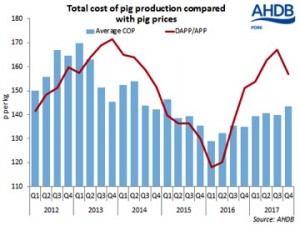

Falling finished pig prices, coupled to some increase in production costs, meant producer margins were squeezed in the final quarter of 2017. Provisional AHDB estimates suggest producer net margins fell to 13p/kg (£11/head) during the quarter. This was 14p/kg (£11/head) less than in the previous quarter and the lowest level in over a year.

AHDB estimates the average GB cost of pig production stood at over 143p/kg (£120/head) in the final quarter of 2017. This was almost 4p higher than in Q3, and 9p above year earlier levels, largely reflecting an increasing amount spent on feed. Feed costs were higher due to a combination of poorer feed conversion ratios (FCRs), meaning more feed was fed to pigs per kilogram of weight gain, and rising feed prices. As such, feed costs reached 61% of total production costs during the quarter, the highest percentage since the end of 2013.

Some modest increase in other variable costs was also recorded, compared to both the previous quarter and year earlier levels. This was due to an increase in breeding costs as the value of cull sows declined.

With pig prices continuing to follow a downward trend into 2018, and some increase in feed prices, it seems producer margins will have been further eroded in recent weeks. With the most recent APP standing only 5.33p/kg above the estimated GB pig production cost for Q4, margins may now be close to break even. However, some seasonal uplift in prices might be anticipated in the spring, which may help keep producers in the black. Much will also depend on how feed prices develop, although with concerns over South American crops driving soyameal prices up, and a tight UK supply and demand situation for feed wheat, the outlook doesn’t look favourable in the near term at least.

In light of a potentially more challenging period in the coming months for pig producers, a focus on maximising productivity will be key. For example, the FCR of finishing pigs averaged 2.86 in the 12 months ending December 2017, compared to 2.73 in the 12 months to September 2017. If the FCR had remained at 2.73 in the latter period, producer margins could have been 3p/kg (£2/head) higher. These small differences become increasingly significant as margins start to tighten.