UK Retailers increased the proportion of British pork on display on their shelves during the first few months of the COVID-19 lockdown, according to the first Porkwatch survey since the start of the pandemic.

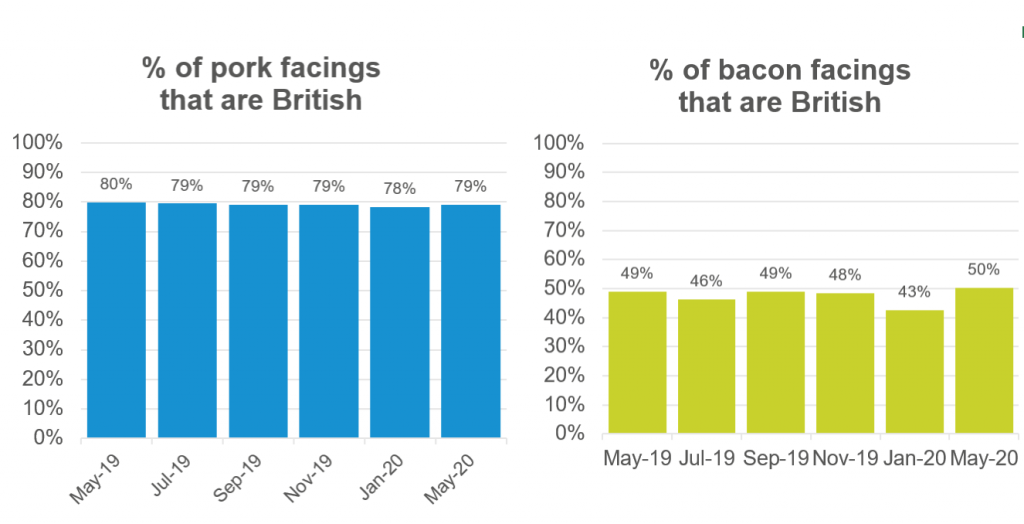

The May AHDB survey of the biggest UK retailers showed 79% of fresh pork on display was British, compared with 78% in January, the last available survey.

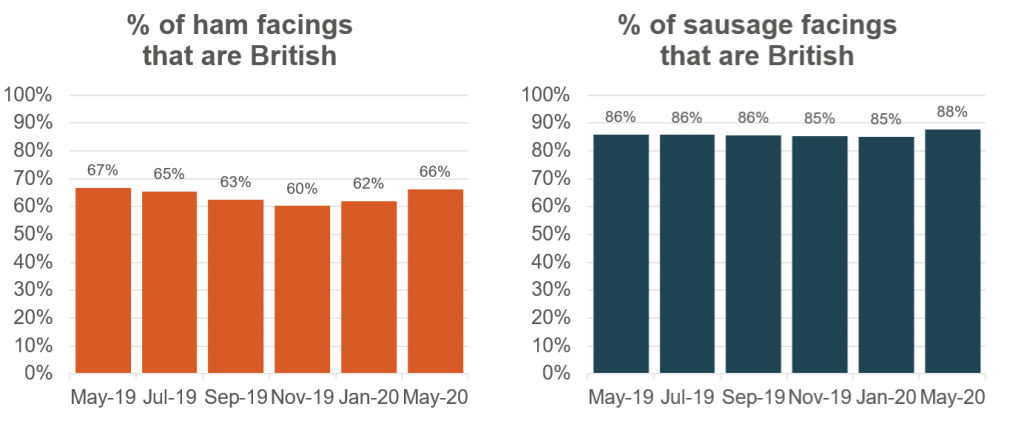

The proportion of British bacon on retail display increased from 43% in January to 50%, just above May 2019, while British sausage increased to 88%, compared with 85% in January and 86% a year ago. The overall proportion of ham rose from 62% in January to 66% in May.

The figures shows how the UK pork sector was able to help meet help increased retail demand during lockdown. In the 12 weeks to May 7, total pig meat sales increased by 14% in volume and 22% in value, with sausages and bacon seeing the biggest overall growth, Kantar data shows.

Aldi, Budgens, Co-op, Lidl, Marks & Spencer, Morrisons and Sainsbury’s all recorded 100% on fresh pork, with Waitrose on 99%. As always, Waitrose, Marks & Spencer and the Co-op led the way, all at or close to 100% on all categories.

Asda, although it lags well behind its competitors in the survey, did record notable increases in May on bacon, up from 24% in January to 35%, and ham, up to 30% from just 22% in January, with its British sausage facings also up.

Aldi also continued to show good support for British pork products, with 100% on fresh pork, 94% on sausage, 84% on ham and 51% on bacon.

The figures for Tesco show a continuous downward trend for British fresh pork on display, from 72% in May 2019 to 58% a year later.

Iceland is, by some distance, bottom of the pile when it comes to displaying British products – just 35% of its fresh pork and 11% of its bacon was British.

NPA chief executive Zoe Davies said the figures highlighted how the UK pork sector had been able to respond to the overnight shift in demand patterns during COVID-19.

“As ever, we thank those retailers who continue to source 100% fresh pork and Aldi deserve special mention for their consistent support for British pork.

“Tesco’s decline in fresh British is worrying and Iceland certainly has a lot work to do to show its support for the British pork sector.”

- The survey covers all fresh, pre-packed pork. It measures the number of product facings found in store and so will differ from sales volumes. Data is collected from Aldi, Asda, Budgens, Coop, Iceland, Lidl, Marks and Spencer, Morrisons, Sainsbury, Tesco and Waitrose. Fieldwork is conducted by ESA Retail on behalf of AHDB.