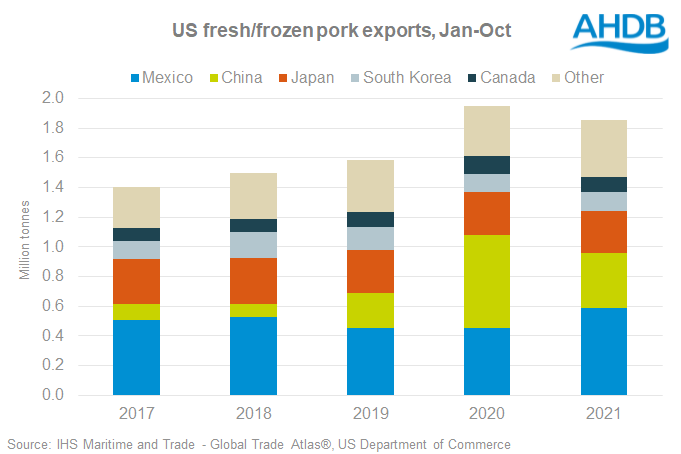

US pig meat and offal exports have continued to experience strong performance across January to October, with volumes traded even a little higher than last year’s record levels, totalling 2.58 million tonnes, according to AHDB – a volume which was achieved despite a 23% drop in exports to its former primary market, China.

The decline was primarily offset by a 30% increase in shipments to Mexico, which totalled 761,000 tonnes, with smaller markets of Colombia and the Philippines also taking in more US-produced pig meat.

Whilst shipments to Mexico have face challenges in recent years, including retaliatory tariffs in 2018-2019 and weakening demand due to the Coronavirus pandemic, volumes have nonetheless been able to recover this year, with the US seeking alternative markets for pork exports as Chinese demand weakens.

Looking at the third quarter of 2021, AHDB analyst Bethan Wilkins noted that shipments were the lowest so far this year at 704,000 tonnes, but that this remained 2% higher than the same quarter last year despite volumes dropping 5% below last year in October.

“Some of the markets that had been showing strong growth, compensating for lost Chinese demand, eased,” said Ms Wilkins. “This was particularly the case for the Philippines. Although these exports had nearly doubled for the year to October overall, totalling 78,000 tonnes, shipments in the third quarter alone were 17% lower than a year earlier.

She noted that the weaker price competitiveness of US pork for much of this ultimately started to dampen international trade prospects, and that weakening Chinese import demand in the second half of the year in would have increased competition on alternative markets from other global exporters around this time.

The latest USDA forecasts for US pork exports (not including offal) anticipate a 1% decline in export volumes this year, although a 3% recovery in expected for 2022.