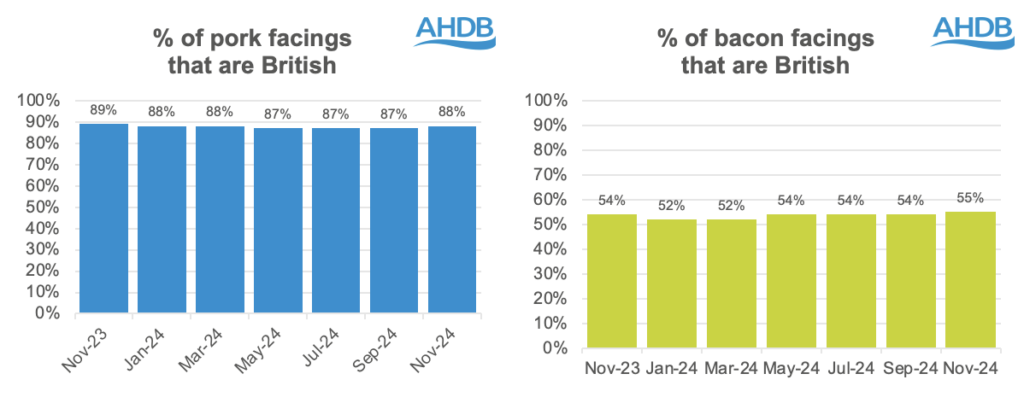

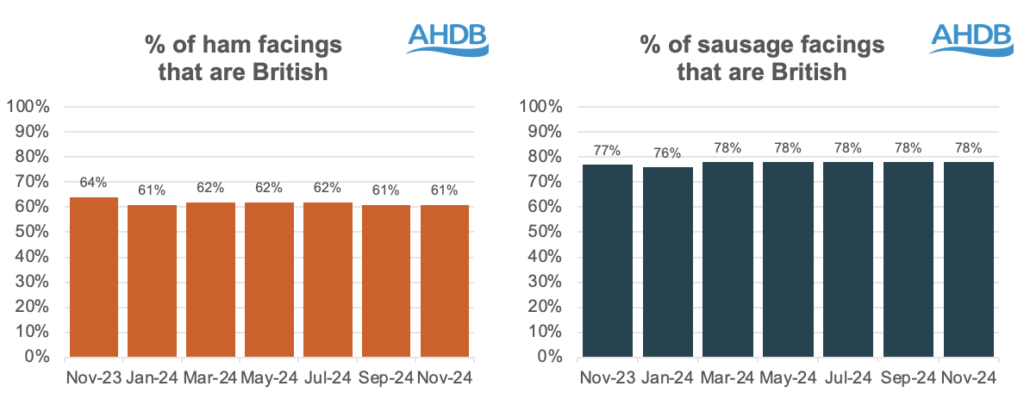

The latest AHDB Porkwatch survey showed steady retail support for British pork towards the end of 2024.

Across the 10 retailers surveyed in November, 88% of the pork on display was British, compared with 87% in September and 89% in November 2023.

Aldi, Co-op, Lidl, M&S, Morrisons and Sainsbury’s all recorded 100%, with Waitrose on 96%, including 100% British on own brand. Tesco was on 78% British and Asda, 59%, down from 68% a year ago, and Iceland just 1%.

A total of 55% of bacon on display was British, slightly up on September and a year ago, with Co-op and M&S on 100% and Waitrose 94%. At the other end of the scale, Tesco stocked just 36% British, with Asda on 26%, Aldi 21%, Lidl 17% and Iceland 14%.

The overall ham figure of 61% was in line with September but down on November 2023, with M&S (99%), Co-op (95%) and Waitrose (90%) leading the way. The worst performers were Morrisons, 38%, Asda and Lidl, both on 33%, and Iceland, 13%.

For sausage, overall 78% was British, in line with September and slightly up on a year ago, with M&S (99%), Aldi (98%), Waitrose (97%) and Lidl (90%) the best backers of British. Iceland, inevitably, was the lowest, on 44%, with all remaining retailers stocking at least 69% British.

Retail volumes

Retail pigmeat volumes saw a 2.9% decrease in the 12 weeks to December 1 2024, equivalent to 6,227 tonnes less than the same period in 2023, Kantar data, summarised by AHDB shows,

This resulted in spend on pigmeat declining by 1.8% year-on-year despite a slight increase in average prices paid (+1.2%). Pork was the only red meat to decline year-on-year.

Volumes of processed pigmeat drove this overall decline, with volumes purchased 4.6% down year on year over this period. Burgers and grills were the only processed cut to see volume growth (+0.2%) due to an increase in shoppers and the frequency of their purchase.

However, primary cuts, where British pigmeat is strongest, saw volumes purchased increase 1.1% this period, helped by average prices paid reducing by 0.6% year-on-year.

Total roasting volumes were 5.8% up over the period, driven by increases in leg (8.7%) and loin (20.3%) sales.

All roasting categories saw average prices decrease in this period, and promotional activity was seen to improve performance most notably for loin, according to AHDB. Pork ribs also saw growth (+16.1%) due to a combination of increased shopper numbers and volumes purchased per shopping trip. Mince saw a 5.0% growth, with an increase in promotional purchases boosting volume sales.

Added value volumes purchased increase by 13.1%, driven by sous vide (+12.2%), while increased promotional activity for marinades attracted in new shoppers resulting in a 23.4% increase in volumes purchased. Ready to cook (+1.9%) benefitted from increased frequency of purchase and volumes purchased per shopping trip, AHDB reported.