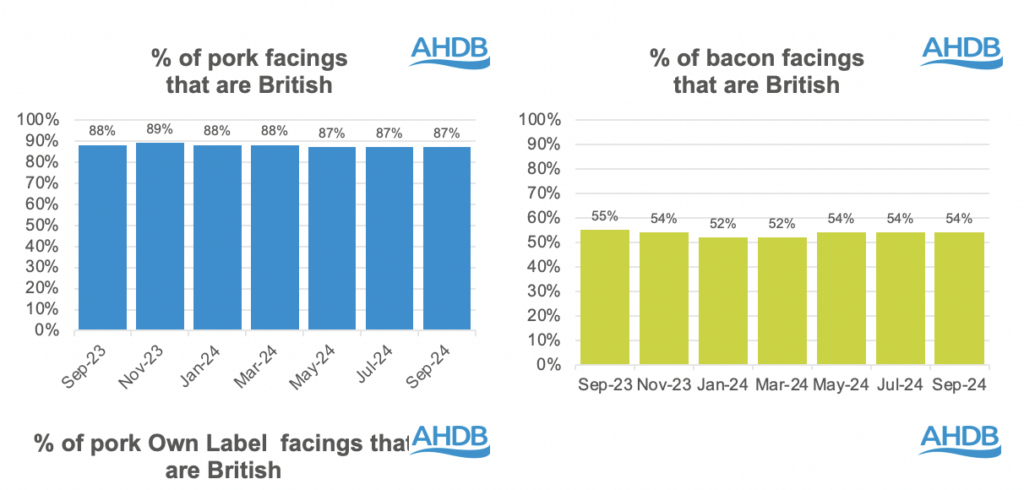

The proportion of British pork products sourced by the major UK retailers in September declined, compared with a year ago, according to the latest AHDB Porkwatch survey.

It shows that, across the 10 retailers surveyed, 87% of pork products on display in September were British, unchanged on July but down from 88% in September 2023.

Aldi, Co-op, Lidl, M&S, Morrisons and Sainsbury’s all displayed 100% British pork, with Waitrose on 96% (100% own label), Tesco 78%, Asda 59% and Iceland just 1%.

For bacon, overall 54% of products on display were British, also unchanged on July, but down one percentage point on a year ago.

Co-op and M&S, both on 100%, and Waitrose 94% were the best performers. In contrast, Iceland (14%), Lidl (17%), Aldi (21%), Asda (26%) and Tesco (35%) were the worst.

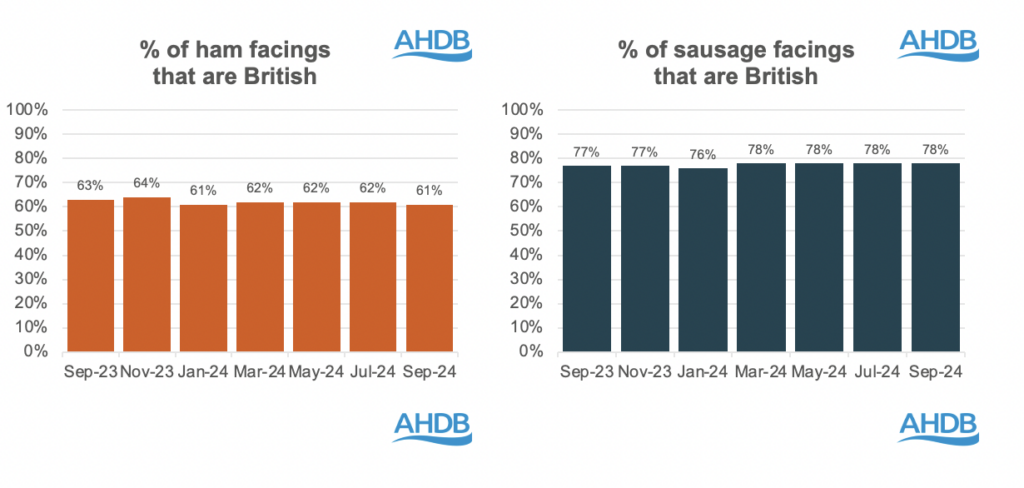

A total of 61% of ham facings were British, down from 62% in July and 63% in September 2023, with M&S, Co-op and Waitrose (all (90%+) leading the way. Iceland (13%), Asda and Lidl (33%) and Morrisons (38%) all had plenty of room for improvement.

Only sausage bucked the trend – 78% was British, the same as July, but up one percentage point from a year ago. M&S, Aldi, Waitrose and Lidl all recorded over 90% British, with all other retailers recording more than 70%, other than Co-op (69%) and, more predictably, Iceland (43%).

Retail pigmeat sales decline

Separate data from Kantar, collated by AHDB, shows UK retail pigmeat sales volumes declined by 2.3% in the 12 weeks to September 29. Despite a 1.8% increase in average prices paid, this resulted in spend on pigmeat declining by 0.6% year-on-year.

Volume purchases of primary cuts declined by 4%, driven by falls in pork steak (-11.5%) and chops (-3.9%) sales, despite average primary pork prices holding in line year-on-year. However, sales of mince (+3.2), on the back of temporary price reductions, and total roasting (+2%), driven by shoulder (+14.2%) and loin (+9.1%) performance, increased.

Processed pigmeat volumes decreased by 4.1%, driven declines in sliced cooked meats (-6.4%), bacon (-4.9%) and sausages (-0.9%).

Added value was the only category to see overall volume increases, due to increases in sous vide (+15.9%) and marinades (+15.3%)

Pork was the only red meat to decline year-on-year, with beef volumes up 1.7% and lamb volumes up 5.5%.