The latest Rabobank quarterly pork report suggest that global trade should pick up in the latter half of 2022, though African swine fever (ASF) and rising inflation continue to challenge the industry.

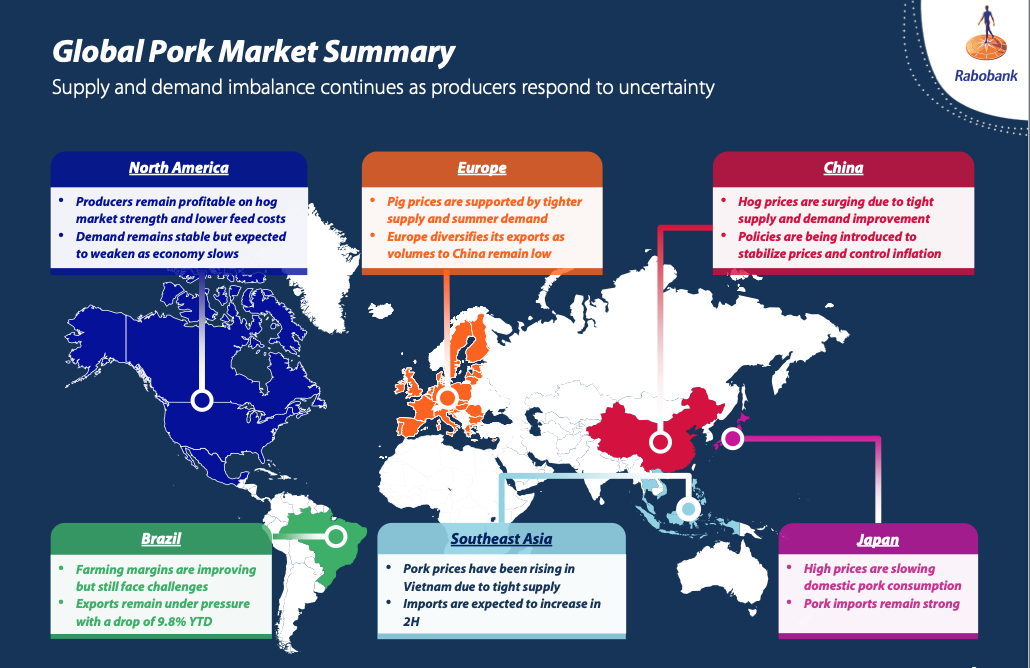

Global pork trade declined in the first half of 2022, as import demands from China reduced, trade policy, shipping, and disease issues arose, and pork supply in exporting countries pulled back.

China’s slowing import demands led to a 65% reduction in the country’s import numbers year-on-year. During the period of January to April 2021 China imported just shy of 1.5 million tons of pork, compared to the same period for 2022, when the import figures only just topped 450,000 tons.

The UK’s January to April import figures rose 27% year-on-year, as did the figures for South Korea (38%), Mexico (31%), and Japan (12%).

Presently, Rabobank expect Chinese imports to pick up, as the country’s Covid restrictions have eased and the pork prices have increased – lending itself to increased imports. Nonetheless, Rabobank expects China’s imports to be down 25 to 35% at the close of the year.

ASF outbreaks in Eastern (Germany-Poland border) and Western (French and Dutch borders) Europe have disrupted the European market, with an oversupply of certain products putting pressure on pork prices.

In Asia, ASF is threatening localised production and prices. In Thailand, ASF could reduce the pork supply by over 35% in 2022 – according to a USDA estimate; in Vietnam and the Philippines, ASF remains rampant; and China is still seeing sporadic outbreaks.

However, Rabobank’s research shows that consumer demand is proving resilient in most regions.

“This is because pork is neither the most expensive nor the cheapest protein, so consumption levels change slowly,” explains Chenjun Pan, Rabobank senior analyst for animal protein.

“The impact of a slowing economy on pork consumption is more about channels, with weaker performance in foodservice and stronger in retail, as consumers make price-value comparisons,” Ms Pan concludes.