Expected reduced Chinese demand for pork imports will have ramifications for the rest of the world this year, especially in Europe, according to Rabobank’s latest quarterly pork outlook.

It forecasts that pork supply will grow in Asia and North and South America, but European production will be flat in 2021, as African swine fever (ASF) and COVID-19 pressures continue to shape the global pork market this year.

While ASF continues to impact pork production in Asia and Europe, as well as global trade flows, COVID-19 continues to affect the whole supply chain, from producers to consumers. However, demand is expected to rebound in most regions in 2021 due to economic recovery.

China

China’s imports reached record levels in 2020, taking its share of global trade up sharply to over 50%, with total meat imports up by 85% to reach 5.56m tonnes, on the back of 40% growth in 2019.

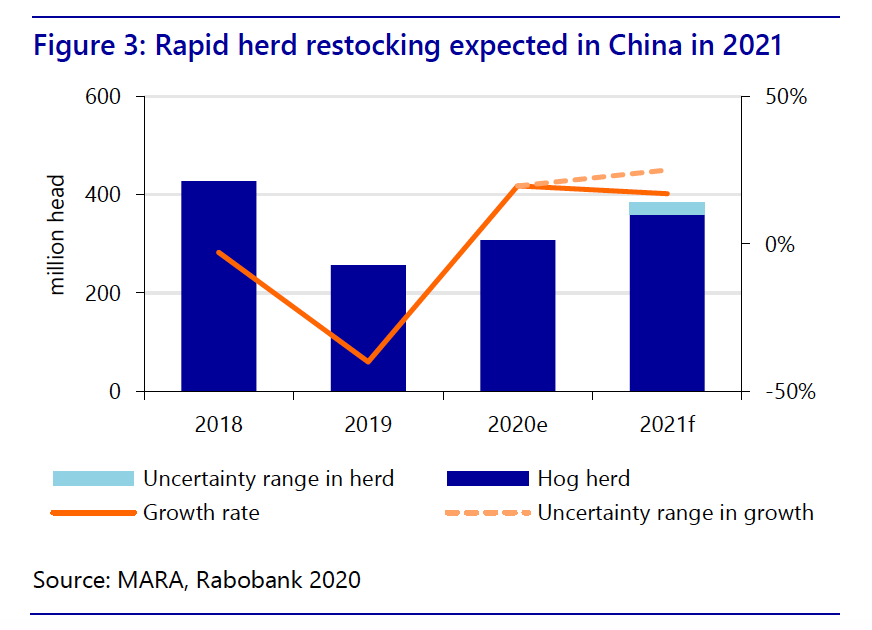

However, the trend is expected to be reversed in 2021. After rapid restocking in 2020, strong growth in Chinese pork production is forecast for 2021. Although ASF continues to spread in the country, the impact is declining. While the recurrence of ASF in 2020 slowed the restocking pace and caused prices to remain high in late-2020/early-2021, herd loss is significantly down and culling of whole herds is rare.

“With production expected to grow by at least 10% to 15%, China’s imports will decline by 10% to 30% this year. This will still make 2021 the second-largest year for imports, but the change in demand will impact all exporters,” said Chenjun Pan, Rabobank senior analyst – animal protein.

Europe

The knock-on effects for the rest of the world will be significant, particularly in Europe, where Germany’s ASF ban is boosting local supply and weighing on the market.

European pork production is expected to be flat or down slightly in 2021, on the back of lower export demand, a slow recovery of local demand due to COVID-19 and ongoing ASF-threats in eastern Europe and Germany.

“While Germany focuses on finding alternative export destinations, Spain and Denmark will continue to benefit from Germany’s absence in some Asian markets,” Mr Pan said.

The update anticipates that the EU will remain the key pork supplier to the UK, despite the disruption, delays and increased costs of trade resulting from the new Brexit checks. The high standards set by retail and foodservice will make it hard for new suppliers to enter the market.

US and Brazil

In the US, strong domestic and export demand is helping drive good pork markets and supporting continued strength in hog prices, while better sales are helping offset rising feed costs.

Brazil witnessed record-high exports in 2020 and local prices surged in response to strong export demand and soaring feed costs.

As drought impacts yields and global demand remains strong, Rabobank expects feed grain prices to stay high in the coming months. Despite this, pig production is expected to increase by 2.5% in 2021 in response to local demand recovery and another strong year for exports.