With growth anticipated in EU pig meat production across 2018, forecasts from the EU commission and others have expected EU pig meat consumption to increase this year.

However, looking at the latest retail figures, demand has remained under pressure in the main EU markets in 2018 so far. Changing consumer preferences are often discussed in relation to the UK market, however similar challenges are being faced across Europe.

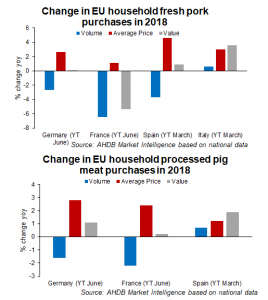

In Germany, the largest pig meat market in the EU, household purchases of fresh pork in January-June this year were almost 3% below year earlier levels. A 3% rise in retail prices, despite lower prices at farmgate level, may have influenced the decline in sales volumes.

Similarly, in Spain, sales volumes were down 4%, while prices were 5% higher year-on-year, during the first quarter. In France, the situation was worse, with sales volumes declining over 6% year-on-year between January and June, despite a smaller 1% rise in average retail prices.

The charcuterie market in Germany and France has also proved challenging. Purchases were down in the first half of the year in both countries, although with rising retail prices there was some growth in market value. Conversely, demand fared better in Spain, at least in the first quarter of 2018. Volume sales increased by almost 1% year-on-year, despite rising prices.

Another positive area has been Italy. Although volumes of fresh pork sold only recorded a small increase on the year for Q1, this is a positive signal for demand considering prices averaged 3% higher.

Despite the subdued retail sales, if EU production, imports and exports are balanced for the Jan-May period, pig meat supplies available for consumption seem to have increased so far this year. Stable export volumes, coupled with a 5% growth in EU production, mean supplies on the EU market were 6% above 2017 levels earlier this year.

While some of this additional product may have been stored, the rise in supply availability also suggests more pork is being consumed in foodservice or as processed products, markets that are typically more price sensitive than retail. Channelling more pork through these avenues has likely contributed to lower pig prices so far this year.