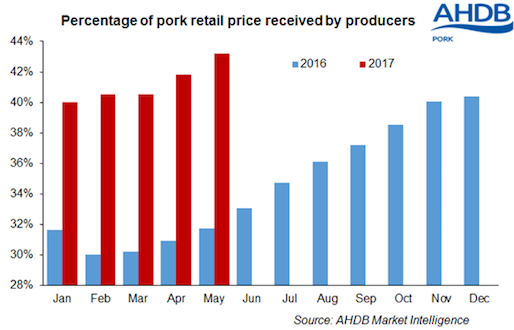

The producer’s share of the retail pork price has reached its highest point since December 2013, after increasing marginally in May to reaching 43.2%, the highest point of the year so far.

This was one percentage point greater than April and 11% higher than May 2016. The main driver for the three-and-a-half year high is, of course higher prices, with average May farmgate prices up 2.6% on April and a massive 36.6% on the same period a year earlier.

Meanwhile, retail prices fell 0.6% in May against the previous month, but remained 0.5% above May 2016.

Price picture

However, the overall price picture is more complicated, with prices up over the year and the latest three-month period. And despite the positive market position, which is being largely driven by tight supplies and high export demand, the domestic retail demand picture remains largely flat, volumes continuing to fall.

The short-term fall in retail pork prices in May was largely due to lower prices for loin steaks, boneless leg and boneless shoulders all falling by 1%, according to AHDB data. Most other cuts remained static, namely, fillet end leg, loin chops, diced pork, minced pork and traditional pork sausages. The only cut to record an increase in price was fillet of pork, which rose by 2% on the previous month.

Over the longer term, there was more movement in the prices of pork cuts. Diced pork and loin chops rose by 2% and 3% respectively on May 2016. Boneless leg increased by 1% and fillet end leg went up by 4%.

Fillet of pork recorded a greater price increase, up on a year earlier by 7%. Meanwhile, minced pork showed no movement, the value of traditional pork sausages fell by 3% and loin steaks were 7% lower in price than in May 2016.

Separate data provided by Kantar Worldpanel showed volumes of fresh and frozen pork sold by UK retailers in the 12 weeks ending May 21 fell by 1.3%,

But total spend was up by 1.6% over the three month period, reflecting price inflation which has been seen across all red meats, as consumers start to feel the pinch. Fresh and frozen pork saw prices rise 2.9% year on year.

The onset of the barbecue season has affected pork demand, with roasting joints suffering accordingly, particularly shoulders (sales down 24%), not helped by the fact that these cuts have also seen the greatest rise in prices.

Sausages have been selling well, 1.3% higher despite being 2.1% more expensive. Bacon prices have hardly changed and they too have performed relatively well, with sales up 2.3%. The largest single sector by value is sliced, cooked meats, which is one of the few areas where prices have actually fallen and has seen increases in both sales volume (3.2%) and value (1.5%).