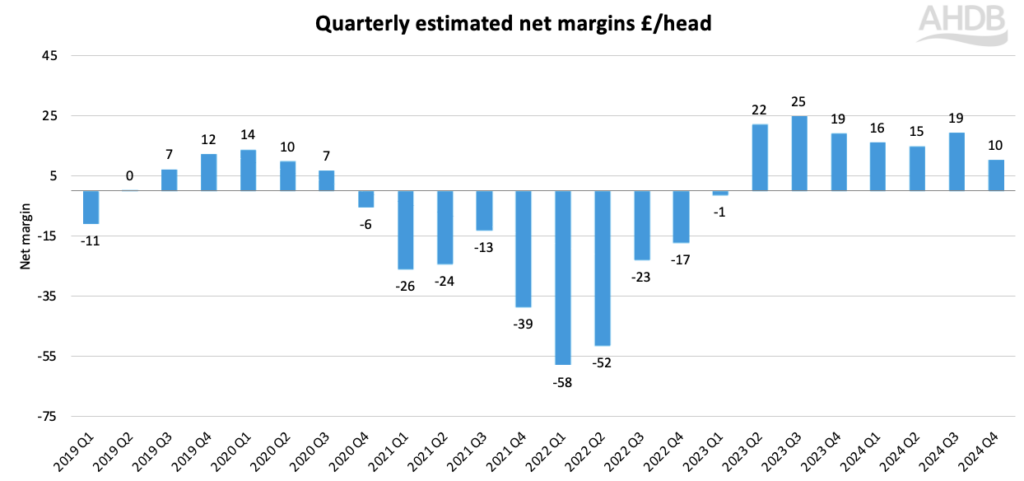

Rising feed costs and falling prices partially eroded producer margins in the final quarter of 2024, although the UK pig sector remained comfortably in the black for the seventh consecutive quarter.

AHDB’s quarterly pork cost of production and margin estimates show average margins almost halved from £19/head in Q3 to £10/head in Q4 2024.

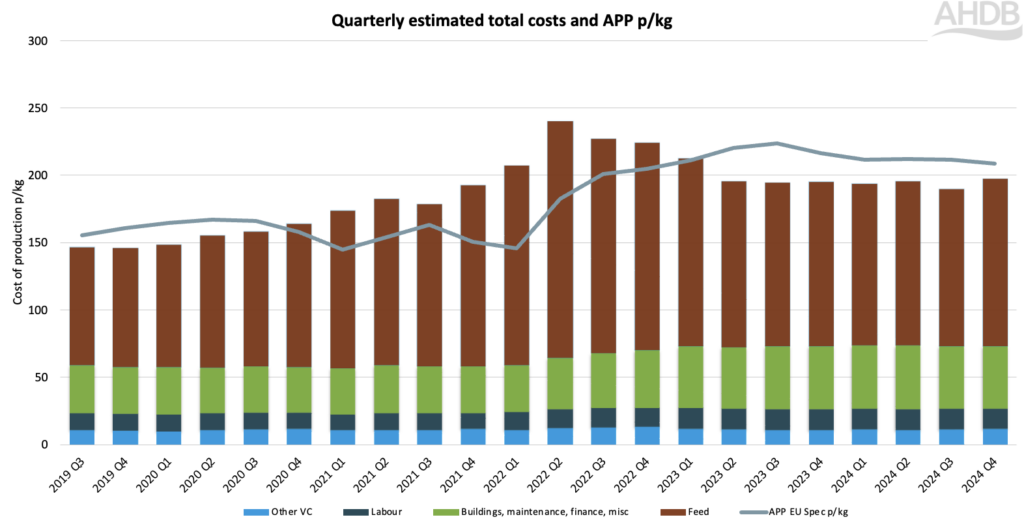

They estimate that the full economic cost of production for Q4 increased from 190p/kg deadweight to 197p/kg, driven by an 8p rise in estimated feed costs to 124p. Feed costs accounted for 63% of total costs, compared with 61% in Q3, but still well below the peak of 73% in Q2 2022, when feed costs soared to 175p/kg.

Other costs were largely unchanged. Energy prices also increased in Q4, but this was offset by a fall in fuel prices and a slight deduction in interest costs.

After consistently averaging 212p (APP) during the first three quarters of 2024, average pig prices fell by 3p to around 209p/kg in Q4. This resulted in an average margin of 11.5p/kg across the quarter, equating to £10.31/head.

While this is a considerable reduction on Q3, it means producers, on average, enjoyed a profitable year, with average margins per head of £16, £15 and £19 over the first three quarters. This followed healthy margins in the last three quarters of 2023, peaking at £25/head in Q3.

But, of course, this followed a devastating 10 consecutive quarters of negative margins, peaking at -£58/head in Q3 2022, during which the pig sector accumulated losses of more than £700m.

Moving into the current quarter, pig prices have come down by a further 3p over the first five weeks of 2025, suggesting that while producers will remain, on average, in the black, margins have been further eroded.