EU sow prices have moved up a little in key member states since the beginning of February, according to AHDB.

AHDB analyst Bethan Wilkins explained that due to the pound having strengthened against the euro recently, the sterling value of the German sow price has remained relatively stable since mid-December, at 67p/kg, inhibiting any potential uplift in GB sow prices, which could follow on from German price growth.

The British sow market has been negatively affected by disruption to trade with Europe, due to regulatory changes now it has left the EU, which has been the dominant factor influencing sow prices.

Ms Wilkins also pointed to the coronavirus-related challenges the sow market has been facing: “Lack of demand for British carcases from the continent significantly curtailed culling levels in January and reports indicate there is now a backlog of sows to cull,” she said

“In the most recent weeks there does seem to be some movement on the sow market again. However, British prices remain at extremely low levels by historic standards.”

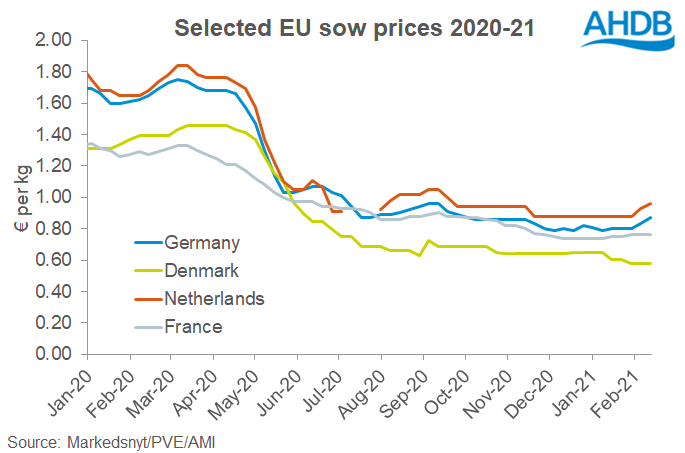

In Germany, whose sow price usually sets the tone for other member states, the average M1 sow price reached 87¢/kg in the middle of the month, the highest level since last October.

Germany’s sow slaughter levels have been relatively high so far this year, likely reflecting the difficult financial position of producers. Ms Wilkins commented that the longer-term outlook is also more challenging, with changes to regulation making pig breeding less attractive.

She explained: “The latest census results from Germany show a declining breeding herd and a sharp fall has also been reported in the Netherlands. Higher sow slaughter levels may also be a limitation for sow prices, though the recent slight uplift might indicate some improvement in demand.

Ms Wilkins added that sow culling also suggests there is a possible tightening of finished pig supplies ahead: “Eventually, this may enable better prices for both clean pigs and sows. Improvement in demand levels, associated with any lessening of coronavirus-related restrictions, could be another factor facilitating some price recovery in the future.”