Pig farm incomes in England have plummeted over the past 12 months, with producers barely breaking even in 2020/21, despite a positive start to the year financially, according to the latest Defra estimates.

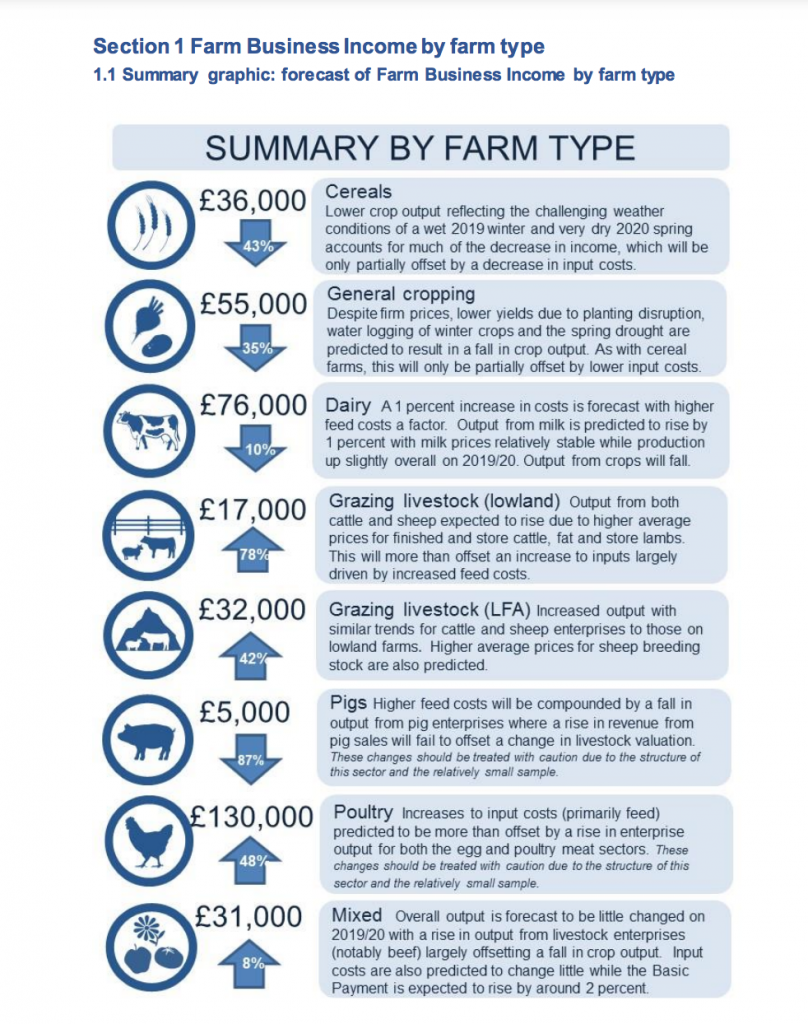

Defra’s latest Farm Business Income (FBI) figures forecast that average pig farm incomes have fallen from £37,000 in 2019/20 to just £5,000 in 2020/21, a massive 87% reduction on the back of falling prices, rising costs and general COVID disruption.

The exceptional nature of the past 12 months is highlighted by the fact that incomes averaged around £30,000 in both 2017/17 and 2018/19.

The NPA has responded to the figures by reiterating its call to Defra to deliver a £3.2 million COVID support package to hard hit producers.

The Defra FBI figures highlighted a 5% rise in input costs, driven by increased feed costs due to higher cereal prices, is a key driver for the forecast erosion of profits in the pig sector.

At the same time, output from pig enterprises is forecast to fall by 1%, as an increase in revenue from pig sales, driven by firmer prices at the start of the year, is expected to be offset by falling values of weaners, store pigs and cull sows towards the end of the financial year.

Average prices for finished pigs moved to a downward trend from the summer of 2020 onwards, with COVID-19 related challenges a contributing factor, along with the detection of African Swine Fever in Germany, which hit EU pig prices due to export bans imposed by key markets, such as China.

Defra statisticians point out that forecasts for specialist pig farms are subject to a considerable degree of uncertainty reflecting both the structure of this sector and the relatively small sample of pig farms in the Farm Business Survey.

However, the trends reinforce AHDB data on pig farms’ financial performance, which show positive margins of £14/head, £10/head and £7/head in the first three quarters of 2020 turned in a negative margin of -£6/head in the fourth quarter. The situation is expected to have deteriorated further in the first quarter of 2021 as costs continued to rise and prices fell steadily.

This is backed up by anecdotal evidence from pig producers, some of which have estimated weekly losses of thousands of pounds per week in the early months of 2021, as the ‘perfect storm’ of rising costs, falling prices, Brexit export delays, the knock-on effects of ASF in Germany, the suspension of China exports from key UK plants and the pig backlog, which resulted in producers receiving deductions for heavier pigs, hit at the same time.

There have been reports of a number of producers leaving the industry, while recent NPA surveys showed a high proportion of members were already or were expecting to be losing money on a weekly basis, with many feared for their future in pig production.

NPA COVID support request

The NPA has submitted a request to Defra for a £3.2 million COVID support package to recognise the impact of penalties for overweight pigs on producers’ incomes. The British Meat Processors Association (BMPA) has submitted a separate request for support to reflect the financial impact on processors of the loss of China exports.

The request from the NPA follows the recent announcement of schemes in Scotland, worth £715,000, and Northern Ireland, worth £2.3m, in March that reflect COVID-related losses suffered by producers.

NPA chief executive Zoe Davies said: “The latest Defra farm income forecasts highlight what a difficult year it has been for the pig sector – but they only tell half the story, as the big collapse in incomes has come in the second half of the financial year, leaving of our members in a dire situation.

“We have submitted what we believe is a reasonable and justified request for support for pig producers to reflect the penalties they have incurred for overweight pigs due to no fault of their own. This financial hit has come at a time when prices have been well below average, and costs significantly above the norm.

“The British pig industry does not ask for much from Government. But these are exceptional times and if Northern Ireland and Scotland can find the funds to support their hard hit pig producers, we fully expect Defra to do the same.”

Mixed picture across the sectors

Overall, Defra’s Farm Business Income froecasts painted a very mixed picture across the sectors, with big gains for poultry ans grazing livestock, but losses for arable and dairy farmers, as well as pig producers: