Retail sales of processed pork products soared as the UK responded to the threat of coronavirus in March. Primary pork sales also rose, although not to the same extent as processed products and other primary meats.

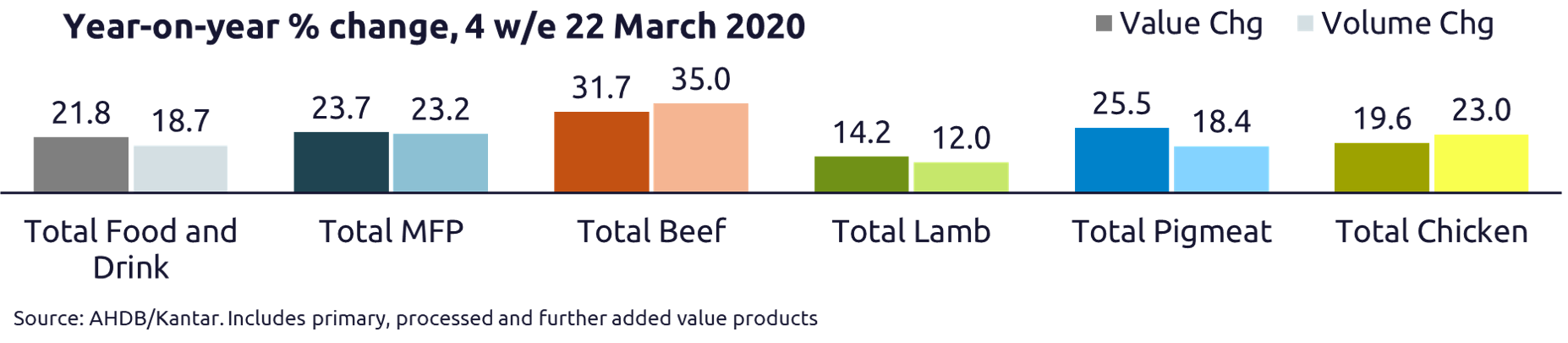

The four weeks to 22 March saw record-breaking grocery sales, with an extra £1.4 billion spent on food and drink, compared to the same period last year, retail data from Kantar shows. This is equivalent to an extra £21.08 spent per person and an uplift of almost 22%.

Though reports of panic-buying were widespread, in reality most pressure on supermarkets came from lots of people shopping slightly more frequently and buying a little bit extra each time, AHDB said. Over the four weeks to March 22, households spent an average of £62.92 extra on shopping, equivalent to five days’ worth of groceries.

As the Government issued its advice on social distancing, between Monday, March 16 and Thursday, March 19 alone, an extra 42 million shopping trips were made, with 88% of households visiting a grocer. The week ended with the closure of all pubs, restaurants and cafes.

Kantar estimate that 503 million meals which would normally have been eaten out-of-home will now take place at home every week, mostly lunch and snacks.

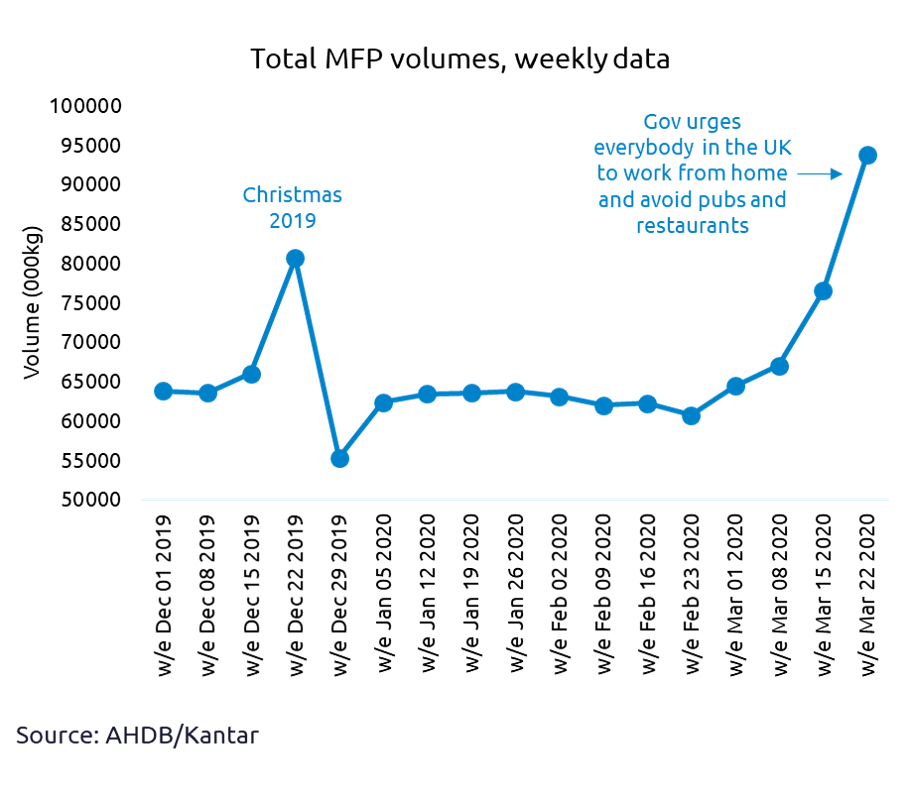

AHDB has summarised the impact on the various sectors. Meat, fish and poultry grew ahead of the market, with spend up nearly 24% in the four weeks to March 22. The main uplift came during the final week of the data period (16-22 March) when social distancing was ramped up and schools closed.

AHDB has summarised the impact on the various sectors. Meat, fish and poultry grew ahead of the market, with spend up nearly 24% in the four weeks to March 22. The main uplift came during the final week of the data period (16-22 March) when social distancing was ramped up and schools closed.

During the period, fresh meat accounted for 77% of volume, with sales up 20% in volume terms, while frozen and ambient (canned) meat products grew by 31% and 73% respective, as shoppers have stockpiled items with a longer shelf life.

Pork products

Total pigmeat sales were up 18.4% by volume and 25.5% in value. Bacon and sausage volumes were up 22% and 33% respectively during the period, outperforming the overall grocery market.

The AHDB/YouGov Consumer Tracker shows that people think sausages are easy to cook and suitable for mid-week meals, making them a good fridge/freezer staple during times like these, AHDB said.

Sliced cooked meat volumes grew 10%. However, with school closures and full coronavirus lockdown coming after this data period, the impact of the loss of the carried-out lunch is yet to be fully felt – with ham being a key lunchbox staple.

Primary pork volumes were also up 10%, although this is less than processed pigmeat and the other primary proteins. Leg and shoulder joints actually experienced a loss of volume, although loin roasting and chops grew 52% and 36% respectively.

You can view more detail on the 12 weeks of pork sales data here

In terms of other products:

- Spend on red meat generally outperformed the total grocery market

- All primary beef cuts experienced significant increases in volume, with roasting beef up 51% and steaks up 20%. Beef mince volumes up 45% and burgers were up 38%

- Lamb volumes were more subdued, up 12% during the month, the smallest uplift in sales out of the key proteins. Pricing could be a challenge here, AHDB said

- Chicken volumes were up nearly 20%

- Dairy saw particularly strong growth, with an additional £131m was spent on dairy products in March 2020, an increase of 17%. Cheese and spreads saw the greatest increase in sales, with cheese volumes up 25% and spreads up 30%

- Fresh potato volumes were up 27% and frozen potato volumes up 30%.

Did retail offset losses to foodservice?

Based on the March data, AHDB estimates that the rise in beef and pigmeat sales would both exceed the losses in food services sales.

Lamb volumes would have fallen short, with milk sales also slightly below what AHDB estimates is required to offset the foodservice losses.

AHDB added: “It’s also important to remember that the market is expected to slow from these key ‘panic buying’ weeks. Therefore, these levels of volume sales are unlikely to be sustained, putting lamb in particular at risk.

“Those products perceived as highly versatile (such as beef mince, chicken breast and pork sausages) are likely to continue seeing enhanced volumes.”