The UK pig sector has suffered its worst financial performance on record over the first half of this year, on the back of record production costs, with little sign of any immediate improvement.

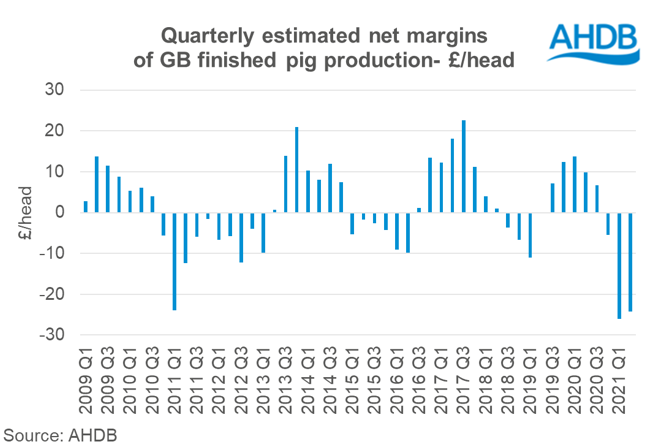

Producers lost, on average, £24/head during the second quarter of this year, following similar unsustainable losses in the first quarter, forcing some producers to quit the industry and leaving many on the brink.

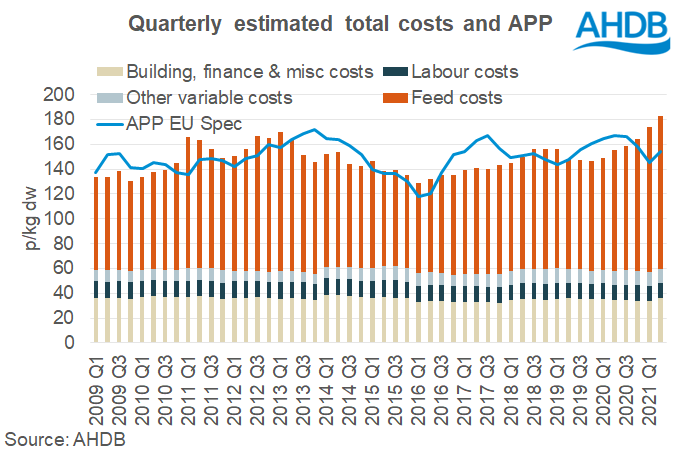

Estimated GB pig production costs in Q2 reached a record 182p/kg, according to the latest AHDB estimates, an increase of 8p/kg from the previous high of 174p/kg recorded Q1. Production costs were 27p/kg higher compared to the same time last year.

The increase primarily reflects rising feed costs, as elevated global cereal and oilseed prices feed into the cost of pig feed. However, both labour and fixed costs had also increased compared to the first quarter of 2021.

Pig prices have increased compared to the start of the year. The APP averaged 154p/kg in Q2, 9p/kg more than during the first quarter. However, compared to last year, prices are 13p/kg lower. This means that, on average, pig producers remain in a significant loss-making situation.

Estimated net margins stand at -28p/kg (-£24/head) in Q2 2021, a similar situation to the first quarter.

AHDB analyst Bethan Wilkins said: “The first half of 2021 therefore represents the worst financial situation for pig producers, across a six-month period, on record. It is typical for pig production to go through cycles of profitability and loss-making. However, it is unusual for margins to be this low for a prolonged period.”

The AHDB estimates for net margins use spot feed prices and she pointed out that producers will have varying buying strategies to mitigate the volatility in feed markets, meaning the level of exposure to rising feed costs may be less in some cases than the estimates indicate. Non-cash costs, such as depreciation and family labour, are also included in the cost of production calculation, which do not affect the short-term cash flow of business.

“Nonetheless, the latest estimates paint a picture of finances that will be difficult for British pig producers to sustain for long,” Ms Wilkins said.

There are no signs, currently, that the situation will improve during the current quarter, with AHDB forecasting a contraction of the pig sector. The EU-spec APP averages 165p/kg from the start of July to mid-August, which is higher than the Q2 average, but prices are now on a downward trend.

“Low EU prices and a more challenging Asian export market may mean this trend stays in place for the coming weeks,” Ms Wilkins added.

“At the same time, it seems feed markets have remained strong. As such, the outlook for British pork producers remains difficult.

“In the July Outlook, we already believed some reduction in breeding herd numbers was underway and these latest financial figures support the view some industry contraction would be expected.”