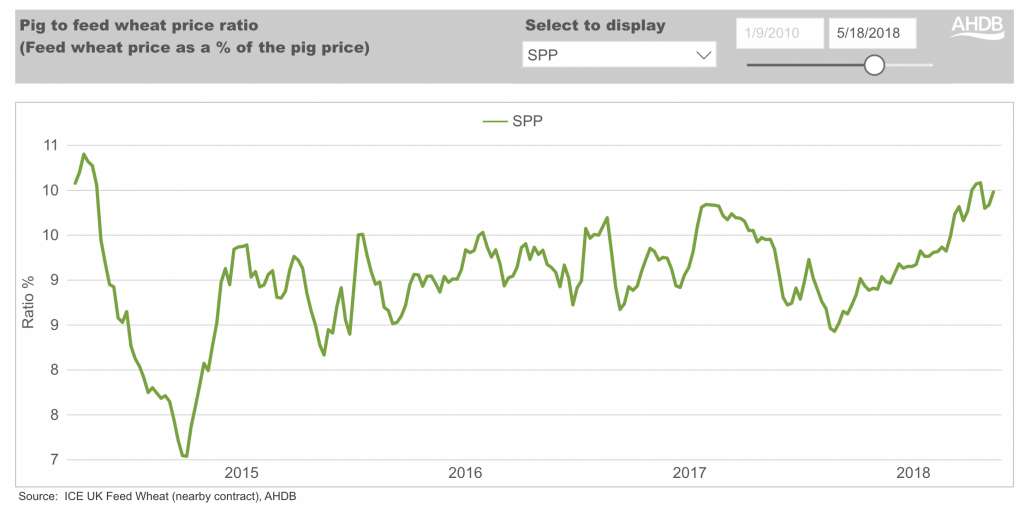

April 2014 – May 2018

From the introduction of the SPP in spring 2014 right through to spring 2018, the ratio (SPP:wheat price) stayed below the magical 10 figure, as pig and wheat prices fell and rose again broadly in harmony.

Back in October 2014, an SPP of 155.2p and a wheat price of £109.50/t gave an all-time-low SPP-based ratio of 7.03.

Back in October 2014, an SPP of 155.2p and a wheat price of £109.50/t gave an all-time-low SPP-based ratio of 7.03.

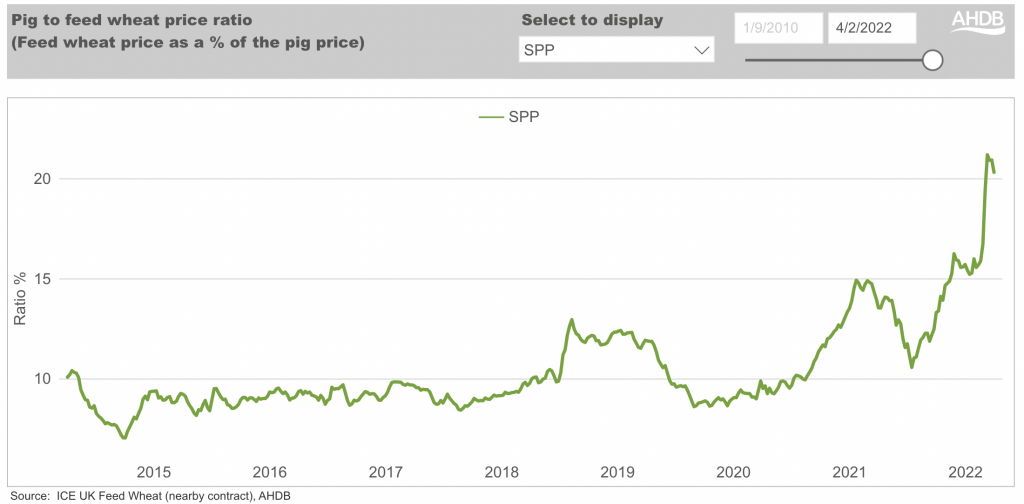

May 2018 – January 2022

The index crept above 10 in May 2018, nearly hitting 13 in August, as wheat prices topped £190/t. But it dropped again, dipping below 10 from summer 2019 to summer 2020, as a strong SPP building from around 150p/kg to a high of 165p/kg overshadowed steady prices in the £135-£160/t range.

Then wheat prices started to rise and so did the index, as pig prices were left behind. By early 2021, as the wheat price topped £200/t, with pig prices in the mid-140s, the index had shot over 14. In fact, for much of the first half of the year, the index hovered around the 13-14-mark, resulting in heavy industry-wide losses of around £25/pig in Q1 and Q2.

A brief dip in feed price and rising pig prices gave some relief in Q3, but Q4 saw the index hit a high of 16 in late-November, as wheat prices topped £230/t and the pig price dipped to the low-140s, further piling on the pain for producers. Even bigger industry losses were experienced in Q4 – a staggering -£39/head on average, according to AHDB.

January 2022 – April 2022

This was the worst it had ever been, and the early weeks of 2022 saw no respite, with the index around the 15-16 mark, reflecting wheat prices at £210-£220 and the SPP now below 140p/kg.

Of course, it has since got worse. Just before Russia’s invasion of Ukraine, the index stood at 15.88. Then, as wheat prices went first to £230/t and then, within weeks, beyond £300/t, the index went to 16.73, 19.41 and for the week ending March 12 a staggering 21.18, as the SPP remained below 140p/kg. That is more than three times the October 2014 SPP low.

As the SPP has partially recovered, hitting nearly 147p/kg in late-March, the index has come down very slightly, dipping below 21.

Pig prices must rise

The losses being suffered by producers are devastating and unsustainable. With the cereals outlook as it is, currently it appears the only way we will see the index heading back downwards is if we can get the pig price above £2/kg.

Even that would leave it still historically high – and that is without factoring in soaring soya and other feed ingredients, energy, fuel and labour costs to producers’ bottom lines.

The desperate need for significant and rapid pig price hikes could not be clearer.

Peaks and troughs

Wheat £/t SPP p/kg Index

12/03/22 293.4 138.51 21.18

04/10/14 109.5 155.62 7.03