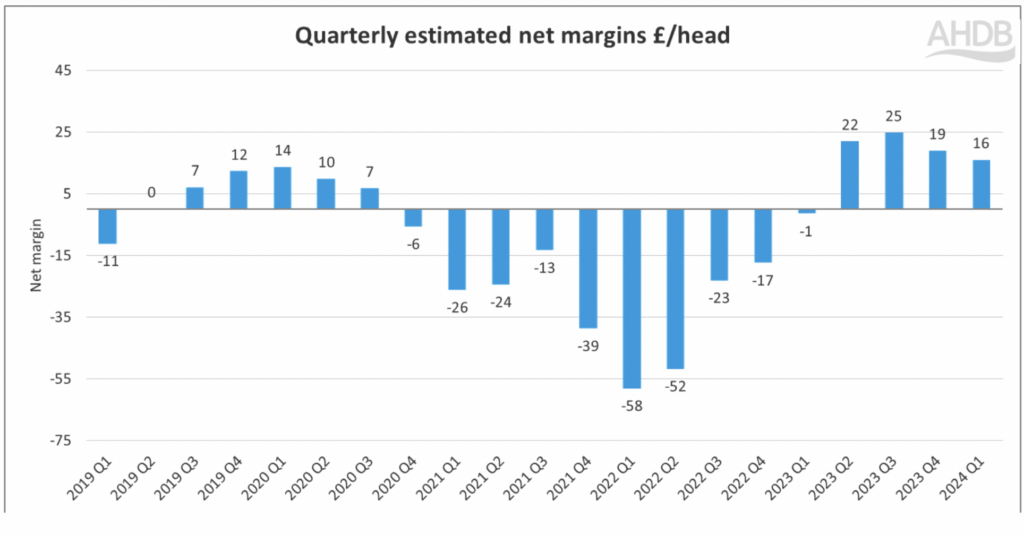

UK pig producers continued to make a healthy profit during the first quarter of 2024, but lower prices eroded margins slightly, the latest AHDB net margin figures show.

Pig producers, on average, recorded a margin of £16/head during Q1, down from £19/head in Q4 2023 and £22/head and £25/head respectively in Q2 and Q3. It means there have now been four successive quarters of positive margins, averaging in excess of £20/head, following 10 successive quarters of losses, which exceeded £50/head during the first half of 2022, with total industry losses estimated to have exceeded £750 million over that period.

The Q1 estimates, which use performance figures for breeding and finishing herds, indicate that the full economic cost of production for Q1 2024 was 194p/kg deadweight, down very slightly from 195p/kg over the previous two quarters.

Feed costs have remained consistent with Q4 2023, at 121p/kg, making up an estimated 62% of total costs. Feed costs are, however, down considerably from the peak of 175p/kg in Q2 2022, when feed accounted for 73% of total costs, and 139p/kg in Q1 2023. Energy and fuel costs rose slightly over Q4, which contributed to a slight increase in other variable costs.

Pig prices fell during Q1, compared to the second half of 2023, with the APP down 5p on Q4 to average 212p/kg over the three-month period. This resulted in a net margin of 18p/kg, compared with 21p in Q4 2023, and a still healthy net margin per head of £16.

Prices have remained remarkably stable moving into Q2. However, looking at a monthly breakdown of costs it is evident that feed costs started to come down towards the end of Q1, AHDB senior economist Jess Corsair said.

Prices have remained remarkably stable moving into Q2. However, looking at a monthly breakdown of costs it is evident that feed costs started to come down towards the end of Q1, AHDB senior economist Jess Corsair said.

But she added: “It is worth considering that grain prices have been rising in Q2 which could impact feed prices and cost of production going forward.”