Pig producers have expressed anger at the ‘dismal’ UK pig prices currently being paid at a time when the global pork market is being buoyed by higher demand from China.

The Standard Pig Price (SPP) started inching up during April, reaching just short of 140p/kg towards the end of April. The price remains around 6p below a year ago and the increases seen in April pale into insignificance in comparison to what is happening in the EU.

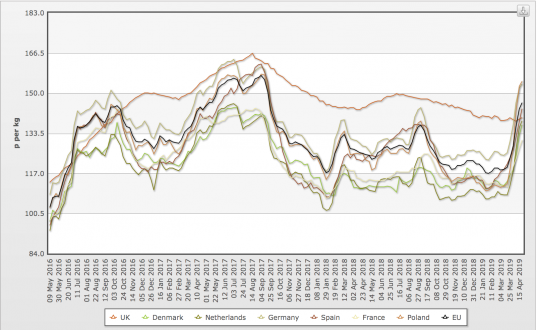

EU exports to China, fuelled by China’s African swine fever crisis, were up 16% year-on-year in February and the extra demand has helped add 30p to the EU reference since early February – it stood at just short of 146p/kg in late-April. Most major producers have seen massive hikes over that period, including Germany (122p/kg to 153p/kg), the Netherlands (106p/kg to 138p/kg) and Denmark (110p/kg to 136/kg).

Yet, despite a 40% year-on-year hike in UK pork exports to China, the UK price remains where it was in early February. The difference in pig price trends in the UK and major pig producing countries is highlighted in the AHDB graph (main picture).

Producers have been demanding answers.

Brexit stockpiling is partly to blame for the situation, according to AHDB. With EU prices now above the UK, an ‘unsustainable’ situation, AHDB analyst Duncan Wyatt said expects UK prices to ‘eventually catch up with EU price rises’.

“I would be amazed if we’re not working our way through what is store, but I could not say how soon inventories will fall. I understand that some weekly contributions in contracts are now going up, which should kick-start more of a rise in the SPP,” he said.

Pig World asked some of the UK’s leading processors to explain the situation, but they chose not to comment.

The NPA has condemned the actions of processors and has renewed its calls for measures to make pricing more transparent in the supply chain

NPA chairman Richard Lister said he had been contacted by ‘numerous producers’ over the past fortnight ‘wanting to understand why we are not seeing a proper and significant recovery in their price’.

He said relief at higher EU prices had ‘turned to anger and frustration at the scraps being offered over the last four weeks’. “The price we are getting is dismal, especially in the context of what is happening with China. As the EU pig price surges ahead, UK pig producers are left feeling like the modern day Oliver Twist,” he said.

The NPA has been collecting data from members about the current market situation. “Unless there are clear explanations from processors and a rapid and significant change in prices, we will share the information with Groceries Code Adjudicator, Christine Tacon,” chief executive Zoe Davies she said.