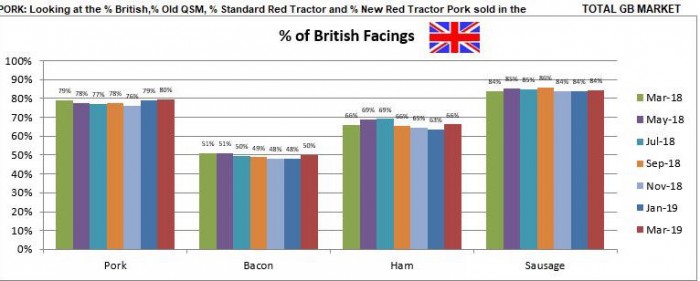

Retailers sourced a higher proportion of pork products from British farmers in the early spring, compared with the start of the year, according to the latest Porkwatch survey.

Overall, across the 11 retailers surveyed in the March AHDB survey, increases were identified in three of the four pork categories.

The proportion of British fresh pork on display increased marginally on January to 80%, which was also higher than a year ago.

Eight retailers – Aldi, Budgens, Co-op, Lidl, Marks & Spencer, Morrisons, Sainsbury’s and Waitrose – displayed 100% British pork. Asda increased its percentage from 42% in January to 44% in March, with Tesco remaining at 64%, down slightly on 2018, and Iceland upping its figure from 46% to 54%.

The percentage of British bacon on display reached the 50% mark, up from 48% in January, although down slightly on a year ago. This was helped by a substantial increase in Tesco stores, up 10 points to 46%, with Aldi, Lidl, Morrisons and Sainsbury’s also recording notable increases. The Asda figure for bacon dropped from 28% in January to just 23% in March, however.

The overall proportion of British ham increased from 63% to 66% between January and March, with Asda (up from 26% to 36%), Lidl (24% to 43%) and Tesco (65% to 68%) among those recording increases. Morrisons (62% to 55%) was the only retailer in which a notable decrease was recorded.

The overall percentage of British sausage remained unchanged at 84%, with Aldi (91%), Co-op (93%), Lidl (96%), Marks & Spencer and Waitrose (both 100%) leading the way.

Most retailers continued to show good support from British pork products, with Waitrose, Marks & Spencer and the Co-op coming the closest to 100% British-sourced across the board. Aldi, Lidl, Morrisons and Sainsbury’s all scored well in most categories.

Welcome improvements were recorded at Asda and Tesco, although, along with Iceland, they continued to display the lowest percentages of British pork products.

You can see the full March survey results here

NPA chief executive Zoe Davies said: “We are monitoring retail sourcing policies particularly closely at the moment, as the pig sector faces a whole range of challenges with Brexit uncertainty and a difficult market that appears to be currently bucking the upward trend being seen in Europe.

“It is pleasing to see an increase in the proportion of high quality British pork products on retail shelves in March and the continued good support for the industry by the vast majority of retailers.

“We expect that support to increase however as EU prices continue to sky-rocket and British pork becomes ever more competitive. We will be looking for a positive impact on both pork price and retail sourcing policies as a result.”