The latest data from Kantar, for the Easter 2022 period, shows that pork roasting joints had the smallest price increase of all roasting joints.

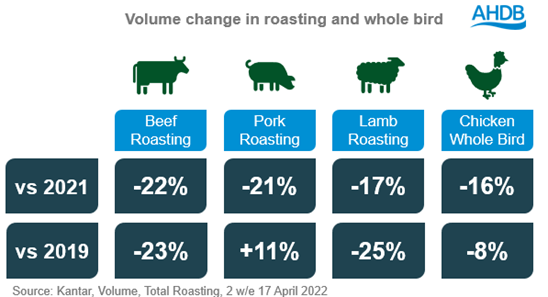

In the two weeks leading up to Easter 2022, Kantar data results show that 9 million kg of roasting joints were sold through retail, which is a 19.2% decrease year-on-year. For pork roasting joints, the figures show an 11% volume increase on 2019’s Easter figures, however, volume numbers have decreased 21% since 2021.

AHDB’s senior retail insight manager, Kim Heath said that the low Easter numbers have been influenced by the cost-of-living crisis, as ‘inflationary pressure hit +5.9% in the 4w/e 17 April 2022, which impacted people’s ability to celebrate’.

Data from the consumer research agency Two Ears One Mouth evidenced these concerns, as 84% of consumers said that during April 2022 the cost of living was a worry for them; COVID is now ranked as a lesser concern, with only 37% of consumers fearing they may catch COVID in April 2022.

Inflation has also affected the BBQ category, with price per kg up 10.7% (since 2019) – which equated to an additional £3.5 million spend during Easter 2022. As a result, the burger and sausage volumes were down this year, -9.5% from 2021, as consumers can be seen returning to the eating out market with COVID restrictions lifted since previous years.

Total meat, fish, poultry (MFP) volumes were down 11.6% year-on-year, with a 3.1% decline in the two weeks running up to Easter compared to 2019. Lamb roasting joints saw the largest decline since 2019 (-25%), as inflationary prices saw lamb have the biggest price increase (+11.5%, for £10.31/kg increase year-on-year) but the fastest volume losses.

57% of lamb losses were recorded by shoppers leaving the roasting category completely, while 12% chose to switch to other, cheaper, protein options, with chicken being most notable, especially among younger consumers. However, chicken whole bird also saw a 16% decline on 2021, and an 8% decline on 2019.

Meat-free options also saw a decline year-on-year, down 1.8% since 2021, as inflationary prices ‘may have influenced shoppers to reduce the volume they buy, or drop out of the category,’ noted Ms Heath.

For AHDB’s full Easter 2022 retail insight report, visit: ahdb.org.uk/news/consumer-insight-inflationary-pressures-impact-easter-2022.